Bitcoin (BTC) miners have raised $11 billion in convertible debt — company debt that’s convertible to shares — during the last yr, amid a pivot into synthetic intelligence information facilities.

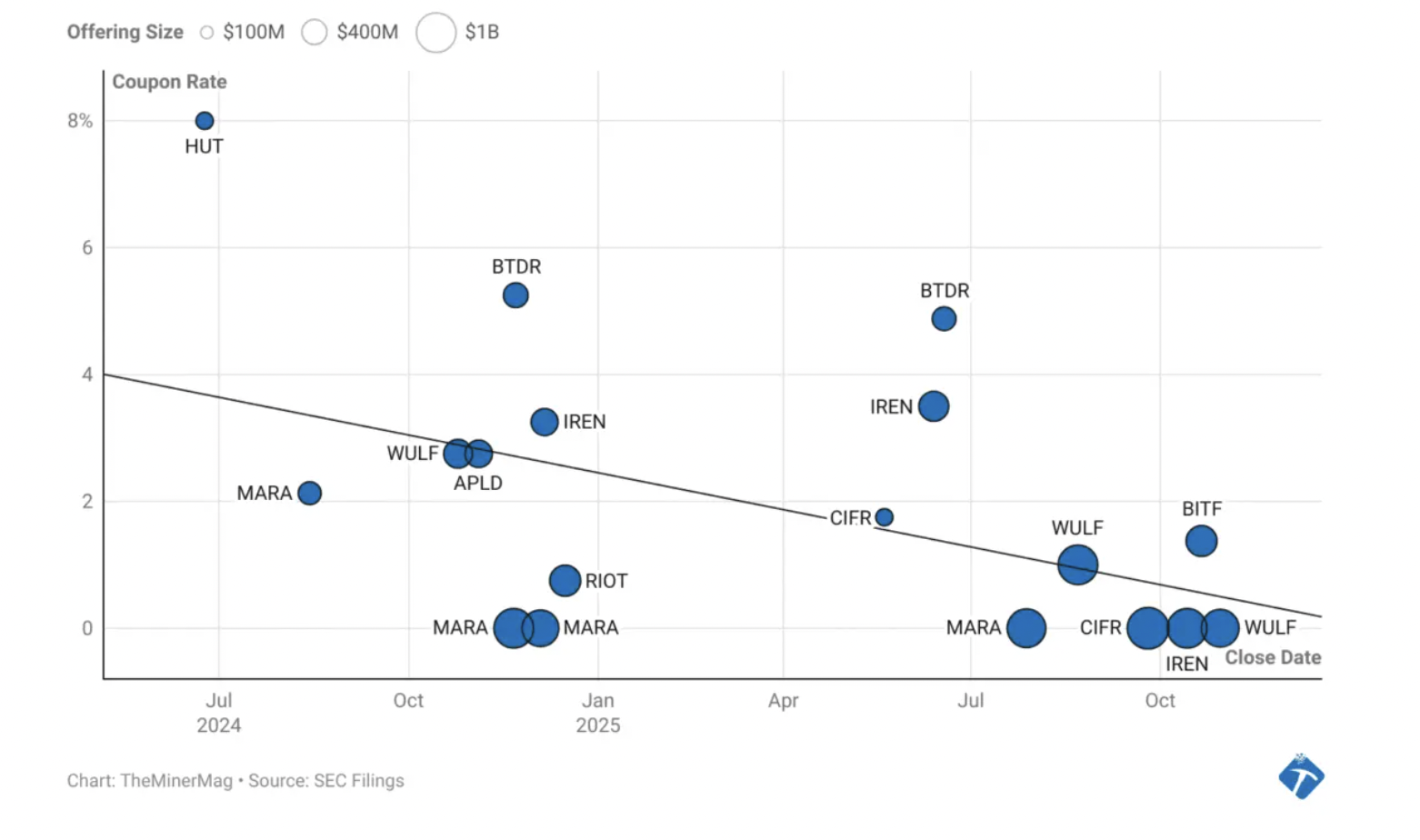

Miners accomplished 18 convertible bond offers following the April 2024 Bitcoin halving that slashed the block reward by 50%, in keeping with TheMinerMag.

The common convertible bond situation greater than doubled, with mining corporations MARA, Cipher Mining, IREN and TeraWulf every elevating $1 billion by means of single bond points. Some choices have featured coupons as little as 0%, signaling traders’ willingness to waive curiosity funds in change for potential fairness upside.

Convertible bond offers from July 2024 to October 2025. Supply: TheMinerMag

In distinction, most convertible bonds issued by Bitcoin miners the previous yr ranged from $200 million to $400 million.

The mining business diversified into AI information facilities to handle income shortfalls following the April 2024 halving. Miners proceed to battle with a difficult enterprise mannequin, which is affected by tokenomics, commerce insurance policies, provide chain points, and rising vitality prices.

Associated: Bitcoin miners construct on good points after Jane Avenue discloses stakes

Miners brace for hashrate warfare and energy-hungry AI operations

Miner debt has surged by 500% during the last yr, totaling $12.7 billion, in keeping with a current report from funding supervisor VanEck.

