Dive into Cipher Mining’s Q3 2024 efficiency. From income challenges to strategic funding in fleet upgrades, information middle enlargement and plans for AI/HPC. Uncover what’s subsequent for this Bitcoin miner!

The next visitor submit comes from Bitcoinminingstock.io, offering complete information, in-depth analysis, and analyses on Bitcoin mining shares. Initially revealed on Nov. 21, 2024, it was penned by Bitcoinminingstock.io writer Cindy Feng.

Cipher Mining (NASDAQ: CIFR) has delivered one of many strongest YTD performances amongst public Bitcoin miners as of November 19, 2024. Inside funding circles, comparisons between TeraWulf and Cipher have sparked curiosity, with some noting the latter’s stronger efficiency in particular areas. Having concluded TeraWulf as a rising Bitcoin miner in my earlier evaluation, now it’s time to take a detailed take a look at Cipher, a miner that has quietly carved out its place out there.

Fundamental Profile

Cipher Mining is a U.S.-based Bitcoin mining firm that positions itself as an information middle developer. Its operations are primarily situated in Texas, leveraging the state’s favorable power infrastructure. The corporate’s working amenities embody:

- Odessa Information Heart: A completely owned facility in Odessa, Texas, accounting for 7.1 EH/s, representing 76% of Cipher’s complete hash charge.

- Joint Ventures with WindHQ LLC: Alborz, Bear and Chief amenities situated in Comfortable and Andrews, Texas, contributing an extra 2.2 EH/s to the corporate’s total capability.

Picture Background Supply: ciphermining.com/websites

Past Bitcoin mining, Cipher additionally participates in grid curtailment applications to optimize profitability. Much like Riot Platforms, Cipher leverages ERCOT’s low-cost power grid and applications just like the 4 Coincident Peak (4CP) to handle electrical energy utilization throughout high-demand intervals. In Q3 2024, Cipher reported $1.4M in energy gross sales, generated by promoting electrical energy to ERCOT when worthwhile. This extra income stream helps the corporate’s working prices.

