Coinshares’ Q3 mining report, led by researcher James Butterfill, highlights mounting prices and challenges impacting the bitcoin mining business in 2024.

How Bitcoin Mining Trade Giants Are Battling Rising Costs

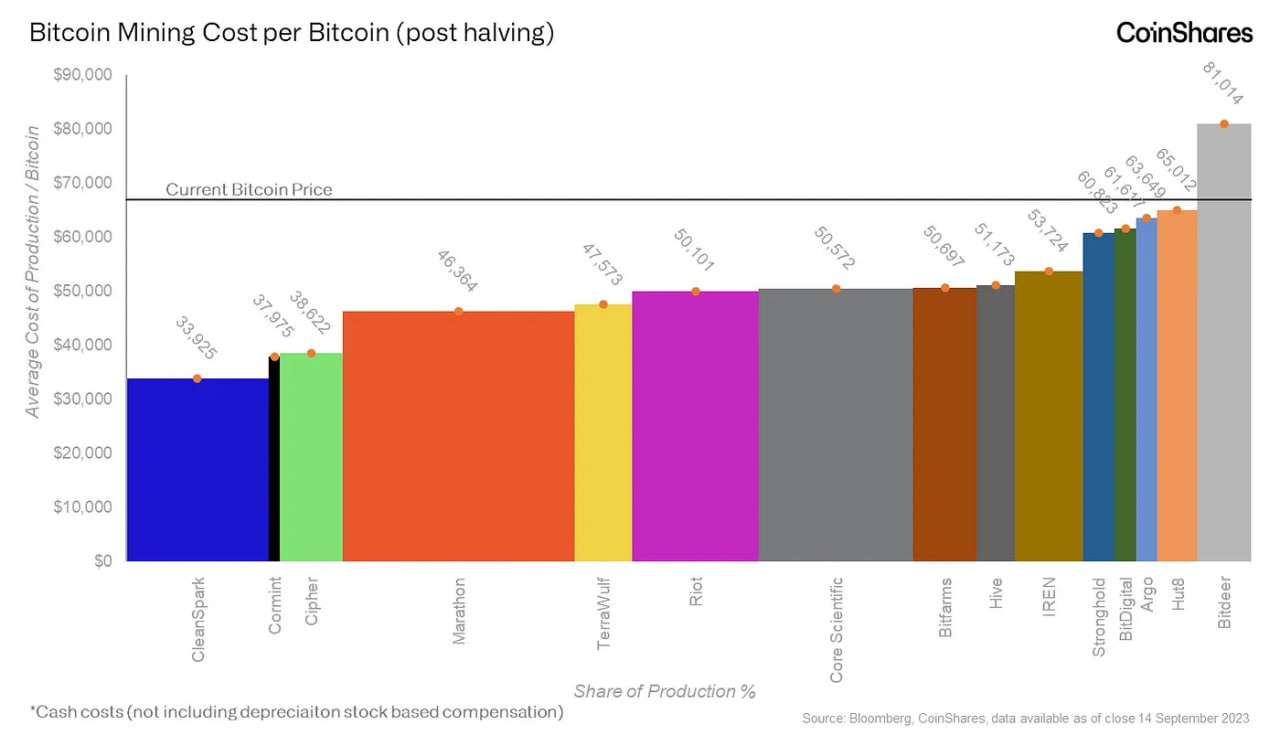

The Coinshares Q3 mining report, with analysis led by James Butterfill, reveals that bitcoin mining prices are rising, reaching an estimated $49,500 per bitcoin (BTC) when accounting for money bills alone. Together with further prices like depreciation and stock-based compensation, the manufacturing price averages $96,100. This heightened price setting stems from an elevated mining problem and infrastructure growth, which have collectively pushed up expenditure.

Butterfill notes:

Regardless of this, miners have continued to roll out new infrastructure and have dedicated to additional growth, anticipating future worth will increase.

One vital hurdle outlined by Coinshares is restricted entry to financing choices, exacerbated by rising rates of interest and diminished credit score availability following latest cryptocurrency market disruptions. Many miners have resorted to issuing shares to finance operations, a transfer that has diluted shareholder worth.

Butterfill’s report additionally notes a correlation between the value actions of bitcoin and miner shares; nevertheless, whereas bitcoin has seen worth boosts from U.S. bitcoin ETF developments, miner shares haven’t totally capitalized on these good points.

“Not too long ago, the costs of listed miners have tracked bitcoin’s worth extra carefully; nevertheless, they’ve missed substantial good points earlier within the 12 months as they didn’t profit from the U.S. spot bitcoin ETF launches that drove bitcoin’s worth,” Butterfill stated.

Coinshares’ evaluation anticipates sustained development in bitcoin’s hashrate, which measures mining effectivity, projecting it’s going to rise from the present 684 exahash per second to 765 exahash by year-end. Butterfill’s workforce employs a singular mannequin factoring within the limitations of stranded gasoline as an power supply, theorizing that miners could finally attain an energy-saturation level by 2050. Ought to this occur, Coinshares tasks a possible 63% discount in carbon emissions, as miners shift to changing flared gasoline into usable power.

Profitability projections by Coinshares additional point out that below current market circumstances, direct funding in bitcoin might yield increased returns than bitcoin mining. Butterfill’s report advises miners to diversify income streams, akin to investing in synthetic intelligence (AI) applied sciences, as further miner charge income is unlikely to satisfy profitability targets. Coinshares concludes that for the mining business to stay aggressive, effectivity and value administration might be essential.