Nonetheless, VanEck analysts Nathan Frankovitz and Matthew Sigel famous that these debt ranges replicate a elementary downside within the mining business — heavy capital expenditures on mining {hardware} that have to be upgraded yearly in some instances.

“Traditionally, miners relied on fairness markets, not debt, to fund these steep capex prices,” they wrote, and referred to as the numerous {hardware} prices to stay aggressive a “melting ice dice.”

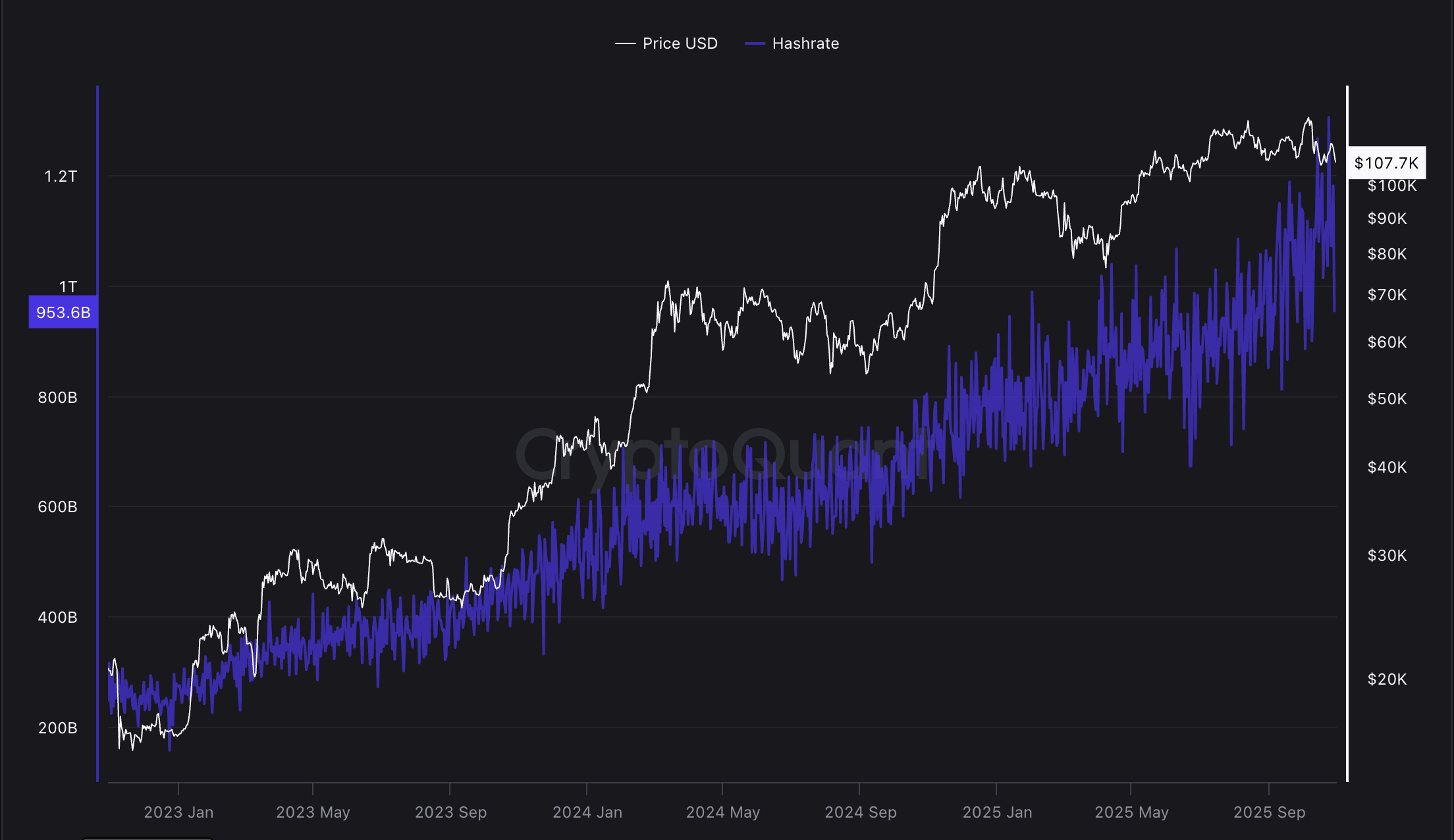

Bitcoin’s community hashrate continues to rise.

The rising Bitcoin mining hashrate, the overall quantity of computing energy securing the Bitcoin community, additionally continues to rise, forcing miners to expend ever-greater computing and vitality assets as time goes on.

In October, US Vitality Secretary Chris Wright proposed a regulatory change to the Federal Vitality Regulatory Fee (FERC) that will enable information facilities and miners to attach on to vitality grids.

This could enable these energy-intensive purposes to fulfill their vitality wants whereas they act as controllable load assets for the vitality grid, balancing and stabilizing {the electrical} infrastructure throughout instances of peak demand and curbing extra vitality throughout low demand.

Journal: 7 explanation why Bitcoin mining is a horrible enterprise concept