$WULF targets 250-500 MW of recent HPC signings every year, and nonetheless plans to mine Bitcoin by way of a minimum of the top of 2026.

The next visitor put up comes from BitcoinMiningStock.io, a public markets intelligence platform delivering information on corporations uncovered to Bitcoin mining and crypto treasury methods. Initially revealed on Nov. 13, 2025, by Cindy Feng.

It’s earnings season once more, and whereas many corporations had fascinating updates, TeraWulf’s Q3 2025 name actually caught my consideration. Not due to earnings numbers, however as a result of it hinted at what may very well be the subsequent working mannequin for Bitcoin miners. Beneath all of the discuss of AI/ HPC, leases, and gigawatts, it’s now apparent that some miners are evidently changing into energy-infrastructure suppliers for the AI period.

Let’s break it down.

Rising Deal Sizes

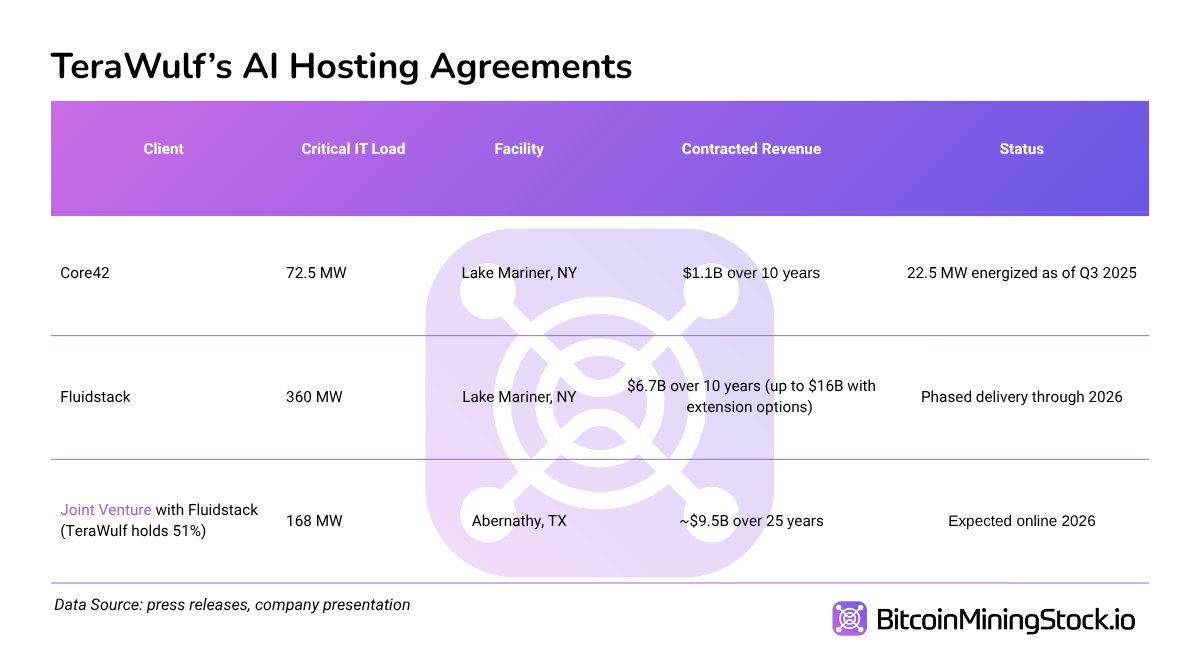

Again in August, TeraWulf inked two HPC lease offers with Fluidstack, totaling 360 MW. These offers introduced one thing new into the mining sector: Google. The tech big backstopped the leases, placing institutional credibility behind what had beforehand been thought of speculative crypto infra buildouts.