Not So Fairly Q3 2024 Efficiency

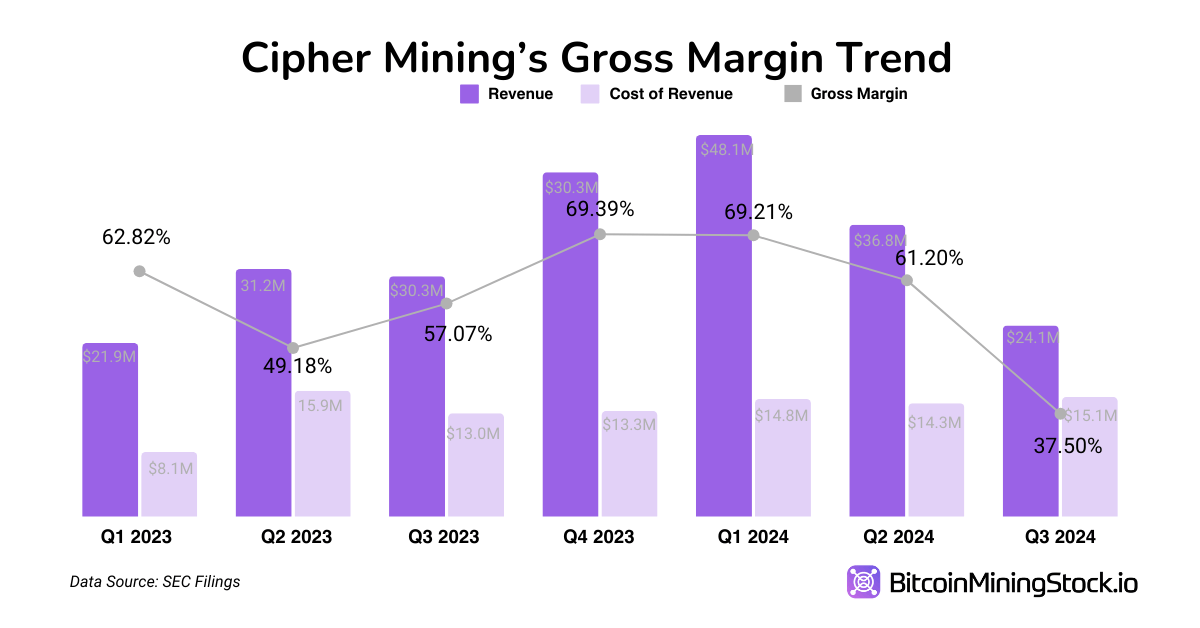

In Q3 2024, Cipher reported $24.1M in income, a 35% QoQ and 20.5% YoY decline. This drop was primarily pushed by diminished Bitcoin manufacturing. The corporate mined 493 BTC in Q3, down from 638 BTC in Q2. Seasonal surges in electrical energy charges throughout ERCOT’s summer season 4CP intervals additional compounded the influence.

Throughout this era, Cipher’s value of income rose to $15.1M, up from $13.0M in Q3 2023. Internet losses widened to $87M, a stark distinction to the $19M loss in Q3 2023. Contributing elements included larger depreciation prices related to new mining rigs and amenities, in addition to by-product losses linked to energy contracts. In consequence, Cipher’s gross margin declined considerably, from 57.1% in Q3 2023 to 37.5% in Q3 2024.

Cipher Mining: Quarterly Income, Value of Income, and Gross Margin Tendencies (Q3 2023 – Q3 2024)

These numbers collectively painted an undesirable operational strain for Cipher.

A Change of Perspective

Amid operational challenges, Cipher’s complete property grew to $775.4M as of Q3 2024, up from $566.1M firstly of the yr. This progress displays vital investments in its Bitcoin treasury and mining infrastructure.

