Distinguished crypto analyst Burak Kesmeci has tipped Bitcoin (BTC) to hit a value goal of $124,000 primarily based on information from the Golden Ratio Multiplier value mannequin. This bullish prediction comes after a formidable value surge prior to now week, hinting that the premier cryptocurrency could have extra room for fast value development.

Can Bitcoin Return To 1.6x Accumulation Peak Goal?

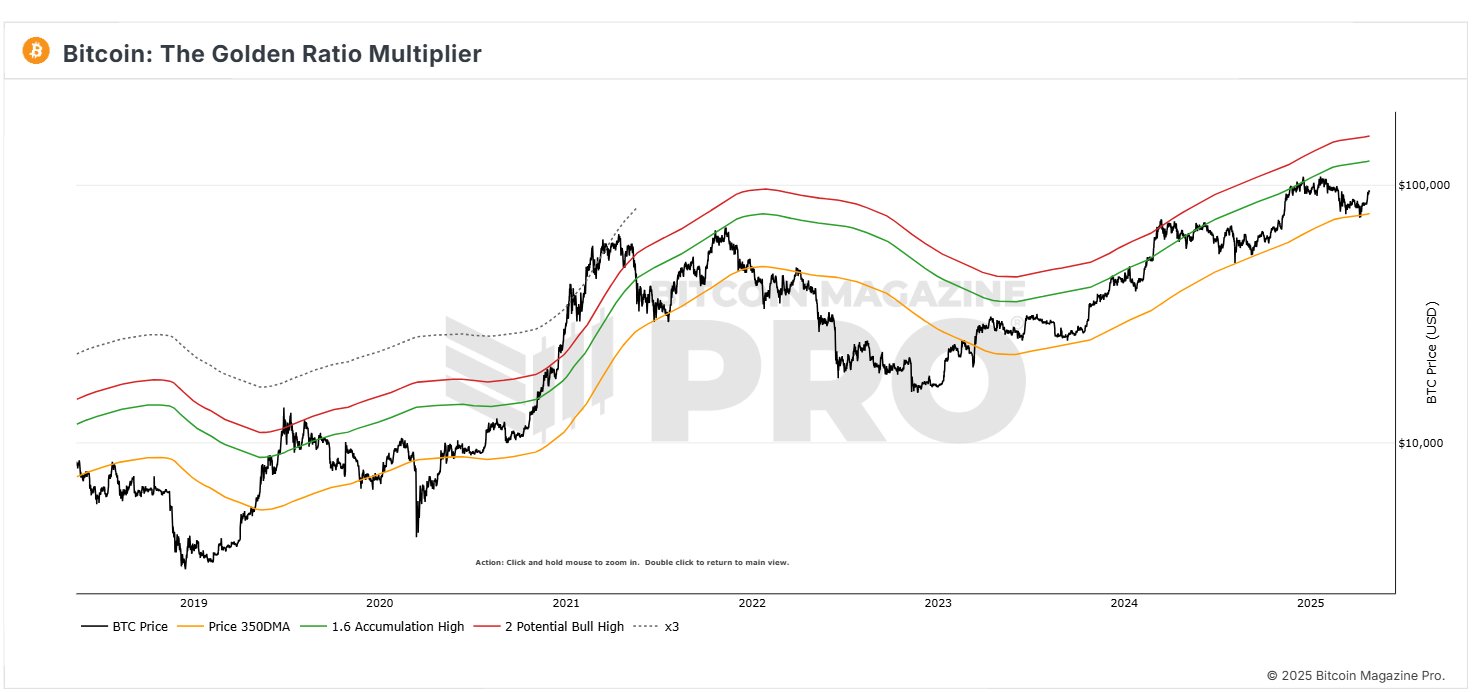

In an X put up on April 26, Burak Kesmeci shared the newest updates on the Bitcoin Golden Ratio Multiplier value mannequin, referencing information from Bitcoin Journal Professional. For context, the Golden Ratio Multiplier mannequin makes use of transferring averages and Fibonacci ratios to assist determine when BTC could be overvalued or undervalued, thereby signaling doable market tops or good accumulation alternatives.

In accordance with the chart beneath, Bitcoin has lately retested the 350 each day transferring common (350DMA) at $77,000. Because the identify implies, the 350DMA tracks BTC’s common value during the last 350 days and acts as a key help zone. Touching or briefly dipping beneath this stage typically alerts a possible long-term shopping for alternative.

Bitcoin lately rebounded off its 350DMA, after a value dip to $75,000 was adopted by two subsequent value rallies to commerce as excessive as $96,000.

In keeping with the value bands on the Golden Multiplier ratio, BTC is now headed for 1.6x Accumulation Excessive, i.e, 1.6 instances the 350 DMA, which is at present at $124,000. Subsequently, regardless of the continued value consolidation, BTC is more likely to produce one other value rally primarily based on the Golden Multiplier ratio value mannequin.

Curiously, when Bitcoin strikes close to or above this stage, it typically alerts the tip of an accumulation section and the beginning of a stronger bullish pattern. Subsequently, BTC reaching the $124,000 would solely pave the way in which for additional value positive aspects according to the lofty targets of some market analysts.

BTC Miners Acquire $18.60 Million In Revenue

In different information, one other high crypto analyst, Ali Martinez, stories that miners have lately capitalized on Bitcoin’s spectacular value rally, realizing almost $18.60 million in earnings as costs surged previous $94,000.

This realized revenue spike highlights that early miners are strategically taking earnings at these excessive value ranges. Nonetheless, it’s value noting that Bitcoin retains a powerful bullish momentum regardless of this promote strain, fueled by a number of components, together with robust inflows into spot ETFs.

On the time of writing, BTC is valued at $94,393, reflecting a value decline of 0.76% prior to now day.

Featured picture from Investopedia, chart from Tradingview

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.