The latest slowdown in mining led to the most important dip in problem in six months. The shift will give present miners some respiration area, as $BTC stays under $70,000.

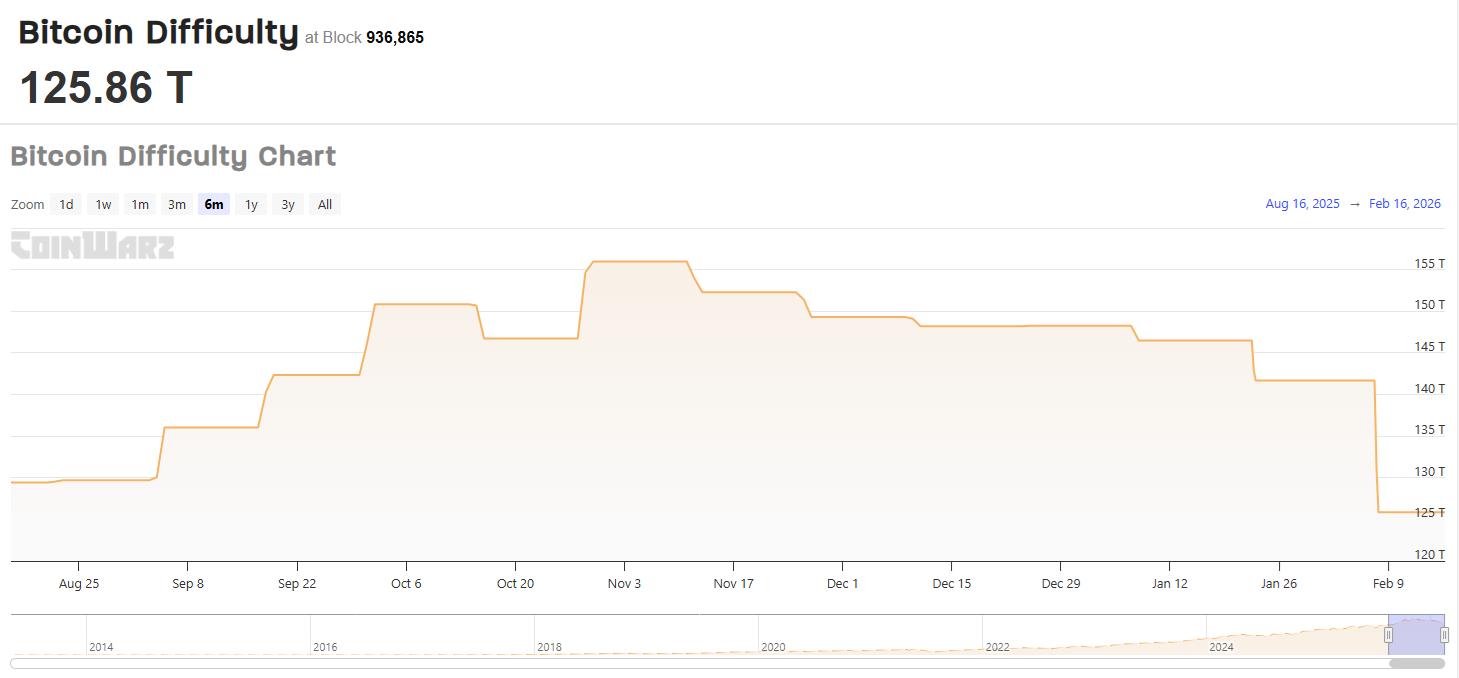

$BTC mining confirmed the most important single drop of problem, following the most recent recalculation. Problem had its single largest drop in six months, sinking to ranges not seen since August 2025.

The most recent $BTC problem calculation had a steep downturn, reflecting seasonal shutdowns, in addition to non-viable miners shifting away from the market. | Supply: CoinWarz.

The problem dip is a mixture of seasonal shutdowns, in addition to choices by some miners to close down and never mine unprofitably. The problem metric remains to be comparatively near its all-time excessive, and a few miners are in misery.

For now, a lot of the large swimming pools present strong exercise, whereas mining corporations with older knowledge facilities haven’t slowed down their hashrate. The slowdown additionally displays the weakened $BTC market worth, which hovered at $68,841.76.

Will $BTC miners nonetheless help the community?

$BTC has sufficient miners who can overcome the present problem ranges. Up to now, the chain has not slowed down throughout any of the two-week intervals of higher problem. In contrast to smaller networks like Bitcoin Money, the primary $BTC chain has no want for shorter intervals of problem re-evaluation.

Some swimming pools, like Mara[.]com, haven’t shed even a little bit of their hashrate, remaining at 61.7 EH/s. The largest features got here for Foundry USA, which aggregates the hashrate of US-based miners.

Following the problem recalculations, some knowledge pointed to a V-shaped restoration for mining. The present shift in mining situations might take away smaller operations, giving extra affect into the fingers {of professional} miners.

Current knowledge exhibits $BTC remains to be mined in misery, because the manufacturing worth is increased than the market worth. Hash ribbon situations have marked historic worth bottoms. The present interval of mining misery has now develop into the longest because the 2021 market correction.

At what $BTC worth is mining non-viable?

On the present worth vary, miners can nonetheless promote a few of their older holdings, mined at a lower cost. $BTC miner reserves fell from 1.89M to 1.80M, with short-term promoting additionally placing worth stress on $BTC.

The typical value to mine one $BTC ranges from $74,000 to $87,000, relying on methodology. Moreover, the total value might embody amortization of recent machines, in addition to the price of credit score.

Primarily based on a tough estimation of mining exercise, the cut-off worth for miners to endure can be $35,000 per $BTC.

Regardless of this, shares like IREN replicate the longer term enlargement of AI knowledge facilities. IREN traded at $42.22, close to the upper vary for the previous few months. MARA recovered from latest lows as much as $7.92. Riot Platforms and Hut8 are additionally holding their positions.

$BTC mining is as soon as once more questioned as a device, particularly after one other halving. At present, community charges are too low to cowl the prices of mining, elevating the problem of long-term community safety.