Bitcoin’s hashrate is close to file ranges, but miner income per unit of compute has fallen to file lows, pushing the community right into a ‘high-security, low-profitability’ part.

Whereas the community’s hashrate has pinned itself above the one-zettahash watermark, which is a file for combination computing energy, the income underpinning that safety has disintegrated to historic lows.

Nonetheless, the system seems strong to the protocol. Nevertheless, the mining sector is present process a slow-motion liquidation within the capital markets.

Bitcoin mining issue folds, hashrate holds

In keeping with Cloverpool information, Bitcoin mining issue slipped roughly 2% at block peak 925,344 on Nov. 27 to 149.30 trillion. This was the second consecutive decline this month, but block intervals stay stubbornly near the ten-minute goal.

This falling issue coincides with a interval the place Bitcoin mining economics have grow to be more and more punishing.

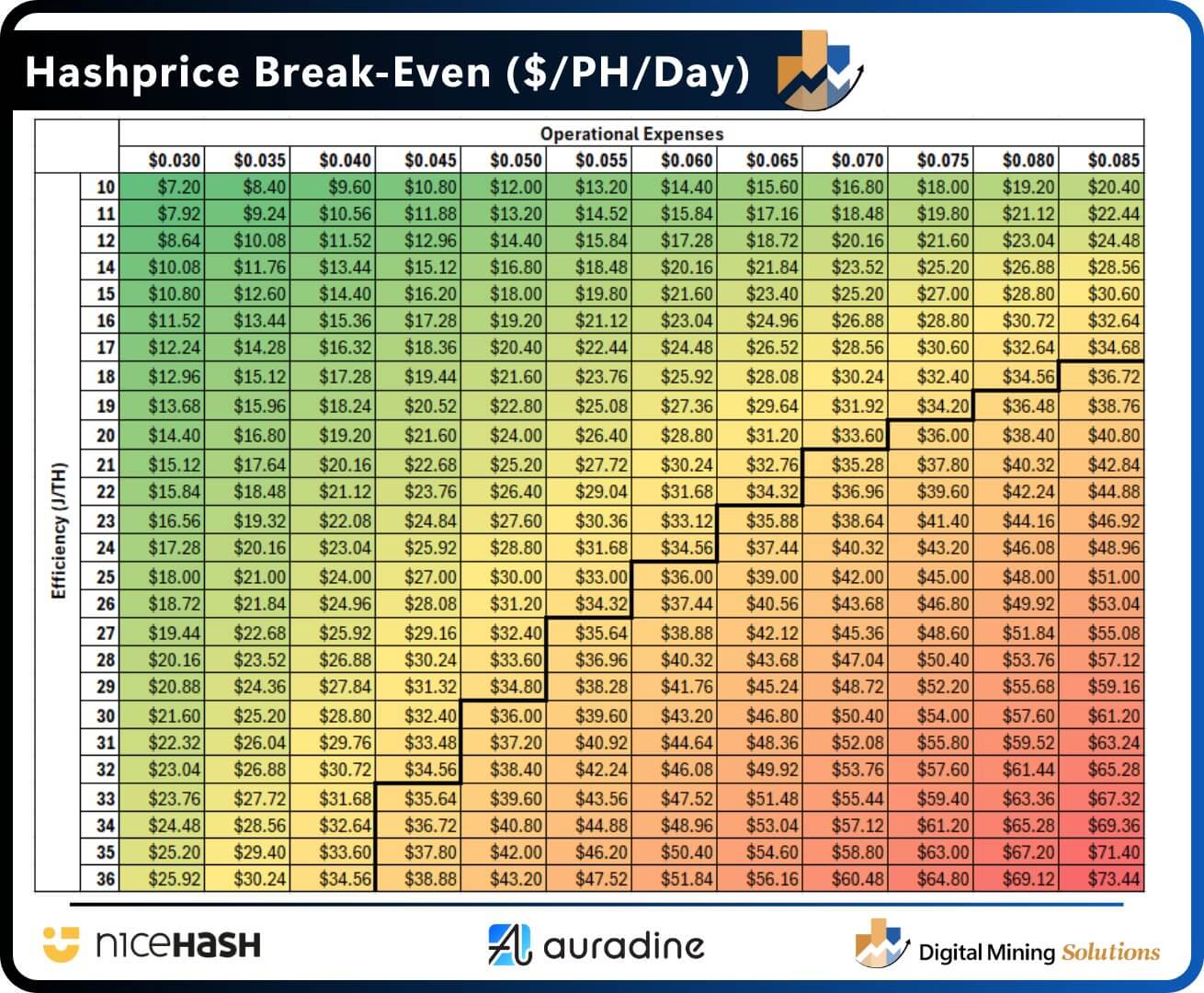

Hashprice, the business’s metric for day by day income per unit of compute, has collapsed almomst 50% in current weeks to an all-time low close to $34.20 per petahash per second. At this valuation, the common operator’s gross margins have evaporated.

Nico Smid, the founding father of Digital Mining Answer, defined that this implies fleets operating {hardware} with an effectivity beneath 30 joules per terahash now require all-in energy prices beneath 5 cents per kilowatt-hour to interrupt even, as soon as hire, labor, and upkeep are factored in.

This threshold has pressured a bifurcation, the place hundreds of older rigs are going darkish, solely to be instantly offset by industrial-scale deployment.

Nevertheless, this doesn’t clarify why complete hashrate has barely budged and why combination safety work stays above one zettahash.

The reply lies within the fleet’s composition. Small miners with out entry to low cost energy are capitulating. Then again, deep-pocketed operators with long-term energy buy agreements (PPAs), sovereign-linked amenities, or off-grid technology are holding regular or increasing.

For context, stablecoin issuer Tether has reportedly halted its mining enterprise in Uruguay, citing excessive vitality prices and tariff uncertainty. So, if a agency of Tether’s stature is unable to lock in sturdy phrases, smaller miners face even steeper odds.

