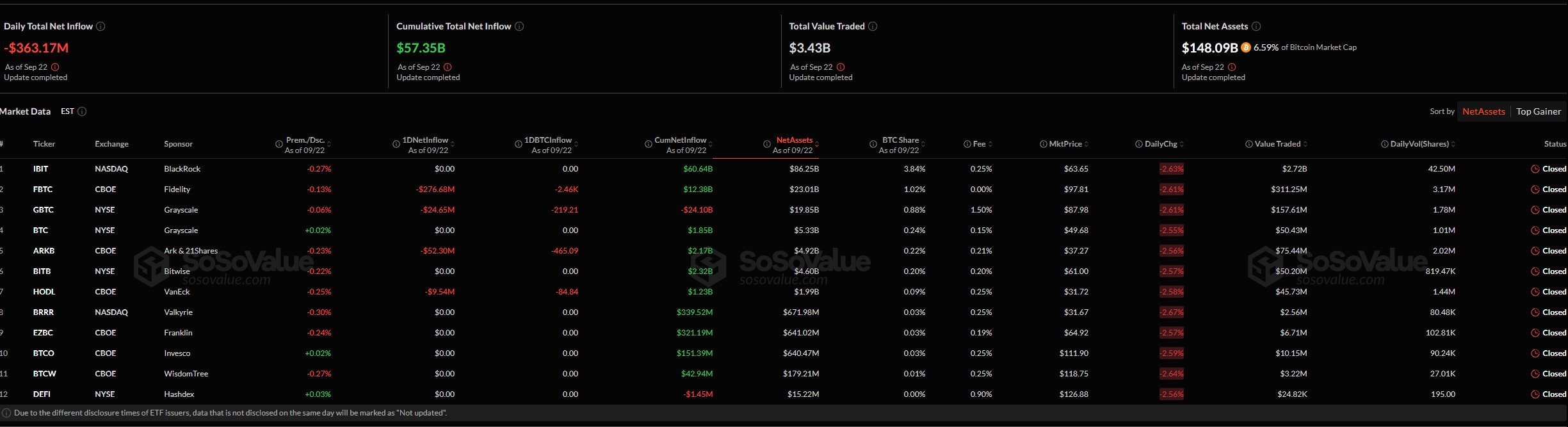

Bitcoin remains to be underneath strain, and this time, institutional exercise is the supply of the strain. Statistics point out that on Sept. 22, 2025, Bitcoin spot ETFs noticed one of many largest day by day drawdowns of the 12 months, with an outflow of an astounding $363.17 million. The worth of Bitcoin is at present hovering round $113,000, holding onto help however reflecting a insecurity amongst bigger market members.

Bitcoin ETFs bleeding

This sudden motion coincides with ETF breakdowns revealing that there have been massive redemptions at a number of main issuers. In in the future, Constancy’s FBTC misplaced $72.68 million, Grayscale’s GBTC noticed a $24.65 million outflow, and Ark and 21Shares’ BITB noticed $52.30 million depart. VanEck’s HODL ETF, then again, suffered the most important loss: $94.54 million have been withdrawn. The 12 ETFs didn’t report web inflows, indicating a constant shift in capital away from institutional publicity to Bitcoin.

The truth that cumulative web inflows for Bitcoin ETFs are nonetheless at $57.35 billion regardless of the numerous outflow exhibits that, regardless of latest bearish sentiment, longer-term institutional dedication has not been misplaced. Quick-term fluctuations, nonetheless, are main causes of value volatility, and since there usually are not any recent inflows, Bitcoin is extra prone to promoting strain.

Bitcoin’s value bleeding

This uncertainty is seen on the value charts. Though Bitcoin briefly hit $111,900, the 200-day EMA remains to be at $105,000, offering a buffer earlier than the psychologically essential $100,000 stage is reached. Though the Relative Power Index (RSI) signifies impartial momentum, if outflows proceed and institutional promoting is current, the market may break decrease.

Within the bigger image, institutional outflows level to a rising sense of warning within the face of market-wide liquidations and macroeconomic worries. If redemptions persist into the upcoming week, the bullish narrative that has been established all through mid-2025 could also be undermined, and Bitcoin could check deeper help ranges.

Though Bitcoin is at present above $113,000, stability is shaky as a result of institutional waves opposing it. The opportunity of a correction to $105,000 or much less could be very actual until inflows begin up once more.