HPC/AI publicity drove miner valuations in 2025. The subsequent part will separate execution from narratives, and that’s the place re-ratings will diverge. $IREN $APLD $CIFR $WULF $HUT.

The next visitor submit comes from BitcoinMiningStock.io, a public markets intelligence platform delivering information on firms uncovered to Bitcoin mining and crypto treasury methods. Initially printed on Jan. 30, 2026, by Cindy Feng.

Over the previous few weeks, we’ve identified a transparent shift in how capital markets evaluated public Bitcoin miners in 2025. From the second half of the 12 months onward, traders more and more favored firms with credible HPC/AI publicity.

This wasn’t a sentiment-driven commerce. It coincided with a pointy acceleration in execution. In 2024 just one public miner, Core Scientific, had secured a hyperscaler settlement. In 2025, that quantity rose to 5. What was as soon as framed as experimental diversification is now shaping stability sheets, improvement pipelines, and long-term technique throughout the sector.

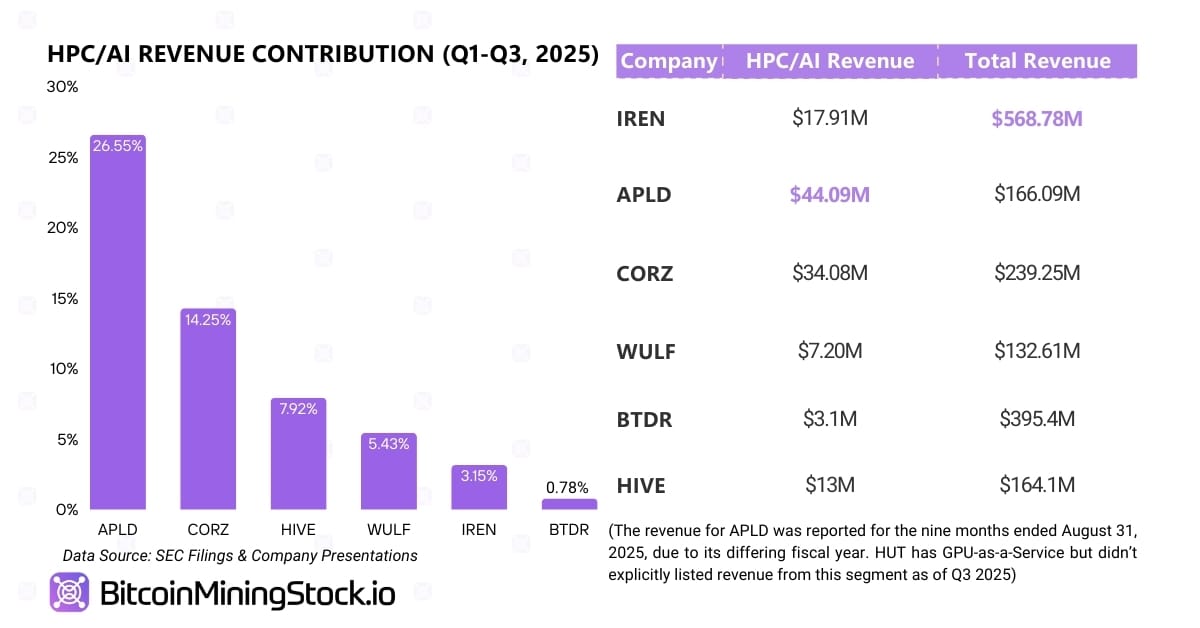

Income Is Nonetheless Small, However Income Visibility Improves

Regardless of the surge in bulletins, HPC/AI income contribution remained restricted by way of 2025, which is anticipated. Most hyperscaler offers are structured as long-term contracts with phased infrastructure rollout. Capability is being constructed and energized in levels, with significant income anticipated to ramp starting in 2026 and past.

