Public Keys is a weekly roundup from Decrypt that tracks the important thing publicly traded crypto corporations.

This week: CoreWeave and Core Scientific plan to make it official, Bitcoin ETFs are booming, a BTC and Dogecoin miner embraces Solana, and Bitcoin’s largest treasury holder takes per week off from the shopping for grind.

Core fusion dance

Bitcoin miner Core Scientific and newly public AI powerhouse CoreWeave have determined to do the fusion dance in a staggering $9 billion all-stock transaction.

Sadly, they aren’t altering the ticker to DBZ.

The Bitcoin miner trades on Nasdaq beneath the CORZ ticker, and CoreWeave, the newly public AI powerhouse, trades on the identical change beneath the CRWV ticker.

The deal between the 2 corporations appears to be one of many largest crypto-adjacent M&A offers ever. However traders favored the look of it firstly of the week greater than they do now.

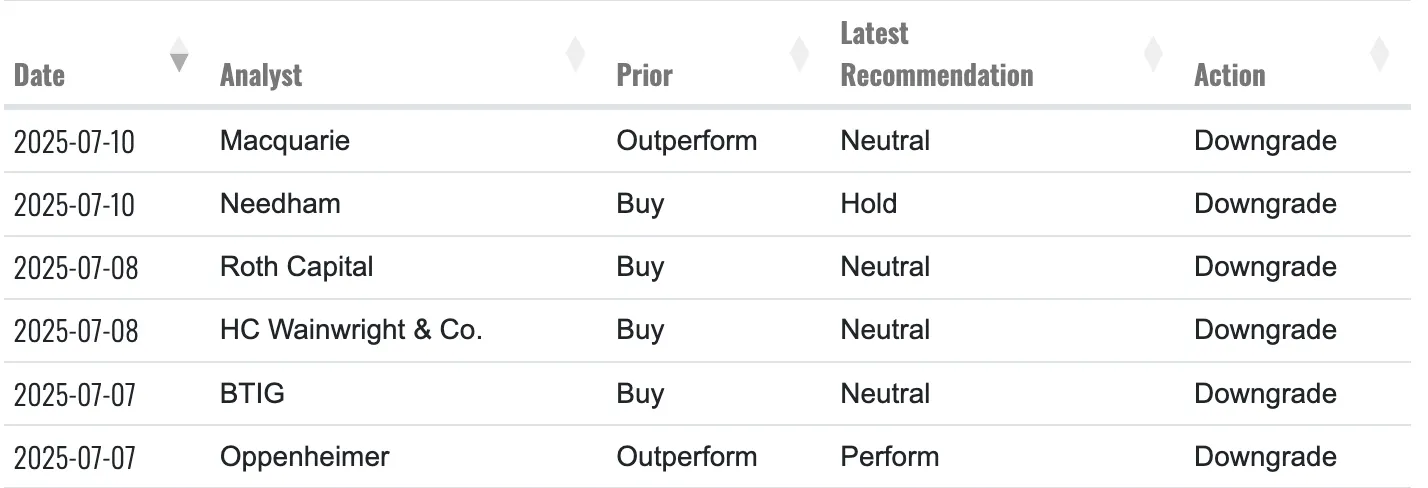

Supply: FinTel.io

CORZ rose to $15.71 when the information was introduced Monday. However shares for the newly-acquired Bitcoin miner have since sunk to $12.51. That’s not the sort of trajectory you usually see for a miner the identical week Bitcoin continues pushing to new all-time highs. And CRWV, which peaked above $160 on Monday, has since sunk to $125.84.

Needham’s John Todaro was one in all six analysts this week to downgraded Core Scientific. Macquarie analysts Paul Gooding and Marni Lysaght lower their CORZ ranking from outperform to impartial, whereas sustaining their $15 worth goal.

That’s partially as a result of traders had already gotten wind of the deal and had began pricing it in earlier than it was introduced, they wrote.

“Previous to this, each tickers have been pricing in a deal coming to fruition after media studies suggesting a excessive chance,” they wrote within the be aware shared with Decrypt. The analysts added that as a result of it is a definitive—not non-binding—deal that already has approval from Core Scientific CEO Adam Sullivan, it’s unlikely a greater bid will materialize.

One billy for Bitcoin ETFs

Bitcoin spot ETFs cleared $1.17 billion price of internet inflows on Thursday, marking the second largest day for the funds since they launched.

That is the sort of institutional momentum that has so many analysts gleefully pointing at falling Bitcoin volatility. And no small shock that BlackRock’s iShares Bitcoin Belief, or IBIT, accounted for practically half—$448.5 million, to be precise—of the money flowing into the funds.

IBIT has but to surrender the crown because the fastest-growing ETF within the business’s 32-year historical past. The fund has now surpassed $80 billion in property beneath administration, roughly a month after it inched previous the $70 billion mark.

Turning in the direction of the SOL

BIT Mining noticed its inventory get an enormous carry after the Bitcoin and Dogecoin miner revealed a $300 million Solana treasury pivot.

BIT Mining, which trades on the New York Inventory Alternate beneath the BTCM ticker, was having an in any other case placid week. However when the Solana pivot was introduced on Thursday, its shares opened at $7.01 after having closed at $2.42 on Wednesday.

What’s gone up hasn’t crashed all the best way again all the way down to Earth, however BTCM shares have misplaced a few of their levity. As of this writing, the inventory is altering arms at $4.34 after having gained 83% over the previous 5 days, however shedding 29% in comparison with yesterday’s standout efficiency.

Even when the announcement turned heads from the Solana crowd, it wasn’t sufficient of a catalyst for HC Wainwright, the one equities analysis agency that covers the corporate, to concern new steering. The agency has maintained its “impartial” ranking on BTCM because it initiated protection in 2022.

Bye week technique

Sure, even the Purchase Bitcoin button at Technique will get a while off. No less than, it did final week, skipping a weekly BTC buy for the primary time in three months.

Bitcoin large Technique has seen its BTC treasury swell to a $70 billion valuation because of Bitcoin taking part in footsie with $120K late this week.

In lieu of including much more of the world’s first cryptocurrency to its coffers, Technique rolled out a brand new $4.2 billion most popular inventory providing of STRD.

Technique founder and chairman Michael Saylor has beforehand known as the STRD most popular inventory the corporate’s “fourth gear,” as a result of it grants traders a excessive yield—however with much less sensitivity to the value of Bitcoin.

By the top of June, Technique capped off a $7 billion Bitcoin shopping for spree throughout the second quarter. The corporate started the 12 months with 446,400 BTC and has now elevated its treasury to 597,325 BTC as of this writing.

However hey, sufficient with the Sat counting. Saylor says, “Simply get in.”

Different Keys

- Tokenized equities growth: Robinhood CEO Vlad Tenev stated he desires “1000’s” of personal corporations tokenized on the corporate’s platform. However as we noticed final week, not all of these non-public corporations are eager on the concept.

- Coinbase’s “10x unlock”: For those who suppose the GENIUS Act is bullish for Coinbase, wait till you get a take a look at the way it’s planning to supercharge buying and selling with AI. CEO Brian Armstrong stated on X he’s “most excited to see crypto wallets absolutely built-in into LLMs at some point,” whereas asserting the crypto change’s partnership with Perplexity AI.