Rewards for holding bitcoin BTC$89,477.17 will not be well worth the wild experience anymore.

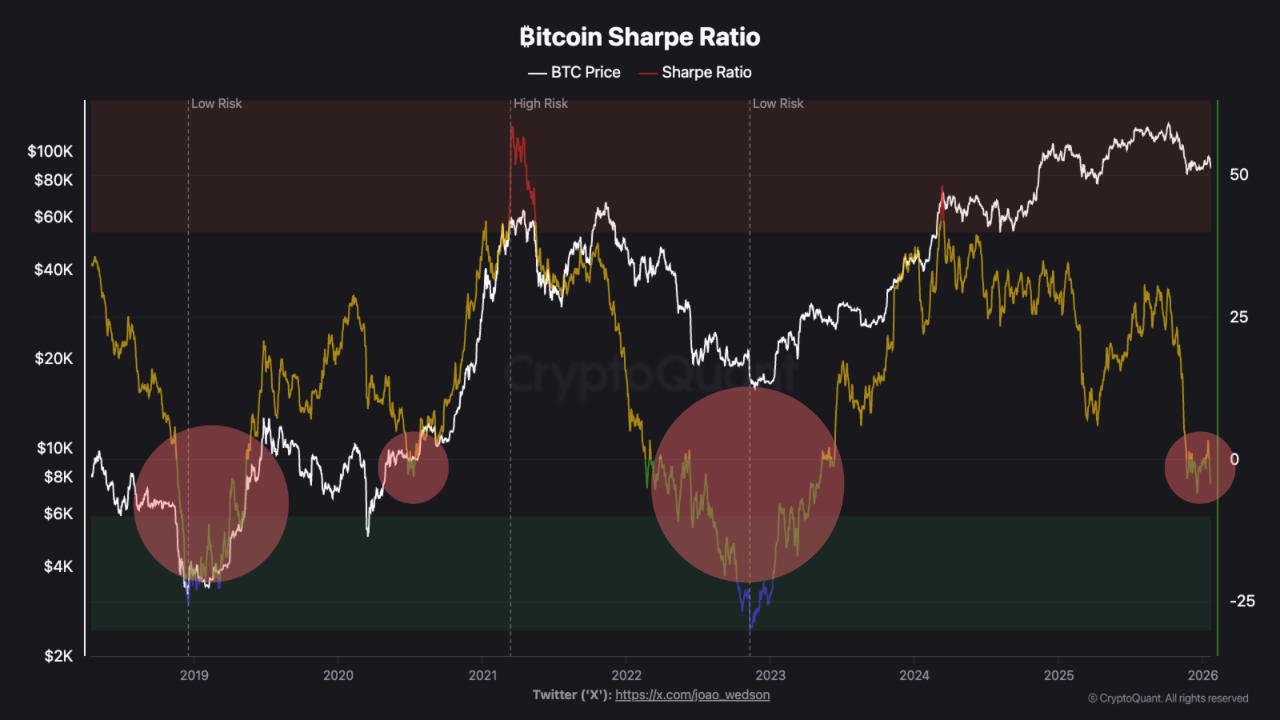

That is the sign from bitcoin’s Sharpe Ratio, a software fund managers use to verify if an funding’s further income (above secure choices like U.S. Treasury payments) compensate for volatility dangers.

The ratio has turned damaging for bitcoin, in keeping with knowledge supply CryptoQuant, indicating that returns now not justify the curler coaster experience. Its reflective of an setting the place sharp intraday swings and uneven rebounds have didn’t ship returns. Costs could also be effectively off current highs, however volatility stays elevated, compressing risk-adjusted returns.

This comes as BTC has pulled again to $90,000 since hitting file highs above $120,000 in early October.

We noticed related damaging sharpe ratio readings on the depths of the earlier bear markets. Therefore, some on social media are viewing the newest damaging print as an indication the downtrend in BTC costs is over, and a brand new bull run might start quickly.

Nevertheless, the damaging studying doesn’t essentially indicate a renewed uptrend. That is as a result of, the Sharpe ratio, which measures risk-adjusted returns, reveals the present state of the market and never future efficiency.

“The Sharpe Ratio does not name bottoms with precision. But it surely reveals when risk-reward has reset to ranges that traditionally precede main strikes. We’re oversold. The type that breeds alternative—decrease threat for long-term positioning, not as a result of worth cannot go decrease, however as a result of the risk-adjusted setup favors it,” analyst at CryptoQuant mentioned in a weblog submit.

In late 2018, the ratio stayed damaging for months as costs continued remained depressed. The same sample emerged in 2022, when the metric remained depressed all through a chronic bear market triggered by leverage failures and compelled promoting.

Principally, the damaging sharpe ratio situation can persist lengthy after costs cease falling sharply.

What merchants usually watch as an alternative is how the metric behaves after extended weak spot. A sustained transfer again towards constructive territory usually indicators enhancing risk-reward dynamics, the place positive factors start to outpace volatility, a sample traditionally aligned with renewed bull runs.

As of now, there aren’t any indicators of renewed bullishness in bitcoin. The cryptocurrency traded close to $90,000, near ending per week marred by uncommon see-saw volatility and underperformance towards gold, bonds and world expertise shares.