Bitcoin’s value efficiency stays subdued, with the cryptocurrency buying and selling above $97,000 on the time of writing—a roughly 6.5% decline over the previous week. The crypto asset has but to reclaim the $100,000 degree it misplaced earlier this week, leaving market individuals unsure in regards to the near-term path.

Amid this backdrop, one CryptoQuant contributor, often called caueconomy, supplied an evaluation of a big improvement involving Bitcoin’s change withdrawals.

Largest Change Withdrawals Since FTX Collapse

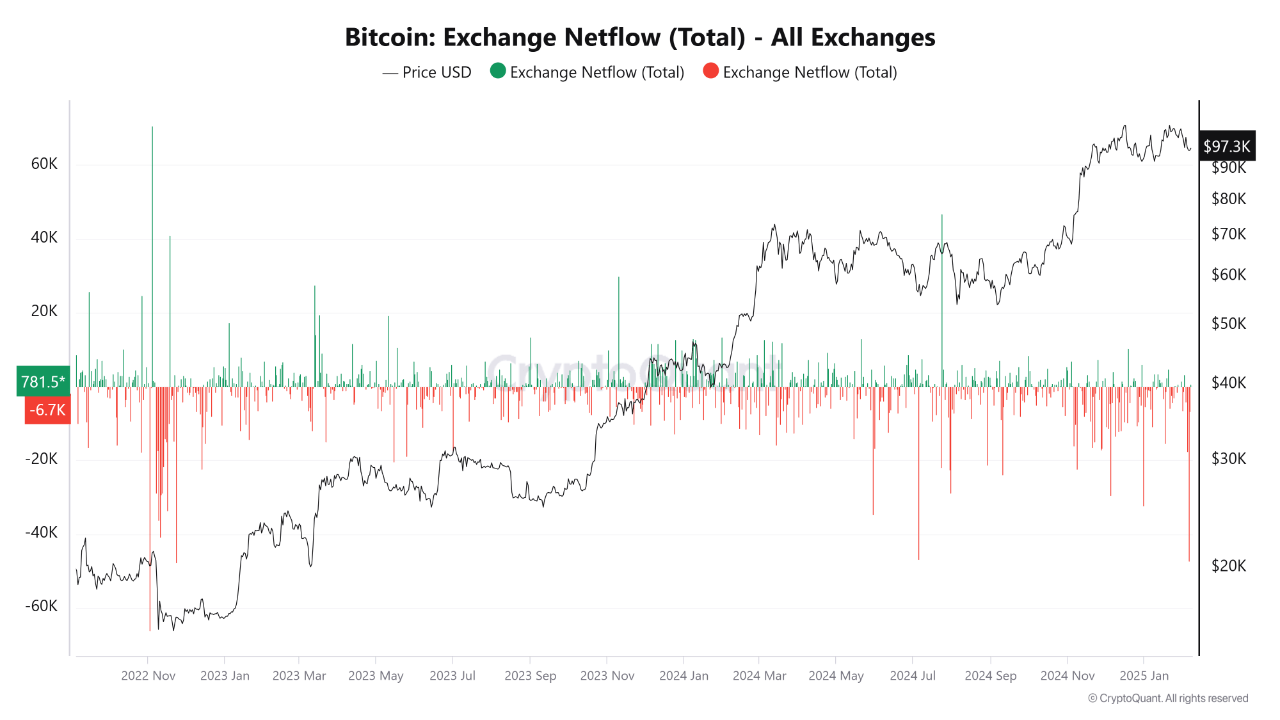

In a current submit, caueconomy highlighted the most important quantity of change withdrawals for the reason that FTX collapse. In line with the information, over 47,000 BTC have been faraway from change reserves.

Whereas a few of these actions could also be inside, in addition they point out potential accumulation by a big market participant or institutional entity. This development of Bitcoin transferring off exchanges sometimes alerts a long-term bullish perspective, as fewer cash accessible for buying and selling might result in diminished sell-side stress over time.

Nonetheless, the analyst clarified that this shift doesn’t produce an instantaneous provide shock able to impacting Bitcoin’s value within the brief time period. As a substitute, it factors to a gradual accumulation section that might present help for future value appreciation.

