The scale and recognition of the Bitcoin choices market have made it top-of-the-line instruments for gauging market sentiment and predicting volatility. Earlier yourcryptonewstoday evaluation discovered that choices wielded an outsized affect over Bitcoin’s worth volatility and have been accountable for a lot of the volatility we’ve seen this quarter.

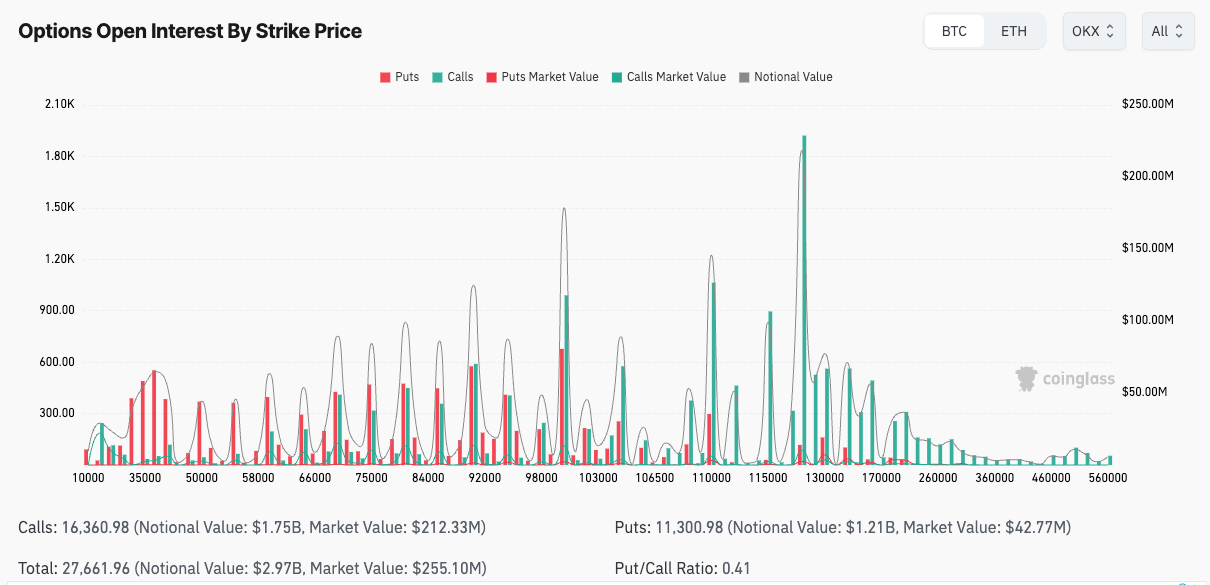

Choices knowledge has proven a major focus of open curiosity (OI) on the $120,000 strike worth for contracts expiring on the finish of the yr. This explicit strike worth has garnered important consideration from merchants, with over $640 million in OI on Deribit alone. This OI far surpasses the exercise we’ve seen at neighboring strikes throughout most platforms. Such a heavy deal with a single strike worth reveals speculators are optimistic a few worth enhance however creates a chance of excessive volatility within the coming weeks.

Open curiosity in strike costs far above the present spot worth of Bitcoin can point out that merchants are prepared to guess on extraordinary worth actions. Whereas Bitcoin’s worth at press time stays considerably beneath the $120,000 stage, mounted at round $107,000, the choices delta can present a clearer perspective on the chance of such bets materializing.

Delta, a key choices metric, represents the sensitivity of an choice’s worth to modifications within the underlying asset and can even function an approximation of the choice’s chance of expiring within the cash. For the $120,000 strike expiring on December 27, the delta sits at roughly 0.10, suggesting a ten% likelihood that Bitcoin will attain or exceed this worth by yr’s finish, knowledge from Kaiko confirmed.

As choices are forward-looking, they supply perception into the place merchants consider the market might transfer and the way risky they count on it to be. A excessive focus of open curiosity at a selected strike and substantial quantity present which ranges merchants see as important. On this case, the $120,000 strike emerges as a most well-liked level.

That is notably important as a result of choices exercise typically precedes spot market developments, as merchants use choices to hedge, speculate, or capitalize on anticipated volatility. Excessive open curiosity on such a excessive strike worth reveals the market is getting ready for a pointy worth enhance.

The scale of Deribit’s OI reveals the dominance of crypto-specific platforms within the Bitcoin choices market. Whereas CME, Binance, and OKX all provide choices buying and selling, Deribit stays the clear chief, notably for high-strike calls.

On Deribit, open curiosity is very concentrated not solely at $120,000 but additionally at different key psychological ranges, reminiscent of $100,000, $110,000, and $130,000. This clustering signifies that merchants are hedging or speculating round key worth thresholds, probably anticipating important worth motion in the previous couple of weeks of the yr. When mixed with low deltas, the information reveals merchants are betting on low-probability, high-reward outcomes.

The disparity between Deribit’s choices knowledge and the exercise on platforms like CME displays a transparent divide between institutional and retail participation. Whereas CME knowledge displays a extra conservative positioning amongst institutional merchants, the speculative exercise on Deribit factors to the next urge for food for threat amongst crypto-native individuals. This reveals the significance of monitoring a number of platforms when analyzing the choices market. Deribit, because the chief in liquidity and open curiosity, typically units the tone for Bitcoin choices developments, whereas conventional platforms present a complementary view of institutional flows.

From a volatility perspective, choices strike worth knowledge and open curiosity ranges are equally essential for understanding how the market is pricing threat. The focus of exercise at distant strikes means that merchants count on Bitcoin’s worth to exhibit excessive ranges of volatility main into the tip of the yr. Choices, notably out-of-the-money calls, typically function cheap bets on excessive strikes. Substantial OI at strikes far above the present spot worth signifies that merchants anticipate worth swings massive sufficient to justify these positions, even when the chance of success stays low.

The publish Choices merchants guess huge on Bitcoin reaching $120K regardless of low odds appeared first on yourcryptonewstoday.