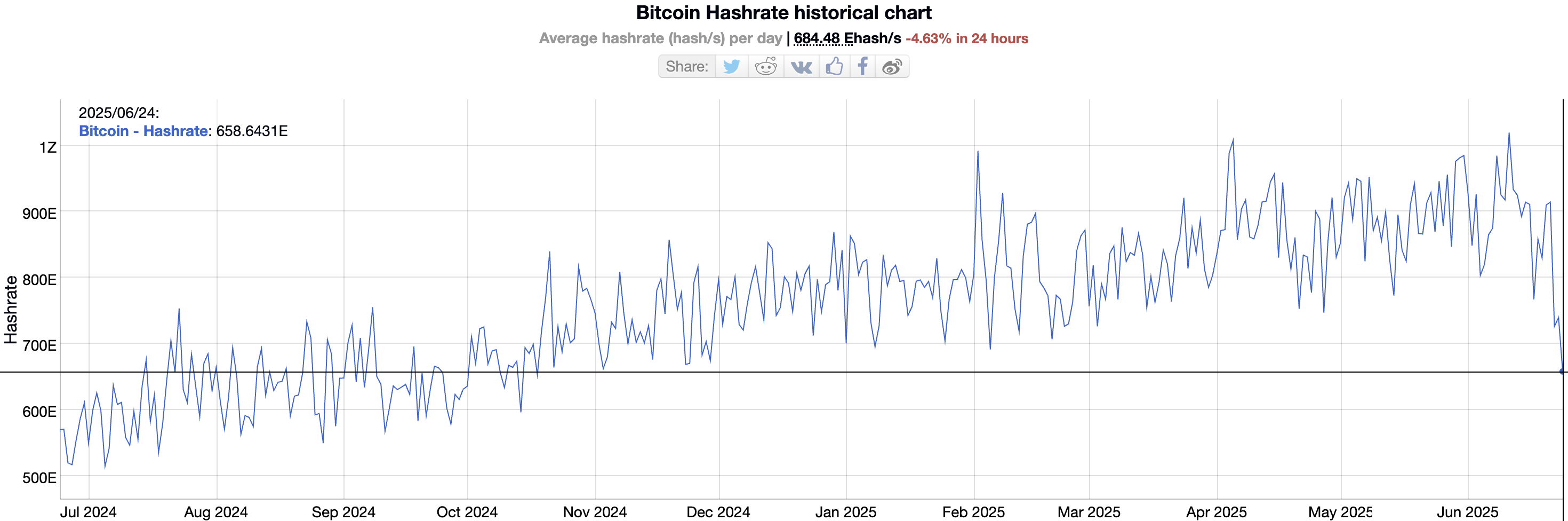

In accordance with information from BitInfoCharts, Bitcoin’s each day common hashrate has dropped to 684.48 EH/s, the bottom since mid-October final 12 months.

This decline, from a peak of 966 EH/s on June 20, 2025, raises a big query: is that this a chance or a threat for the cryptocurrency market?

Hashrate has Decreased, however To not Its Lowest

Though Bitcoin’s present hashrate has fallen to a low degree, it’s nonetheless a lot greater than the 379.55 EH/s recorded in July 2023. This ensures that the Bitcoin community stays secure to some extent.

Bitcoin hashrate. Supply: BitInfoCharts

The first explanation for this decline may very well be associated to the surge in Bitcoin mining prices, which elevated by greater than 34% in Q2 2025 when the hashrate hit new highs, as beforehand reported by BeInCrypto. Increased electrical energy costs and {hardware} and upkeep prices have compelled many miners to droop operations to keep away from losses.

Moreover, energy-saving applications have contributed to the hashrate discount, as some mining farms take part in grid load discount initiatives. Or the struggle in Iran additionally contributed to this decline.

“Hear, I do know “Hashrate is down as a result of Iran acquired bombed” is a superb meme, however for those who truly mine Bitcoin you’re US climate patterns.” X person Rob Waren shared.

The Bitcoin market has maintained outstanding stability regardless of the present hashrate scenario. Bitcoin’s value is presently at $106,000, indicating constructive investor sentiment.

Bitcoin ETFs, particularly BlackRock with $70 billion in property below administration (AUM), proceed reinforcing confidence in Bitcoin as a safe-haven asset, even because the US inventory market plummets. This displays the rising separation between Bitcoin and conventional monetary markets.

