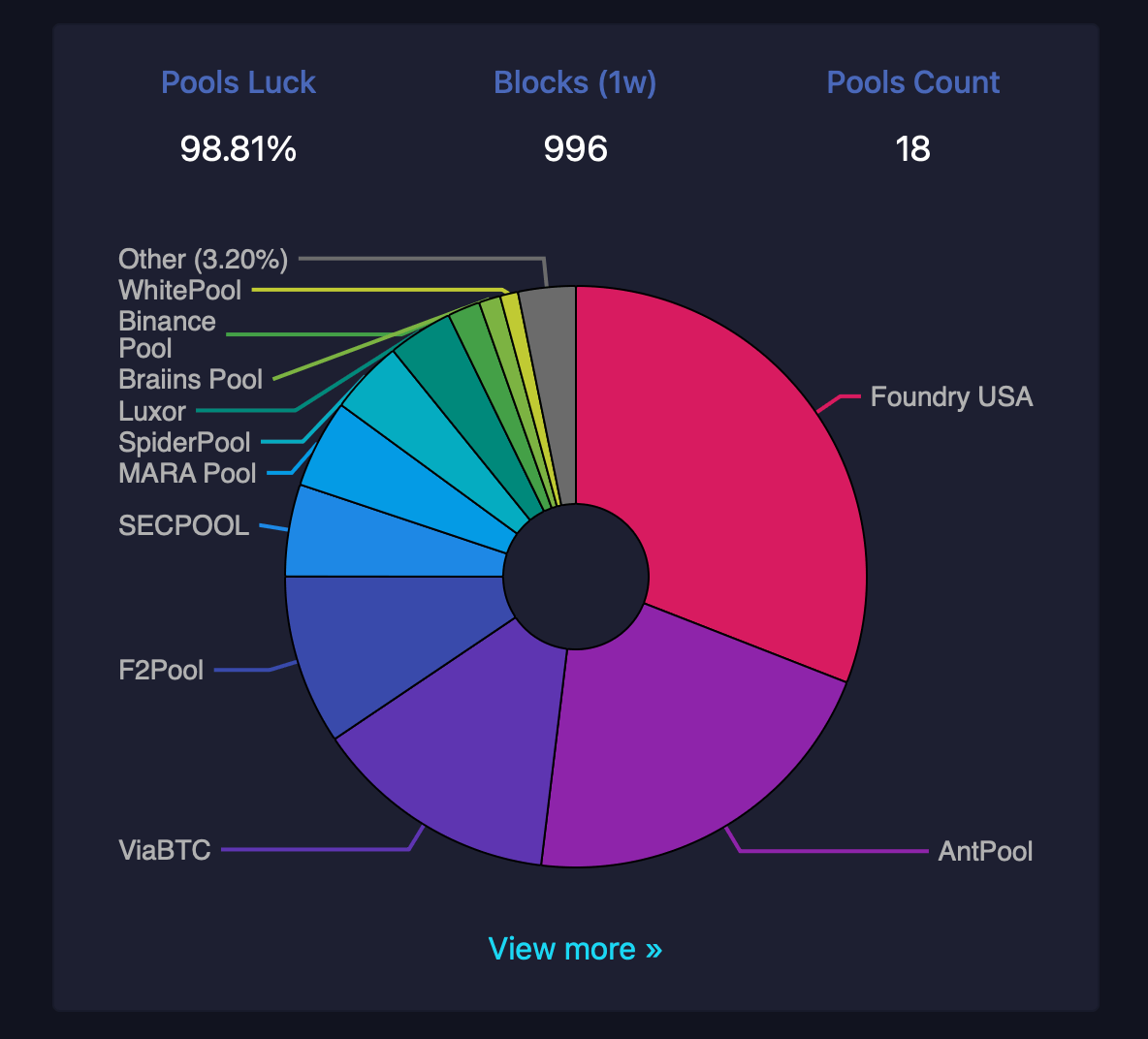

Bitcoin mining swimming pools Foundry, Antpool, and Viabtc collectively command over 65% of the community’s international hashrate, amplifying their dominance by scale, aggressive price fashions, and tailor-made incentives for contributors.

What Are Mining Swimming pools?