The most important quantity of change withdrawals for the reason that collapse of FTX

“Whereas these withdrawals don’t mirror an instantaneous “provide shock” to the value of bitcoin… it nonetheless reveals a development of accumulation by massive gamers.” – By @caueconomy

Full submit 👇https://t.co/ZjYBijDOZp pic.twitter.com/ZEWj95wtfD

— CryptoQuant.com (@cryptoquant_com) February 7, 2025

Bitcoin Breakout On The Horizon?

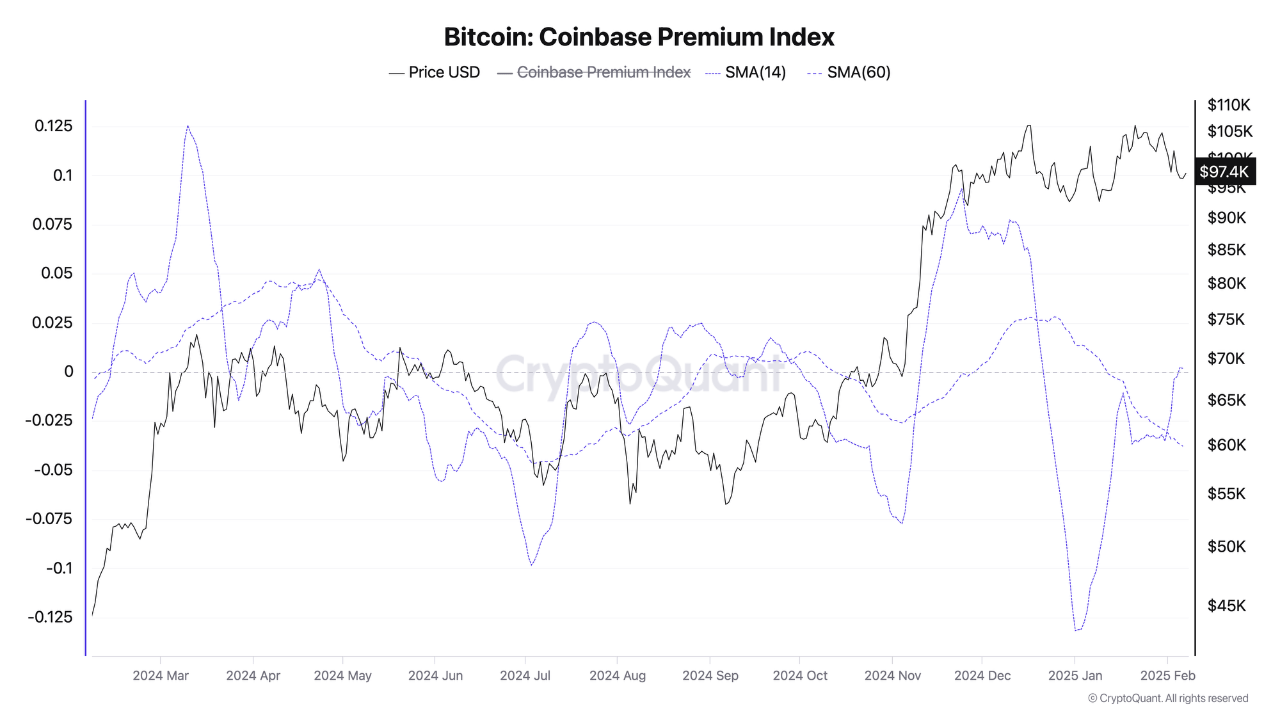

In the meantime, one other CryptoQuant analyst, Onatt, provided insights into potential breakout situations for Bitcoin. Onatt pointed to the sturdy shopping for curiosity captured within the Coinbase Premium Index, a measure that compares Bitcoin’s value on Coinbase to different exchanges.

A optimistic premium usually displays heightened demand from institutional buyers, suggesting that the market’s upward potential is undamaged. Onatt additionally famous the crossover of key transferring averages—SMA14 and SMA60—indicating a attainable build-up of bullish momentum.

The analyst additional highlighted Bitcoin’s growing correlation with gold and the S&P 500, indicating that the cryptocurrency’s efficiency might align extra carefully with conventional danger property. If the broader monetary markets undertake a “risk-on” sentiment, Bitcoin may see an upward development.

Moreover, Federal Reserve Chairman Jerome Powell’s current feedback relating to the restricted influence of employment knowledge on inflation have helped stabilize market expectations. So long as financial knowledge stays inside forecasted ranges, optimistic sentiment towards Bitcoin and different danger property might proceed to develop.

Featured picture created with DALL-E, Chart from TradingView