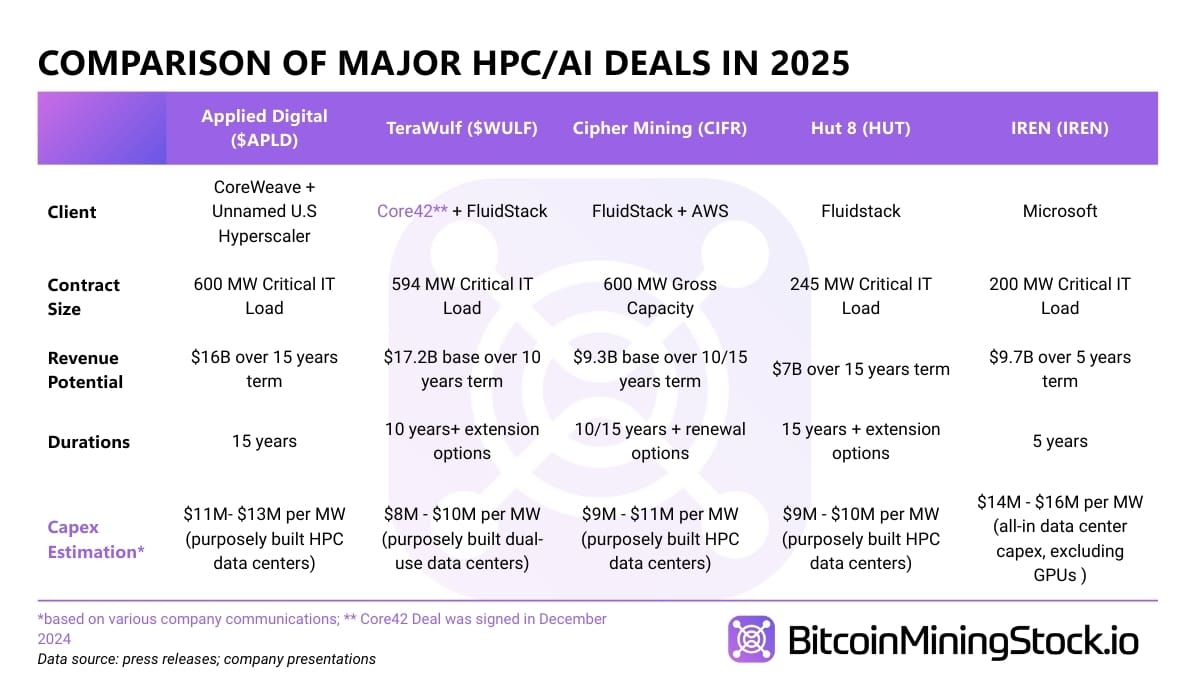

Not All Hyperscaler Offers Are the Similar

Whereas all introduced offers have hyperscaler publicity, the underlying enterprise fashions differ considerably. Usually, miners are positioning themselves as HPC infrastructure suppliers relatively than AI cloud operators. Their position is primarily colocation: delivering energy, cooling, and bodily infrastructure, not promoting AI cloud straight.

The excellence issues, as a result of Capex, margins, execution necessities fluctuate. Two contracts with related headline values can produce very totally different financial outcomes relying on whether or not the miner is working GPUs or just internet hosting them.

*Confer with the unique report to get full particulars on offers breakdown, information middle areas and extra for every particular person firm.

For Some Miners, This Isn’t Diversification Anymore

The extra fascinating shift is going on beneath the headlines. For a number of firms, HPC is now not a aspect enterprise. It’s the place future capital goes.