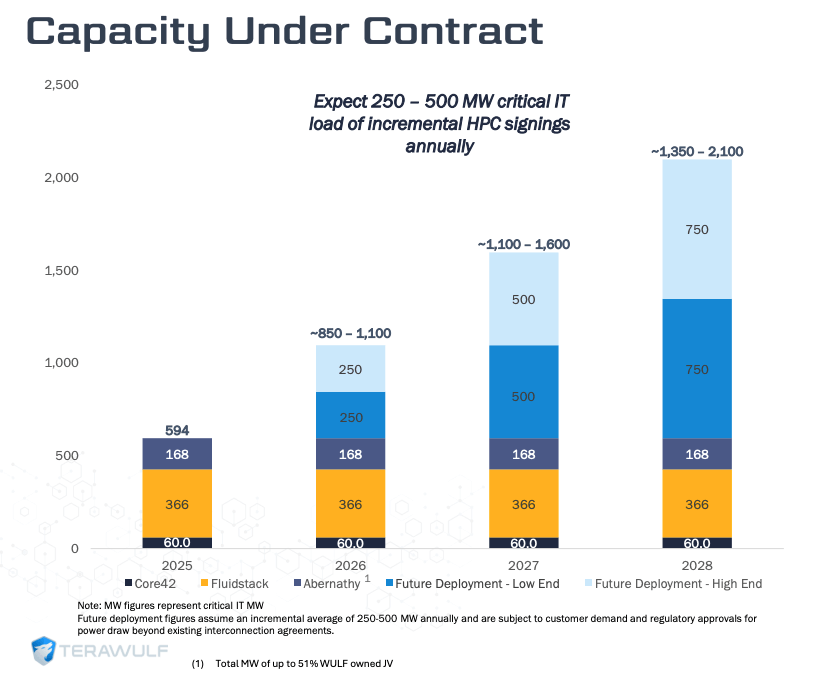

In November, TeraWulf reported 520 MW+ in whole contracted HPC IT load. That’s one of many largest sizes now we have seen within the bitcoin mining sector, and it occurred inside just a few months.

