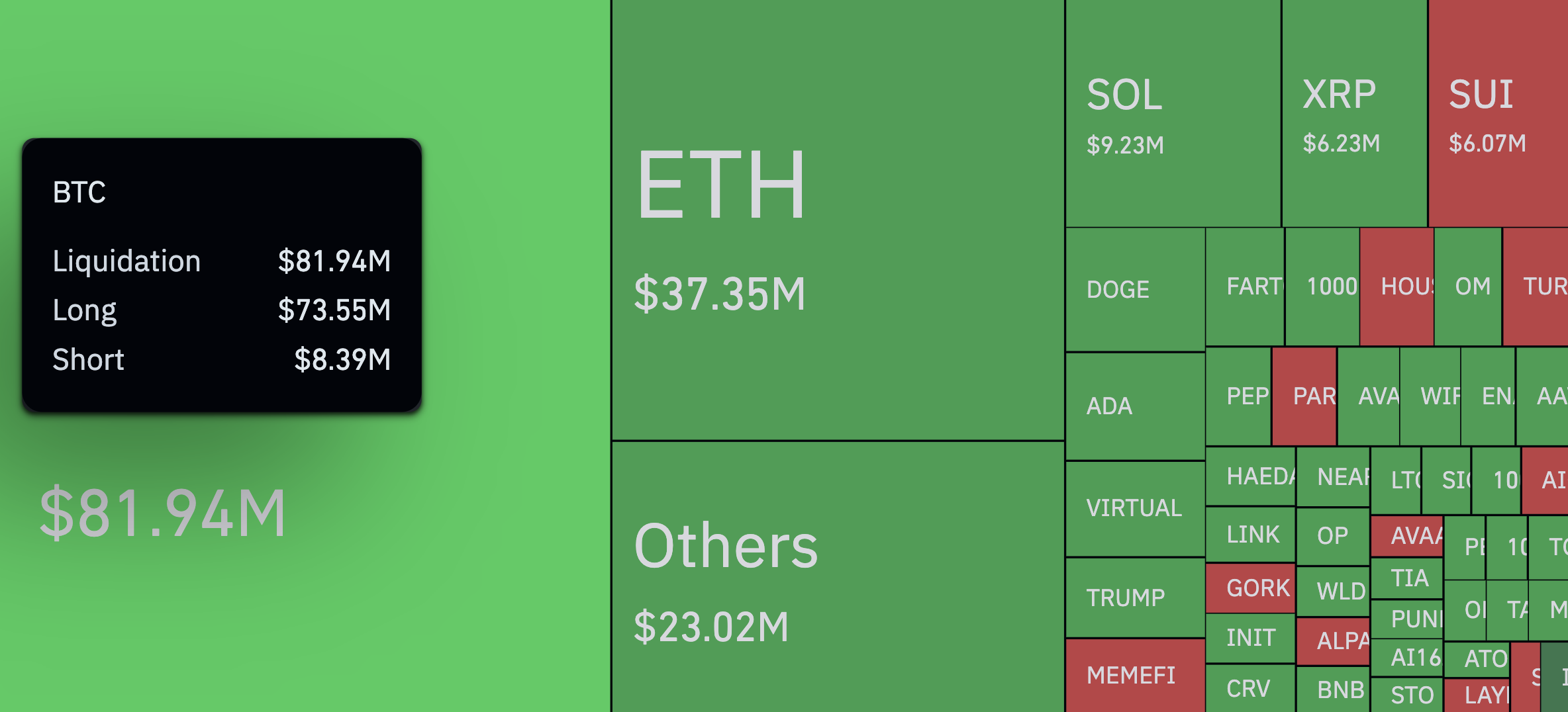

Within the final 24 hours, Bitcoin (BTC) merchants confronted $81.94 million in complete liquidations, with $73.55 million of it coming from lengthy positions. Shorts? Simply $8.39 million. That could be a 9-to-1 imbalance — a 900% spike favoring one aspect — welcome to one among Bitcoin’s most excessive lopsided liquidation occasions in current instances.

It occurred as half of a bigger pattern of liquidations within the crypto house; in complete, $209.97 million in positions had been cleared out in simply in the future, hitting over 74,000 merchants. Simply as with Bitcoin, the longs took the brunt of the injury — $167.03 million versus $42.94 million in shorts.

Ethereum (ETH) was not spared both, with liquidations totaling $37.35 million. Solana (SOL) and XRP adopted, with $9.23 million and $6.23 million, respectively. Whereas these figures will not be out of the atypical on their very own, leaning towards lengthy liquidations throughout almost each main token paints a transparent image: the market was overly bullish, and bulls obtained caught in a entice.

The 12-hour window confirmed the identical story — $80.55 million in lengthy liquidations versus $26.84 million in shorts — pointing to a cascade impact that probably began with gentle draw back and shortly accelerated as cease losses and margin calls kicked in.

It’s fascinating that this all occurred with none large value drops. Bitcoin and the opposite high cryptocurrencies dipped, however not by sufficient to clarify this stage of washout. That’s how tough this market normally is — it’s not simply the transfer itself, however the positioning behind it that may actually do some injury.

In keeping with CoinGlass, the largest liquidation was from HTX’s ETH/USDT pair at $2.36 million. It’s troublesome to say for now whether or not this was only a reset of some form or an indication that the market is in unhealthy form.