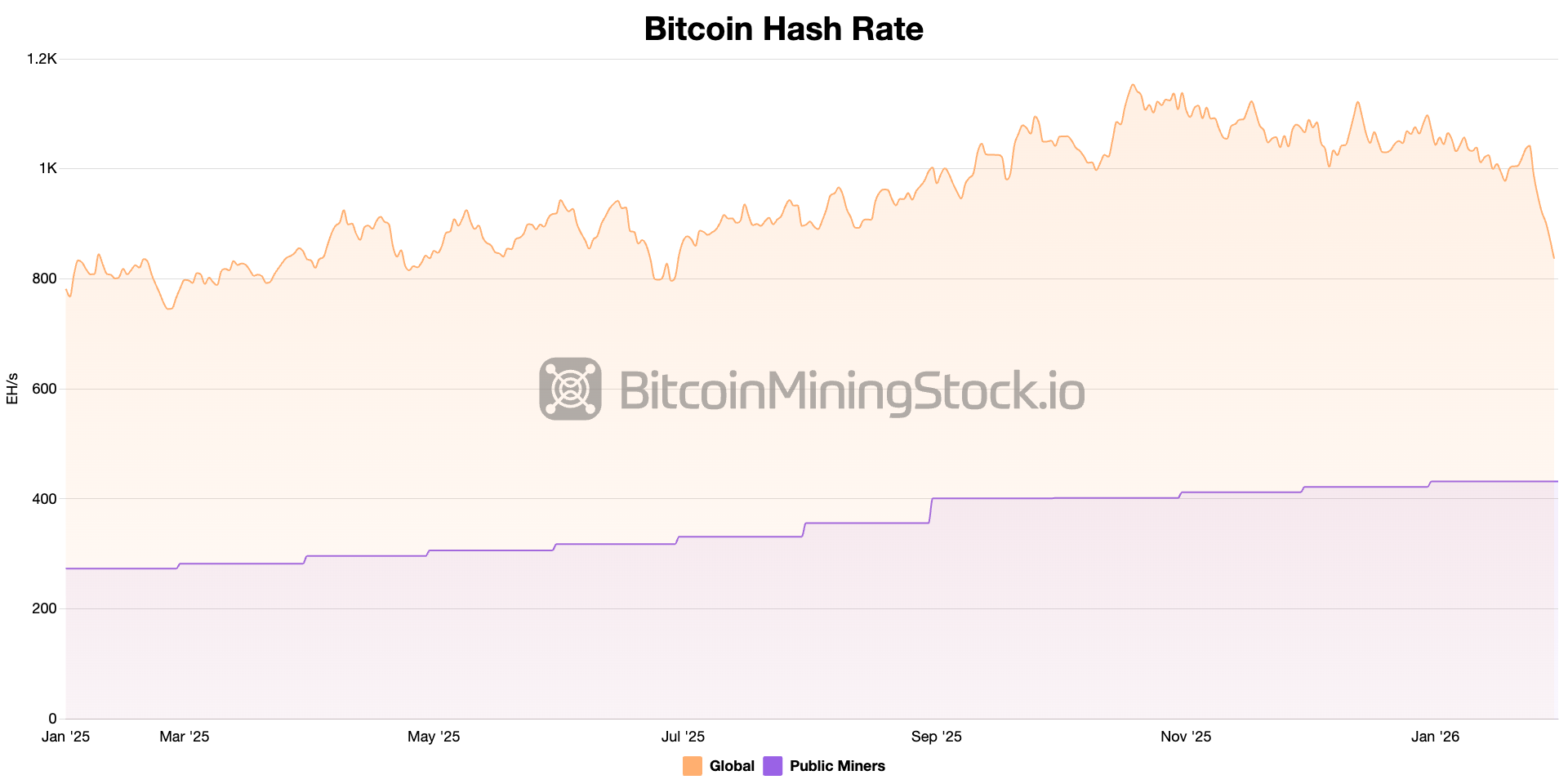

Some miners will proceed operating Bitcoin fleets so long as they continue to be worthwhile. However their improvement pipelines are actually nearly solely HPC-focused, similar to IREN and TeraWulf. Corporations like Bitfarms have gone additional, signaling that Bitcoin mining itself could also be wound down over time.

This shift has second-order results. If public miners more and more allocate capital and energy capability towards AI/HPC workloads, combination hash fee progress from public firms is prone to gradual, flatten, and even decline.