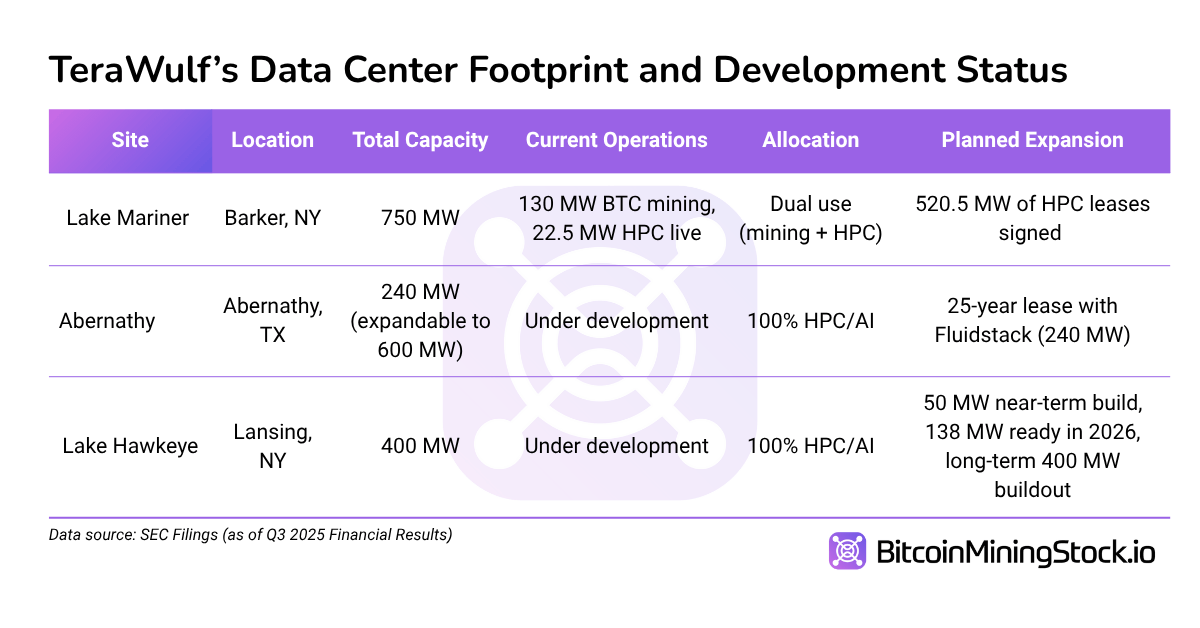

Notably, the 72.5 MW Core42 lease, signed on the finish of final 12 months, continues to be a part of the combo. However it’s Fluidstack who’s emerged as the important thing companion on this play. Past lease dimension, the 2 corporations (together with Google credit score enhancement) have fashioned a three way partnership to co-develop the Abernathy web site right into a 240 MW HPC campus, with growth potential as much as 600 MW.

This marks a delicate however vital shift: as an alternative of leasing land or area to a hyperscaler, TeraWulf is now co-building.

Joint Enterprise in Texas

The Abernathy three way partnership has been structured in a different way from what now we have seen within the business. The deal features a 25-year lease with Fluidstack (longer than typical AI leases), backstopped by a $1.3B Google credit score enhancement. TeraWulf holds as much as 51% controlling curiosity and rights to take part in an extra 200 MW Fluidstack-led buildout.

This layered strategy comprising of land possession, lease structuring, shopper partnerships, and entry to hyperscaler credit score, gives one thing uncommon in mining: long-term visibility.

Curiously, this wasn’t even WULF’s thought. CEO Paul Prager mentioned on the earnings name that it was Google who requested to anchor the JV in Abernathy. That remark reveals how hyperscalers could also be considering. Neglect the mining label, what issues is grid entry, execution historical past, and web site management. WULF, prefer it or not, has all three.

Focusing on 250-500 MW of New HPC Signings Yearly

Maybe the boldest second from the Q3 name got here when TeraWulf raised its annual goal for HPC signings. Beforehand guided 100-150 MW per 12 months, the new purpose is 250-500 MW yearly. If realized, that interprets into $465M – $930M in incremental income per 12 months (assuming the mathematics holds at $1.86M/MW).

Screenshot from the TeraWulf investor presentation (web page 10)

Whereas execution dangers stay, administration expressed sturdy confidence in reaching these targets, citing the 150+ websites evaluated final 12 months and a scaled-up dev/acquisition staff. A part of their $5.2B capital raised is to assist these expansions, although capital wants will stay steep, particularly for purposely constructed HPC information facilities ($8–11M per MW, conservatively).

Compared to conventional miners chasing hash charge and halving cycles, this mannequin goals for recurring income with shopper demand because the lead driver, as an alternative of block rewards.

