Bitcoin’s computing energy has surged to file ranges, at the same time as miners ramp up BTC gross sales to deal with shrinking revenue margins.

Bitcoin’s community energy reached a brand new milestone in early April, at the same time as miners ramped up their Bitcoin (BTC) gross sales to remain afloat. On April 5, the hashrate achieved historic 1 sextillion hashes per second each day, in line with information from BitInfoCharts.

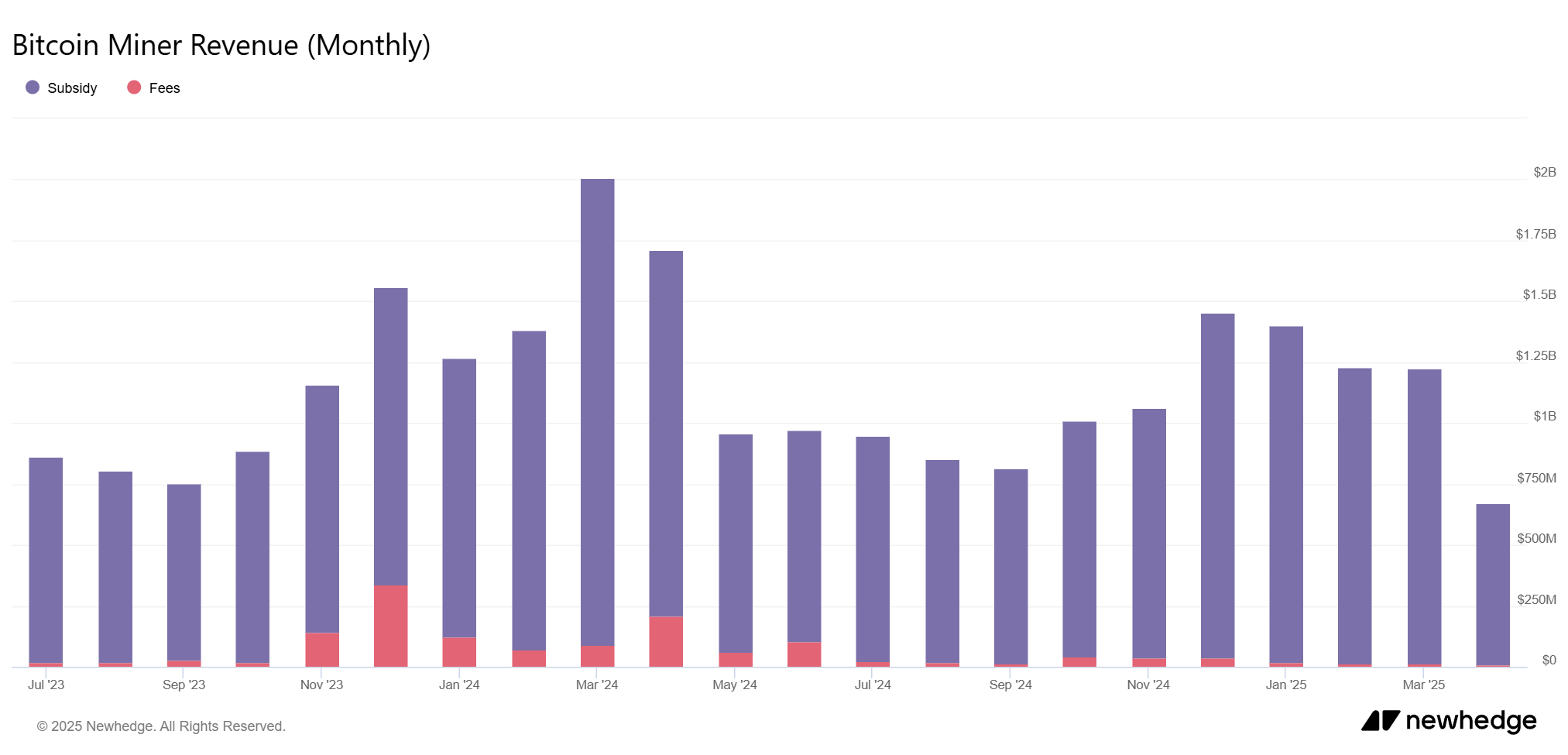

Bitcoin miner income (month-to-month) | Supply: Newhedge

You may additionally like: Miners win most from the US Strategic Bitcoin Reserve | Opinion

However whereas hashrate climbs, miner income stays beneath stress. Bitcoin miners’ income in March dropped almost 50% from March 2024 to roughly $1.2 billion, in line with information from blockchain analytics platform Newhedge.

Miners earn rewards from two sources: block subsidies and transaction charges. With the newest halving in April chopping rewards to three.125 BTC per block, charges have grow to be extra essential. However with charges staying low and blocks usually empty, miners are seeing shrinking margins.

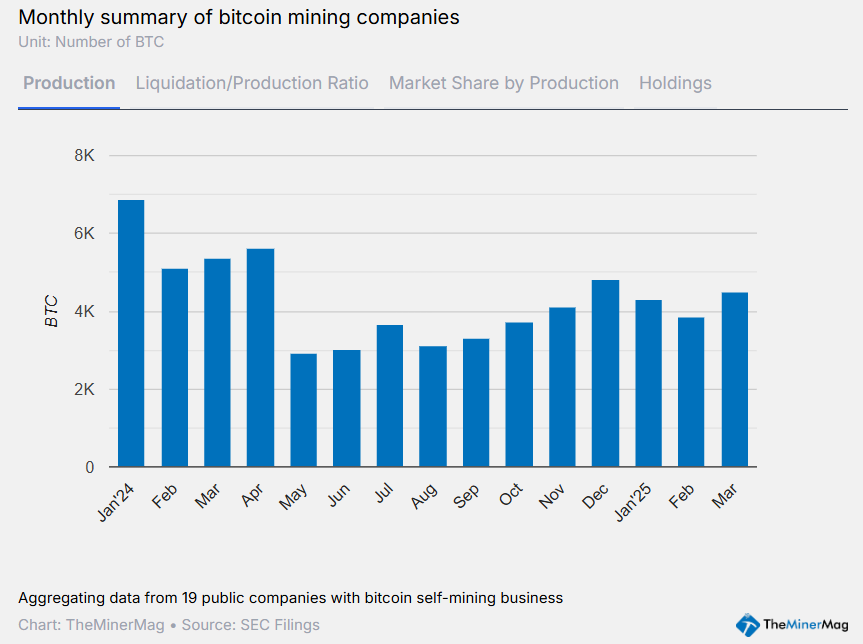

Variety of BTC produced by public miners | Supply: TheMinerMag

In response to information from TheMinerMag, publicly traded miners bought greater than 40% of their Bitcoin manufacturing in March — the very best degree since October 2024. The report notes that the uptick in gross sales “means that miners could also be responding to tightening revenue margins amid persistently low hashprice ranges and rising commerce conflict uncertainty.”

Some companies went even additional. Per the report, HIVE, Bitfarms, and Ionic Digital bought “greater than 100% of their March manufacturing,” whereas others, like CleanSpark, seem like adjusting their technique.

Learn extra: BTC mining hashrate hits ATH, intensifying stress on U.S. miners squeezed by tariffs