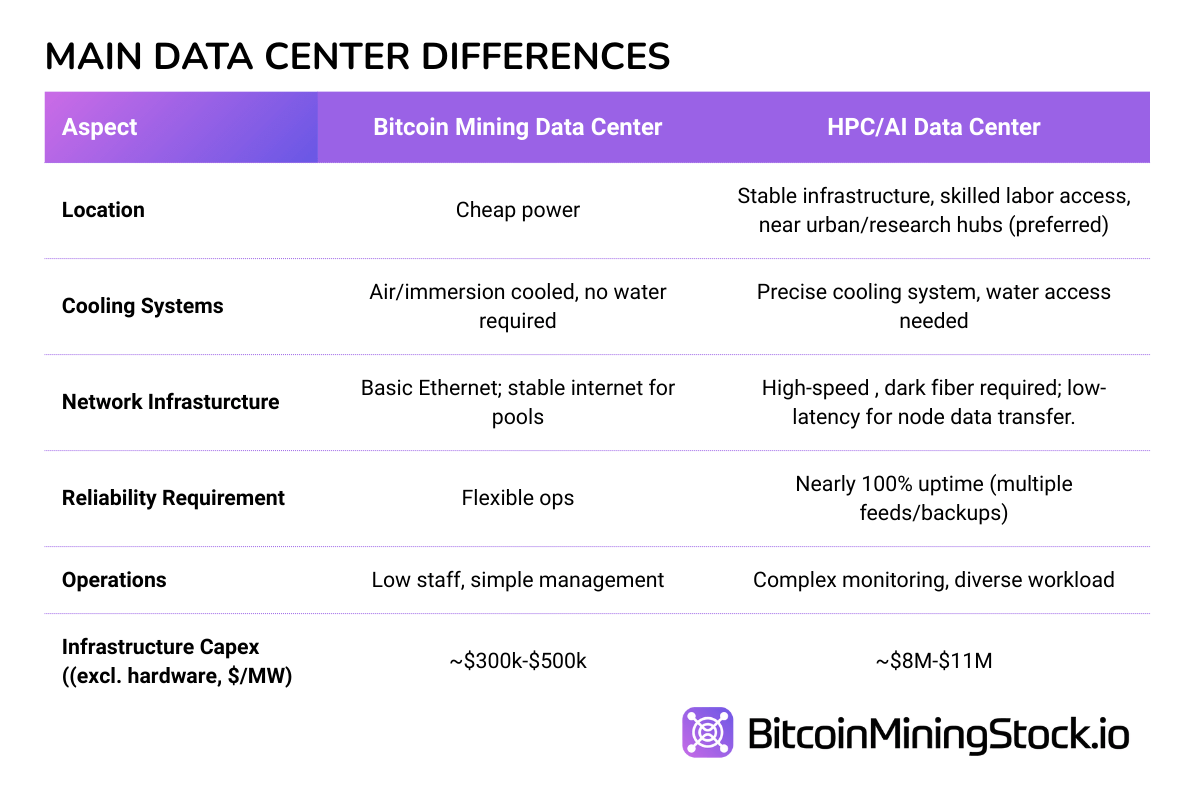

Pivots Are Not Possible For All people

HPC/AI pivots could also be mentioned, however it will likely be fallacious to imagine that transitioning is broadly out there to anybody with energy and land. In follow, most mining websites have been designed for velocity and adaptability (mining containers are broadly used), not for the density, redundancy, and operational self-discipline hyperscale workloads require. Some websites may be tailored, for instance, Core Scientific is modifying (~$1.5-3M per MW) their present Bitcoin mining information facilities to meet contracts with CoreWeave. Many can not, or solely at a price that erodes the economics of the pivot.

Capital and execution are the true constraints. HPC buildouts require massive upfront funding ($8-11M per MW vs $300-500K per MW) and totally different working expertises. Even with the fitting infrastructure and technical capabilities, monetizing a HPC operation takes time and in contrast to Bitcoin mining there are not any assured block rewards to fall again on.

One Prediction: Extra Offers, Much less Narrative

Hyperscaler bulletins are prone to proceed into 2026, given miners already management what AI patrons want most: permitted land, energy entry, and improvement functionality.

However the market is altering the way it reacts. Megawatt counts and headline contract values are now not sufficient. Buyers are asking tougher questions: who funds the construct; when income truly begins; what occurs if the shopper walks; whether or not danger actually sits on the undertaking degree or quietly flows again to the guardian firm…

Basically, not each HPC deal will re-rate a inventory the identical manner. The premium will more and more go to constructions that de-risk the enterprise mannequin and to operators that may execute with out stacking costly capital on high of already cyclical mining money flows.

After the HPC Pivot: What’s Subsequent for Bitcoin Mining?

(The next perspective was not included within the unique report, however it’s price sharing right here, as many readers have raised the identical query.)

For some, the rising shift of public miners towards AI and HPC infrastructure is seen as a menace to Bitcoin mining. In actuality, it is perhaps the start of mining’s evolution. As capital, experience, and vitality capability circulate towards high-value AI workloads, the panorama of Bitcoin mining is beginning to look totally different. When bigger miners reduce or exit Bitcoin mining, their former capability, {hardware}, and sources will redistribute throughout new geographies and enterprise fashions.

One seen impact might be a shift in the place mining occurs. Whereas AI information facilities compete for the very best energy websites in mature markets, particularly in North America, Bitcoin miners might be pushed to locations with stranded vitality, flared fuel, and smaller or off-grid energy sources. These environments favor flexibility over scale. A mining load that when sat on a hyperscale campus in Texas could reappear as a set of modular containers in Paraguay, Ethiopia, or Scandinavia, wherein fleets nonetheless contribute to community safety, however with very totally different economics and danger profiles.

On the identical time, mining will evolve the way it operates. Not like AI workloads, Bitcoin mining doesn’t require fixed uptime or redundancy. That makes it preferrred for hybrid setups the place mining serves as a buffer that absorbs extra energy, participates in demand response packages, and lowers total vitality prices. In these environments, mining isn’t the first product however a priceless instrument in built-in vitality infrastructure.

This evolution may also prone to increase the bar for miners who stay centered on Bitcoin. The previous mannequin: purchase ASICs, plug into low cost energy, and wait – will turn out to be tougher to maintain. In a extra aggressive panorama, operators might have to supply grid providers, reuse warmth, or construct nearer ties to energy suppliers, in order that they’ll generate a number of income streams.

None of those are assured outcomes. However one factor is definite – Bitcoin mining will proceed to evolve.

📙 Notice: This text is deliberately skipping particulars. If you wish to go deeper into particular person firms and their contract constructions, supply timelines, capital depth, and extra, please confer with the unique report.