The Way forward for Its Bitcoin Mining Biz

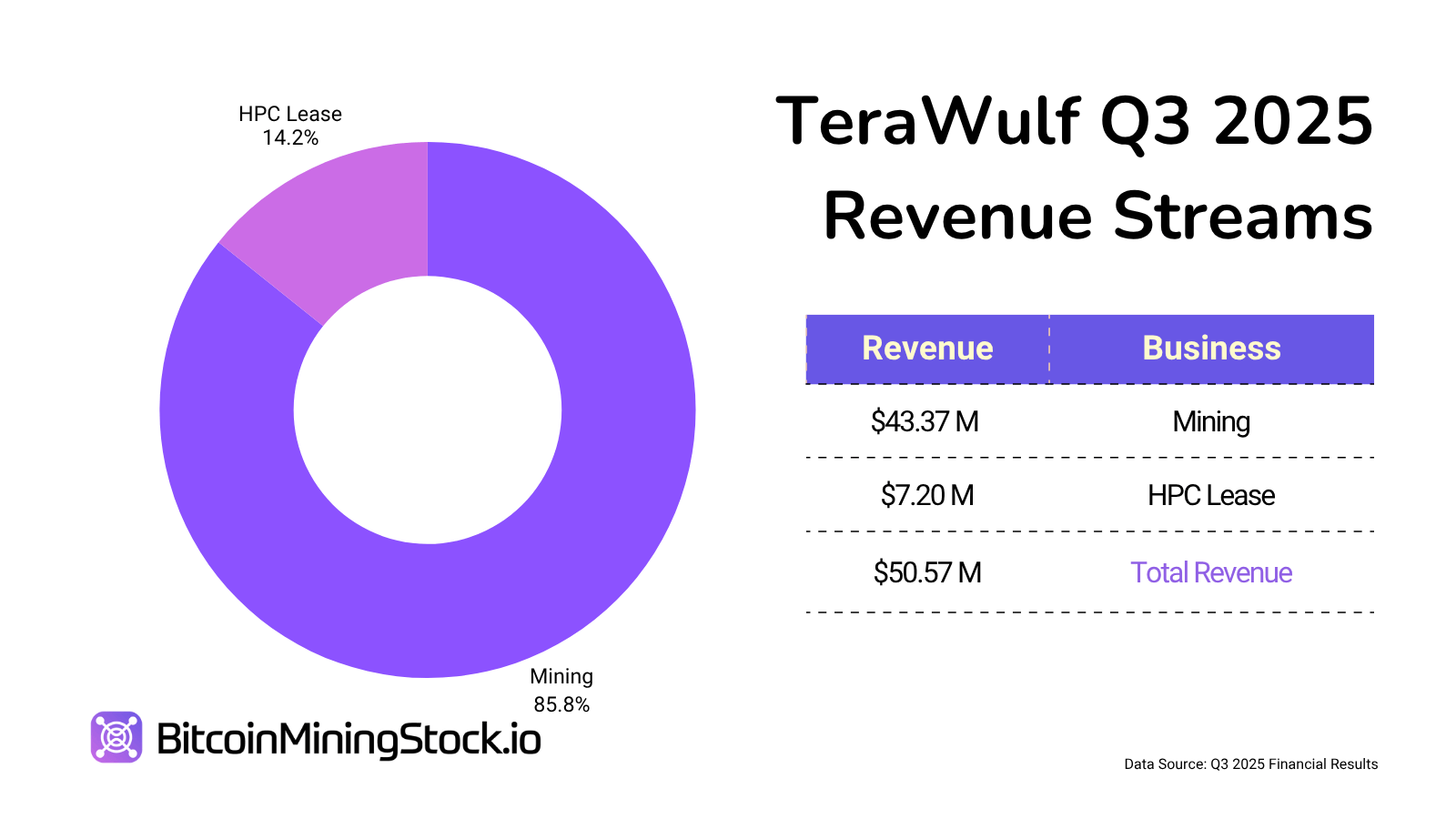

Whereas HPC is the corporate’s new frontier, Bitcoin mining stays the major income contributor right now. In Q3, TeraWulf self-mined 377 BTC (down from 485 BTC in Q2), because it started to retire older mining items and reallocate infrastructure to HPC.

Future developments at its flagship web site Lake Mariner, the place the HPC transition is in full swing, will likely be completely AI/HPC-focused. The corporate made it clear that no new Bitcoin mining infrastructure is being constructed except it helps dual-use capabilities.

Nonetheless, TeraWulf mentioned it intends to mine Bitcoin “by way of a minimum of the top of 2026″.

This strategy isn’t distinctive, however it units a transparent sign. Some miners might have talked about AI pivots, TeraWulf has now hard-coded it into site-level technique, capex priorities, and annual KPIs.

Ultimate Ideas

TeraWulf’s Q3 reveals extra than simply lease wins, it reveals a path different Bitcoin miners might comply with within the AI period. As a substitute of merely leasing infrastructure, the corporate is leveraging what it already controls (land, energy, and venture execution) to kind long-term, equity-aligned partnerships. By doing so, it has secured multi-billion greenback HPC/AI commitments and de-risked its roadmap. The query is not whether or not miners can entice AI offers, however whether or not they’re positioned to scale quick. Few have the assets to repeat this playbook, however the market is watching who strikes subsequent.