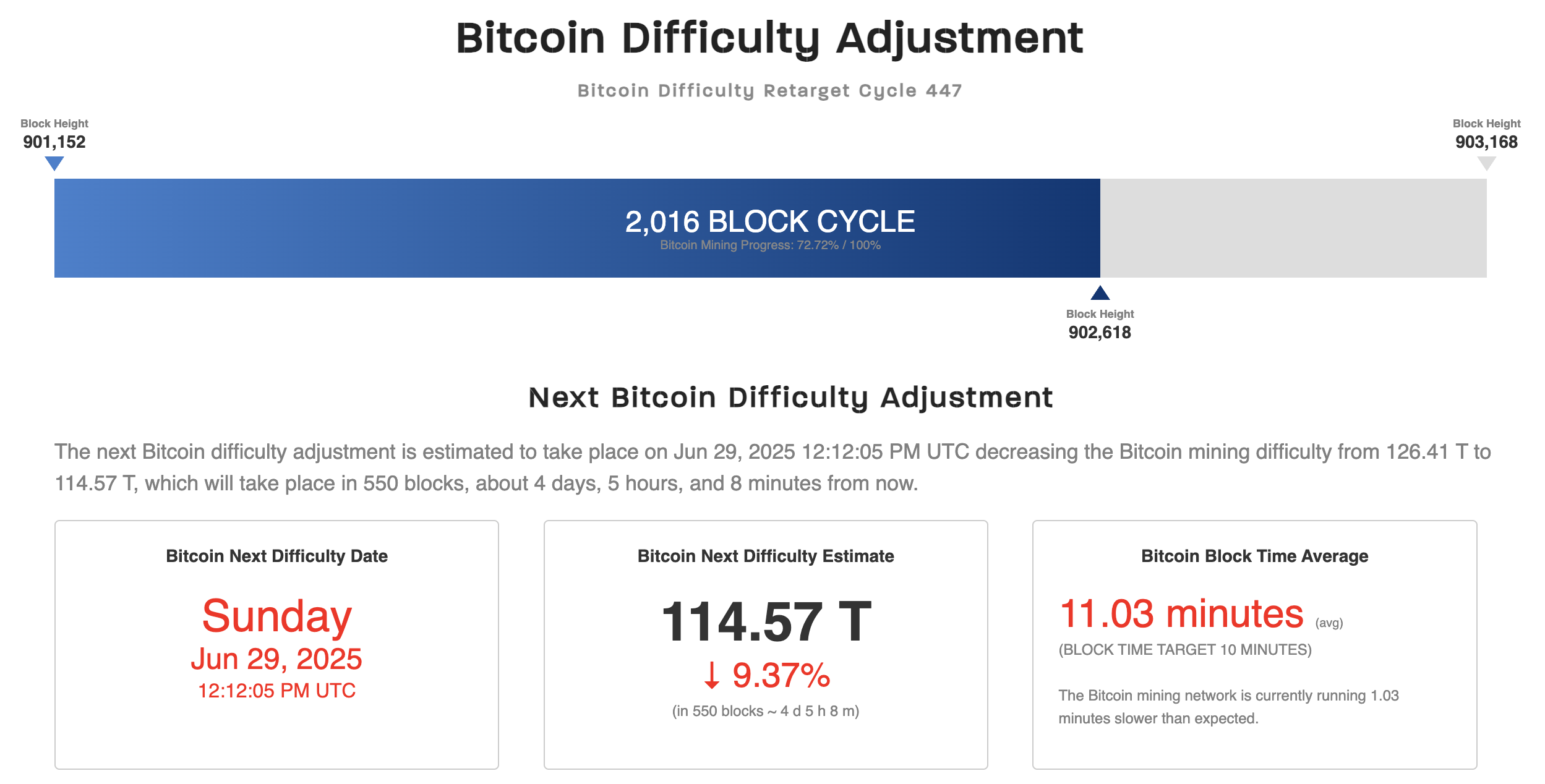

Bitcoin Mining Problem Anticipated to Lower by 9.37%

One other crucial issue is the upcoming mining issue adjustment, scheduled for June 29, 2025. In accordance with CoinWarz, the problem will drop from roughly 126.41 T to 114.40 T, a discount of about 9.37%.

Bitcoin mining issue. Supply: CoinWarz

This is a chance for miners, because the decrease issue will improve earnings, encouraging them to return to the community. Nevertheless, if the hashrate doesn’t get well in time, the Bitcoin community might face a slight safety threat, though the present 684.48 EH/s degree continues to be adequate to guard the community from 51% assaults.

The hashrate decline may very well be a constructive sign in the long run, because it weeds out inefficient miners. On the identical time, Bitcoin’s secure value at $106,000, mixed with the expansion of ETFs, signifies that the market nonetheless believes in Bitcoin’s potential.

Nevertheless, dangers stay. If the hashrate drops additional and the problem adjustment doesn’t happen in time, promoting strain from miners might trigger Bitcoin’s value to say no. Moreover, macroeconomic elements comparable to geopolitical tensions and the Fed’s rate of interest insurance policies might impression the crypto market.