Bitcoin Treasury Technique: Maintain Some and Promote Some

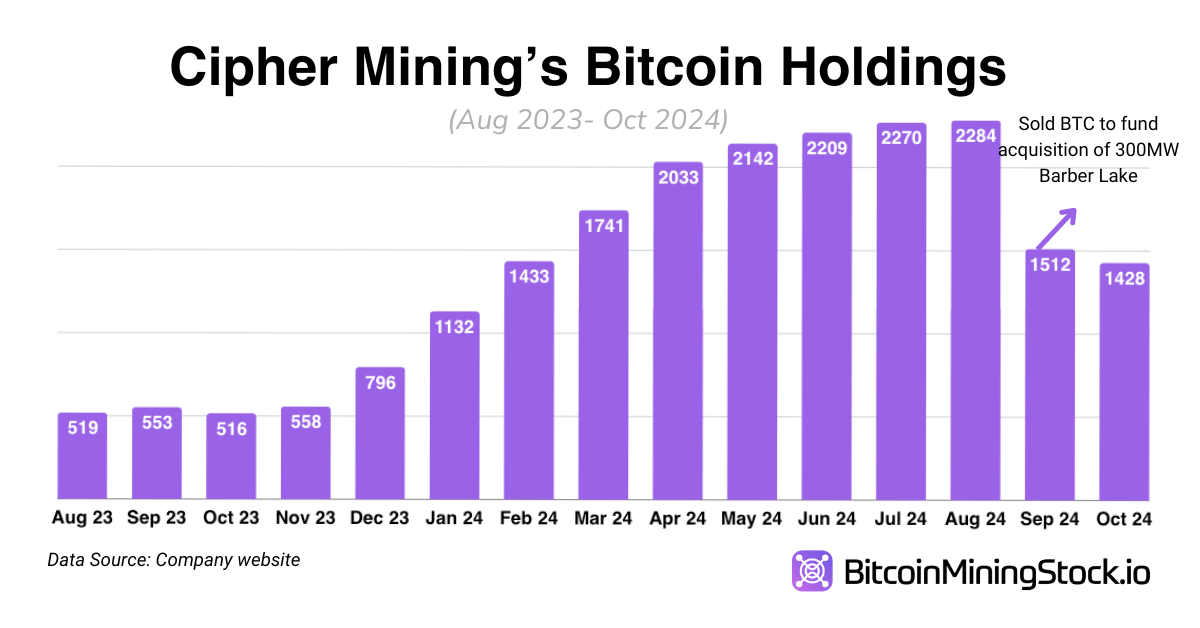

As of September 30, 2024, Cipher held 1,512 Bitcoin valued at roughly $138.1M, up from 796 Bitcoin valued at $32.98M on the finish of final yr. Nevertheless, in comparison with Q2, Cipher had a 33.4% (923 BTC) QoQ decline because of strategic gross sales. In September, Cipher offered a great portion of its Bitcoin holdings, elevating $67.5M to finance the acquisition of the 300 MW Barber Lake facility. This method permits the corporate to leverage its Bitcoin treasury for liquidity whereas minimizing fairness issuance.

Cipher Mining’s Bitcoin holdings (August 2023- October 2024)

Fleet Improve: Strengthening Operational Effectivity

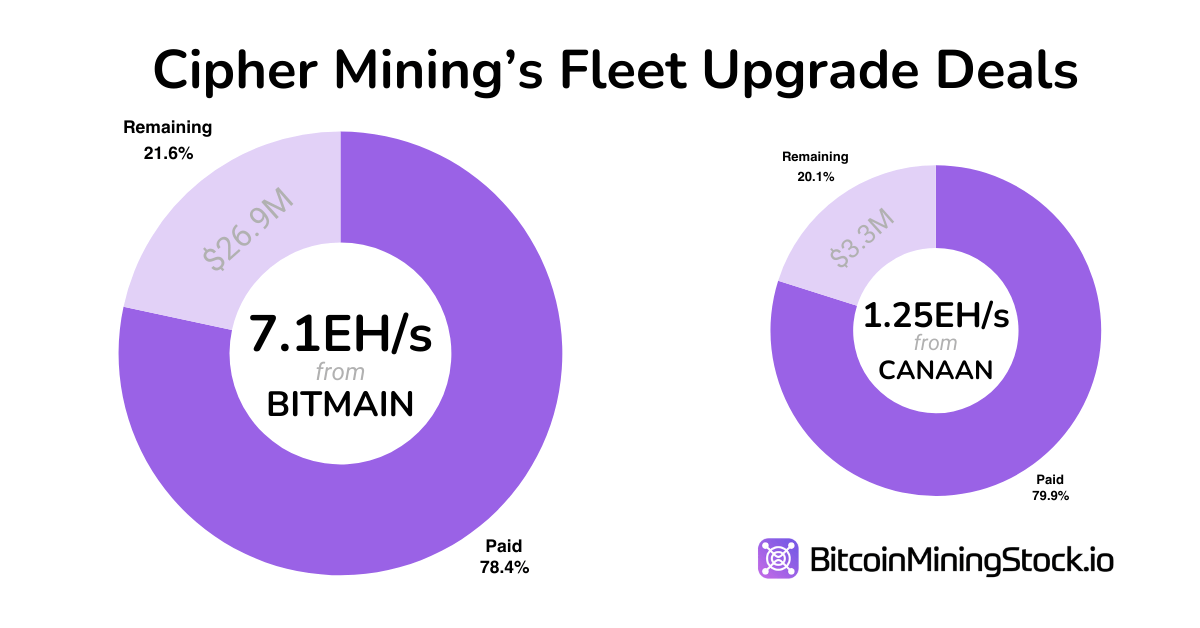

Investments in fleet upgrades considerably impacted Cipher’s value construction. Since This autumn 2023, Cipher entered agreements with Bitmain and Canaan to amass cutting-edge mining rigs:

- The Bitmain settlement includes 7.1 EH/s of miners, initially scheduled for supply for 2025 however accelerated to This autumn 2024 by an modification in June 2024. Cipher paid $97.5M in deposits in the course of the 9 months ended September 30, 2024, with $26.9M remaining.