Collaborative mining swimming pools combination computational sources from particular person miners to boost block discovery odds, distributing rewards primarily based on contributed hashpower. As of March 20, 2025, Bitcoin’s whole community hash charge measures 809.65 EH/s. Main this sector are Foundry USA (246 EH/s), Antpool (173 EH/s), and Viabtc (111 EH/s), collectively representing roughly 65.5% of world hashpower, based on mempool.area stats.

Their expansive infrastructure attracts miners prioritizing regular returns, perpetuating a major suggestions loop the place dominant swimming pools increase whereas smaller opponents face mounting strain.

Foundry USA

Foundry USA at present holds the highest place, steering almost 30% of Bitcoin’s whole hashrate. The pool’s enchantment reportedly stems from stringent safety protocols—comparable to KYC/AML adherence, handle whitelisting, and SOC 2 certifications—coupled with a zero-fee Full Pay Per Share (FPPS) payout construction, guaranteeing constant income streams for institutional contributors. Its “Donate” initiative additional distinguishes it, enabling miners to allocate a portion of earnings to Bitcoin growth, with the aim of fostering goodwill inside the ecosystem.

Foundry’s U.S.-based operations declare to supply regulatory predictability, a key draw for miners cautious of geopolitical volatility. Presumably, the publicly-listed miners Bitfarms, Hut 8, and Cipher Mining mine with Foundry’s devoted pool. Out of the final 998 blocks, Foundry found 310.

Antpool

Antpool, rating second with 173 EH/s, leverages its affiliation with Bitmain Applied sciences (established in 2013) to ship reliability and belief. The pool employs a Pay Per Final N Shares (PPLNS) mannequin with no charges, optimizing miner profitability. Its merged mining performance permits simultaneous participation in a number of blockchains, broadening earnings potential with out added prices.

Antpool’s geographically dispersed node community—spanning the U.S., Germany, and China—minimizes downtime, whereas low payout thresholds and a robust fame cement its reputation. It has been mentioned that Bitfufu and Bitdeer dedicate hashrate towards Antpool’s collective computational energy. During the last 998 Bitcoin blocks, Antpool’s hashrate has managed to acquire 209 blocks.

Viabtc

Viabtc, third with 111 EH/s, prioritizes earnings by way of its proprietary PPS+ payout system, engineered to spice up miner returns. The platform enhances enchantment by built-in monetary instruments, comparable to crypto-backed loans and hedging methods, alongside real-time Telegram notifications for hashrate shifts. Viabtc’s adaptable payout choices make it a compelling alternative for miners. The pool supplies PPS+, PPLNS, and SOLO cost strategies, catering to completely different mining preferences.

Notably, PPS+ is Viabtc’s unique system, designed to maximise profitability—a bonus highlighted by an Ultramining Evaluation. Supporting merged mining for litecoin ( LTC) and bitcoin money ( BCH), Viabtc is alleged to supply a number of diversification alternatives. Reportedly miners flock to this particular pool for its intuitive interface, cellular app, and international person base. Out of 998 blocks mined, Viabtc’s pool managed to seize 136 of them.

Why Miners Select Bigger Swimming pools

Miners more and more favor giant swimming pools like Foundry, Antpool, and Viabtc for his or her reliability and regular reward distribution. These entities mitigate operational dangers by superior infrastructure, devoted help, and cost-efficient price buildings—benefits smaller swimming pools battle to copy.

The ensuing centralization, nonetheless, sparks debates about Bitcoin’s foundational ethos, as concentrated hashpower may theoretically expose the community to coordinated vulnerabilities. These debates have resurfaced on many events however nothing has actually curbed the centralization to today. As of March 2025, the trio’s 65% hashrate share displays a continued trajectory towards heightened centralization, except issues change.

Whereas miners profit from stability and effectivity, this consolidation challenges Bitcoin’s decentralized beliefs. As an example, sooner or later folks speculate that particular entities and transfers may very well be blocked if centralization continues unabated. Financial pragmatism continues to drive this development, suggesting centralization might intensify absent shifts in miner priorities or technological breakthroughs. The continuing rigidity between operational practicality and philosophical ideas stays a defining dynamic for Bitcoin’s evolution.