Bitcoin is cruising at $108,610, seeing a rise of over 2% prior to now 24 hours; in the meantime, the entire digital forex market worth rests at $3.38 trillion. This value climb happens a single week earlier than the Federal Open Market Committee (FOMC) gathering, which is slated for June 18.

Bitcoin Defies Credit score Downgrade—Knowledgeable Says Confidence Is Constructing

On Monday, June 9, 2025, bitcoin (BTC) is floating above the $108,000 mark, which has led to $155.57 million in brief liquidations over the previous day, with $81 million being BTC quick performs. James Toledano, the chief working officer at Unity Pockets, shared with our information desk that “Bitcoin’s rebound from $100K on June 5 speaks to its resilience. This robustness is being powered by sustained institutional inflows into spot ETFs and easing considerations round U.S. rules.”

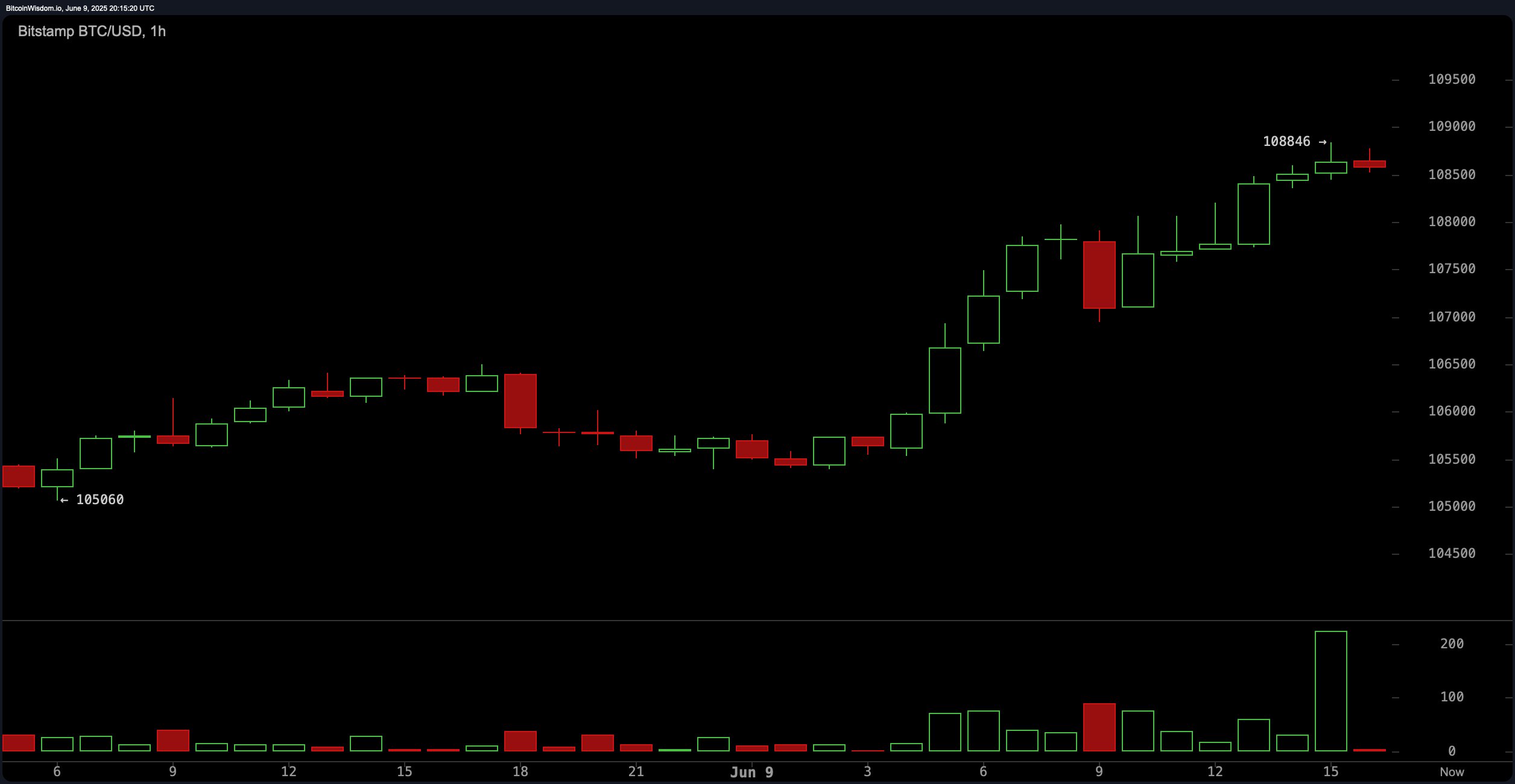

BTC/USD 1-hour chart at 4:15 p.m. Japanese time on Monday, June 9, 2025.

“The truth that the markets didn’t react to main macro components just like the U.S. dropping its AAA credit standing additionally demonstrates rising investor confidence,” Toledano defined. The Unity Pockets government continued:

Moreover, the expectations of a Federal Reserve charge reduce — probably as early as July — have reignited bullish positioning. Collectively, these components have restored momentum after Friday’s dip, suggesting continued institutional urge for food and improved investor confidence are the first forces driving at the moment’s restoration.

Bitcoin’s upbeat climb precedes the approaching FOMC assembly, and whereas July stays an choice, it’s actually a consideration. Knowledge from the CME Fedwatch Software together with forecasts from Polymarket and Kalshi level to the chance of any charge change in June being very low. The CME Fedwatch software signifies a 99.9% probability the Fed will hold charges the identical this month. However, for July, there’s a 14.9% likelihood a quarter-point discount may happen, as said by CME’s futures.

“Trying ahead, a dovish shift by the Federal Reserve, significantly a summer time charge reduce of between 25-50 foundation factors, would doubtless speed up bitcoin’s climb by making threat belongings extra engaging,” Toledano concluded. “Persistent ETF inflows and persevering with regulatory progress would additionally bolster upward momentum. Nevertheless, BTC should additionally overcome robust resistance round $112K–$125K, the place profit-taking may set off momentary pullbacks earlier than any new highs are examined.”

May a Pullback to $92K Occur?

Sergei Gorev, the danger head at Youhodler, identified that each bitcoin and gold have responded to adjustments throughout the U.S. financial markets. “[Bitcoin] quotes are presently in a state of uncertainty,” Gorev mentioned in a observe shared with our newsdesk. “On the one hand, many international merchants are progressively withdrawing from the U.S. forex and shifting to extra dangerous belongings, together with cryptocurrencies.”

Gorev added:

This has a constructive impact on the BTC alternate charge. However, the value on the BTC chart is behaving extraordinarily erratically, and there’s presently a chance of a neighborhood value hike. There’s a ‘Head and Shoulders’ image, which, when carried out in its state of affairs, can result in a correction within the value of BTC to the extent of $92,000 per 1 BTC.