- The Canaan settlement contains 1.25 EH/s of miners, with supply anticipated in This autumn 2024. Cipher paid $13.1M upfront in Q2, with $3.3M remaining. As a part of this settlement, Cipher secured an possibility to amass extra miners equal to 160 MW of capability by June 30, 2025, by paying $5.3M as deposit (paid in Q2).

Cipher Mining entered agreements with Bitmain and Canaan to amass mining rigs

Bitmain’s Antminer S21 Professional and Canaan’s A1566 will probably be utilized to interchange much less environment friendly machines at Cipher’s Odessa facility, relatively than being deployed on the Black Pearl Facility.

To align with these upgrades, Cipher revised the helpful lives of its mining rigs from 5 years to 3 years efficient from June 1, 2024. This variation added $9.4M and $12.2M in depreciation amortization expense for Q3 2024, which closely contributed to the online loss. In Q3 2024, the corporate built-in Bitmain’s Antminer S21 Professional and Canaan’s A1566 miners at its Odessa facility, Cipher’s largest wholly-owned information middle.

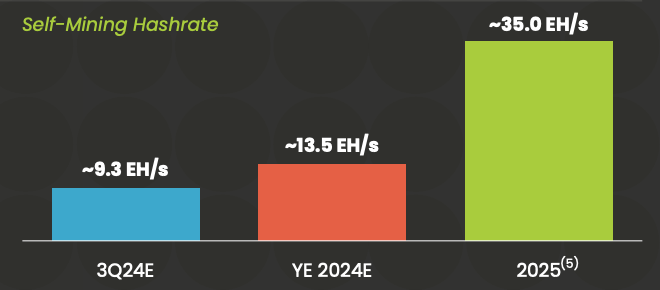

Nevertheless, these upgrades are important for Cipher to succeed in its goal of 13.5 EH/s self-mining capability by year-end 2024, up from 9.3 EH/s as of Q3. By making these upgrades, Cipher is laying the inspiration for improved operational effectivity and profitability.

Cipher Mining’s Hash Price Goal (screenshot from its presentation)

