Bitcoin miners are kicking off February on shaky floor, with income slipping exhausting since mid-January and sitting nicely under July’s 12-month peak. On prime of that, the U.S. winter storm has stored the hashrate caught far beneath the lofty ranges seen again in October.

Bitcoin Miners Begin February With Income Metrics Flashing Pink

Most individuals are nicely conscious of the winter storm ripping by means of a number of U.S. states, inflicting a number of mining operations to briefly energy right down to ease pressure on native grids. As of press time this weekend, the hashrate is idling round 850 exahash per second (EH/s). It hasn’t dipped this low since late June 2025.

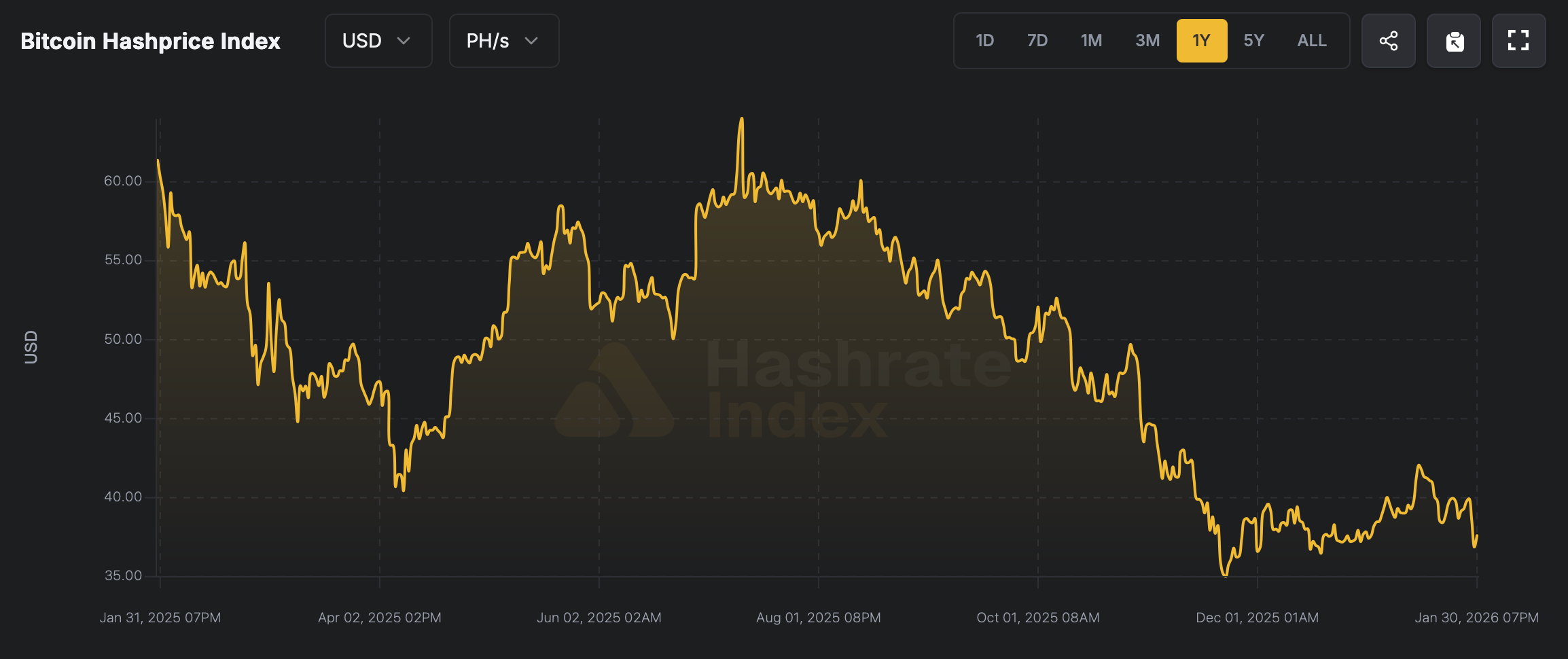

On prime of that, bitcoin mining outfits are grappling with costs slipping to territory not seen since April 2025. That drop has dragged hashprice—a gauge of the estimated worth of 1 petahash per second (PH/s) of hashpower—right down to painfully low ranges. Whereas the $35.22 hashprice hasn’t fairly matched the $34.99 print from Nov. 22, it’s uncomfortably shut for consolation.

Bitcoin’s hashprice on Feb. 1, 2026.

It marks the second-lowest income studying of the previous 12 months for bitcoin miners, with the determine sitting roughly 45% under the 12-month excessive of $64.03 per PH/s set on July 11, 2025. Including insult to harm, the highest 13 publicly traded bitcoin miners by market cap all completed Friday deep within the pink.

Utilized Digital (APLD) took the toughest hit, tumbling 11%, adopted by IREN Restricted (IREN) down 10.19% and Cipher Mining (CIFR) sliding 9.83%—a tidy sweep of losses throughout the leaderboard. Taken collectively, all of it piles critical stress on miners, and solely a brief listing of things stands an opportunity of easing the squeeze.

Learn extra: Latam Insights: Venezuelan Oil Flows to the US Once more, El Salvador Buys the Gold Dip

These embrace bitcoin climbing again from latest lows, as at present costs BTC stays 37.4% under its October all-time excessive north of $126,000. Onchain charges might provide some reduction too, however they’ve been caught under 1% of the common block reward for fairly some time now. The most important—and extra dependable—supply of reduction is more likely to come from the subsequent problem epoch, which is shaping as much as be fairly a significant adjustment.

For now, miners are caught grinding by means of a chilly, unforgiving stretch the place margins are skinny, machines are quieter, and endurance is carrying thinner by the block. Till costs rebound or problem resets ship respiration room, survival comes right down to effectivity, balance-sheet self-discipline, and ready out the storm—each meteorological and market-driven—with fewer comforts than traditional.

FAQ ⛏️

- Why are bitcoin miners seeing decrease income proper now?

Mining income has fallen as bitcoin costs dropped and hashprice slid to one in every of its lowest ranges previously yr. - What’s hashprice and why does it matter to bitcoin miners?

Hashprice measures the estimated each day income earned per petahash per second (PH/s) and immediately displays miner profitability. - How far is bitcoin from its latest all-time excessive?

Bitcoin is at the moment about 37% under its October all-time excessive above $126,000. - What might enhance bitcoin miner income going ahead?

A restoration in bitcoin’s value or a downward adjustment in mining problem might assist ease stress on miner margins.