Bitcoin briefly slid to $72,863 on Bitstamp on Tuesday, however publicly traded mining shares managed to publish mixed-to-positive each day performances whilst U.S. inventory indexes closed firmly within the pink.

Bitcoin Miners Defy Purple Screens Amid Geopolitical Jitters

Bitcoin’s dip adopted a risk-off jolt after Reuters reported the U.S. shot down an Iranian drone approaching an plane service, unsettling international markets. Whereas shares like Technique (MSTR) and Coinbase (COIN) weakened alongside the transfer, bitcoin steadied close to the $76,000 degree by press time, serving to miners keep away from deeper harm.

Among the many prime miners by market capitalization, in line with bitcoinminingstock.io stats, IREN Restricted traded at $54.47, rising 2.61% on the day regardless of a 5-day decline of 8.97%. Utilized Digital climbed 5.37% to $36.67, trimming its weekly loss to three.67%, whereas Cipher Mining added 2.81% to $16.25, although it stays down 8.16% over 5 days.

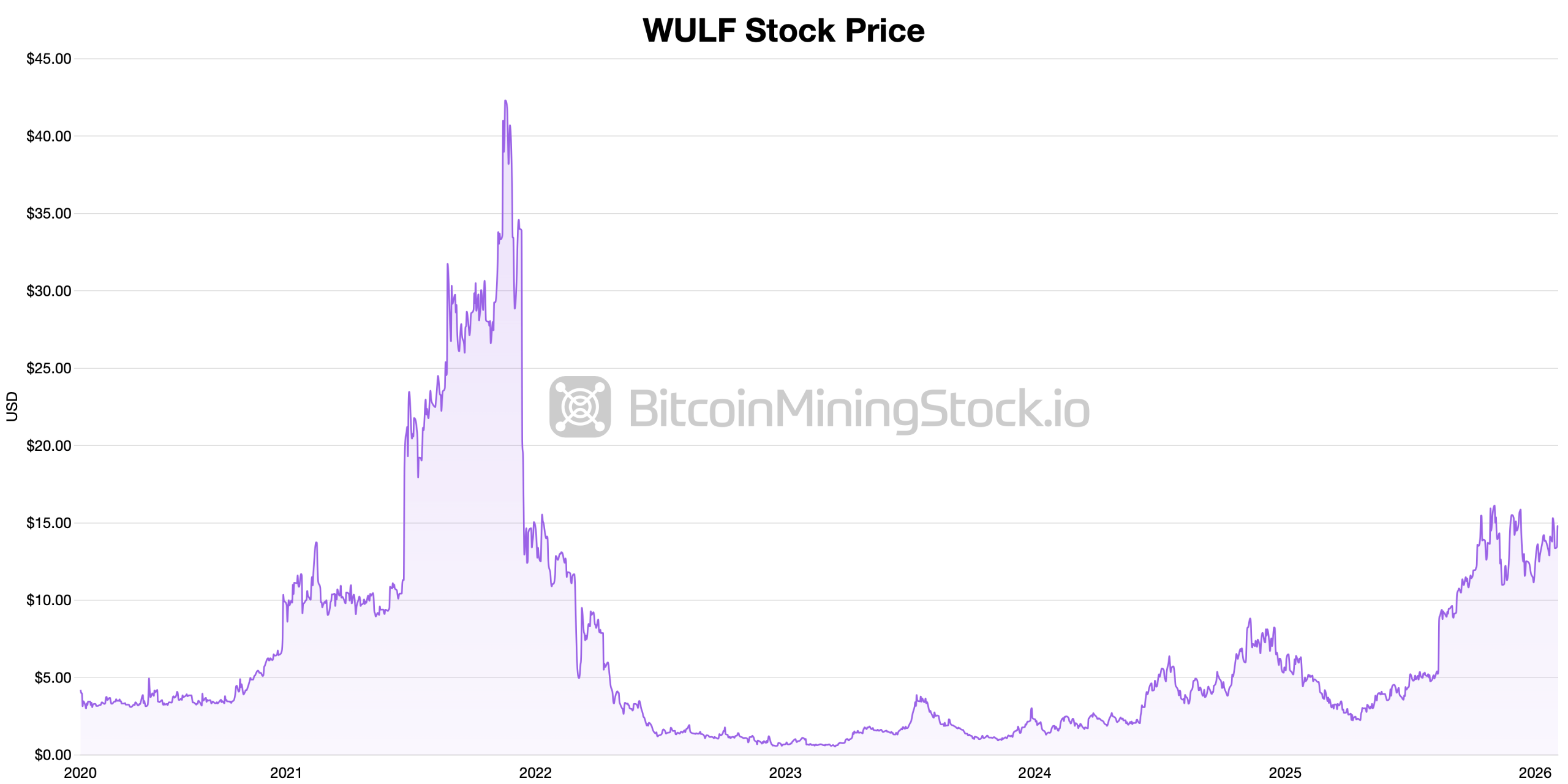

Hut 8 Corp. superior 5.01% to $59.00, outperforming friends every day, whereas Terawulf, Inc. stood out because the lone miner with features throughout each time frames, leaping 10.08% on the day and up 1.75% over 5 periods. Terawulf defined on Tuesday that new acquisitions the corporate made now present it with roughly 1.5 gigawatts (GW) of recent capability.

Terawulf stated it snapped up “strategically positioned” brownfield infrastructure websites in Maryland and Kentucky, turning previous industrial footprints into recent mining actual property. That is the explanation WULF outpaced the remainder of the highest ten pack.

Not all miners shared within the bounce. Riot Platforms edged up simply 0.19% to $15.35 however stays down 9.54% on the week. Core Scientific, Inc. slipped 0.72% to $17.74, whereas MARA Holdings, Inc. fell 0.76% to $9.05.

Additionally learn: Prediction Markets Worth a Brief 2026 Authorities Shutdown

Weekly strain was evident elsewhere, with Cleanspark up 2.89% on the day however down 9.76% over 5 days, and Bitdeer Applied sciences sliding 1.74% on the day to $12.96, off 2.26% for the week.

The cut up efficiency suggests buyers are selectively rotating throughout the mining sector, favoring balance-sheet power and operational scale as bitcoin makes an attempt to stabilize after a risky session. Regardless of this, when it comes to operations, the community’s hashprice is getting very low at $34.18 per petahash per second (PH/s) on Tuesday.

FAQ ❓

- Why did bitcoin dip on Feb. 3, 2026? Bitcoin slid after geopolitical information heightened threat aversion throughout international markets.

- Did all bitcoin miners rise on Tuesday?No, each day features had been combined, with some miners posting modest losses.

- Which miner carried out greatest on each time frames?TeraWulf was the one prime miner displaying features on each the 1-day and 5-day view.

- The place is bitcoin buying and selling now? Bitcoin is holding across the $76,000 vary at press time.