Ahead Trying Progress Potential

Information Heart Growth Pipeline

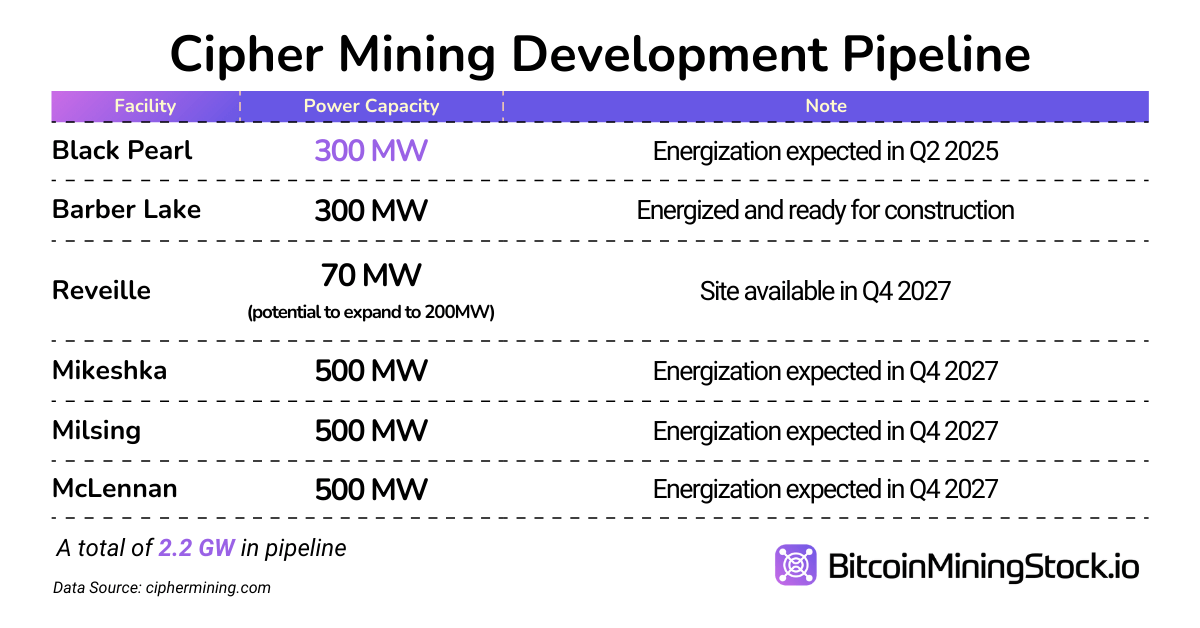

Trying forward, Cipher is enterprise substantial enlargement of its information middle capability. The Black Pearl facility (acquired final Dec), a 300 MW information middle below growth in Winkler County, Texas, is anticipated to be energized by Q2 2025, including roughly 21.5 EH/s of mining capability. Equally, they lately acquired a Barber Lake facility in Colorado Metropolis, Texas, boasting 300 MW of capability and is prepared for building. The 70 MW Reveille web site situated in Cotulla, Texas was one other latest acquisition. This web site has the potential to be expanded right into a 200 MW information middle, pending regulatory approval (word: Cipher hasn’t issued a proper PR about this acquisition, but it surely was talked about of their latest 10-Okay submitting).

On Oct 15, 2024, Cipher introduced buying choices for 1.5 GW of extra information middle capability in West and North Texas. This brings their lively portfolio and growth pipeline to a complete of 2.5 GW throughout 10 websites. Upcoming amenities like Mikeska, Milsing, and McLennan amenities, every have 500 MW of potential energy capability pending regulatory approvals.

AI and HPC Ventures

In response to the extremely aggressive mining atmosphere, like many different miners I beforehand mentioned, Cipher can be diversifying into AI/HPC internet hosting to scale back reliance on Bitcoin mining. As of Q3 there isn’t any income reported from this enterprise sector, however we will see information facilities within the pipeline that are strategically designed to help each Bitcoin mining and HPC actions.

In accordance with a latest firm presentation, their group contains veterans from Google, Vantage, and Meta, bringing deep experience to its AI infrastructure and tier-3 information facilities. On Oct 31, its CEO Tyler Web page stated the corporate has “made nice progress in our discussions with hyperscalers in latest weeks as we search our first HPC tenants”. This appears to sign promising income potential in HPC internet hosting for Cipher within the close to future, presenting a big long-term progress alternative.

Some Issues Stay Unclear

As of September 30, 2024, Cipher reported $39.7M in money and money equivalents (together with $14.4 M restricted money). Whereas this gives some liquidity, it raises considerations about whether or not the corporate has enough assets to satisfy its formidable enlargement plans. With over $30.2M funds due for brand spanking new mining rigs and vital capital necessities for information middle developments and HPC enterprise ventures, Cipher could must discover extra financing choices.

Cipher’s latest financing actions spotlight its means to boost capital, producing $213.5M throughout 9 months ended September 30, 2024. These funds had been primarily raised by the issuance of widespread inventory. Nevertheless, reliance on inventory issuance might result in shareholder dilution if it continues within the long-run. Now, the query is whether or not Cipher can diversify its funding technique to stability its progress ambitions and protect shareholder worth.

Closing Ideas

Cipher Mining’s Q3 2024 outcomes mirror the challenges of working in an more and more aggressive Bitcoin mining atmosphere, particularly throughout summer season months for these situated in Texas.

Nevertheless, Cipher’s forward-looking technique and impressive enlargement plans might place it effectively for future progress. If these initiatives are executed successfully and supported by sufficient assets, Cipher has the potential to emerge as a compelling participant within the present market cycle.