Consolidation by misery

The 2 consecutive BTC issue drops will not be a sign that the protocol is faltering. As an alternative, they’re a sign that the community’s aggressive set is altering.

When income compresses, distressed fleets migrate. Collectors seize inefficient websites, and brokers repackage used rigs for lower-cost areas. Probably the most environment friendly miners sweep up stranded capability.

So, the present headline hashrate resilience is, in follow, consolidation. The community seems stronger by the standard metric, whereas the variety of entities able to funding that power shrinks.

This focus carries tradeoffs. Publicity tightens to single factors of failure, from excessive climate to grid curtailments and native allowing fights.

On the identical time, financing additionally shifts towards a narrower group of stability sheets that may safe fixed-price vitality, put up collateral for interconnection, and carry stock by lengthy drawdowns.

Because of this, the capital markets are rethinking the definition of a miner.

So, as an alternative of pure-beta Bitcoin proxies, many traders now deal with the sector as power-rich information middle companies with a risky crypto overlay. That is evidenced by the truth that many miners are actually embracing high-performance computing (HPC) shoppers to shore up earnings amid falling BTC income.

Bitcoin mining shifting map of energy

Geopolitics can be redrawing the Bitcoin hashrate map. China’s estimated return to roughly 14% of world hashrate, regardless of the blanket 2021 ban, marks a structural flip.

Underground and gray-market operations have rebuilt a footprint that just about disappeared. Vitality-rich provinces with surplus hydro or coal-adjacent industrial hundreds permit websites to function intermittently and largely off the radar.

This “zombie capability” retains hashrate elevated, appearing as a everlasting tax on compliant Western miners.

Nevertheless, the Western Bitcoin miners face a narrowing path.

Squeezed by increased financing prices, stricter disclosure necessities, and risky interconnection timelines, operators can compete on value provided that they lock multiyear energy contracts, migrate to extra versatile grids, or share infrastructure with information middle tenants.

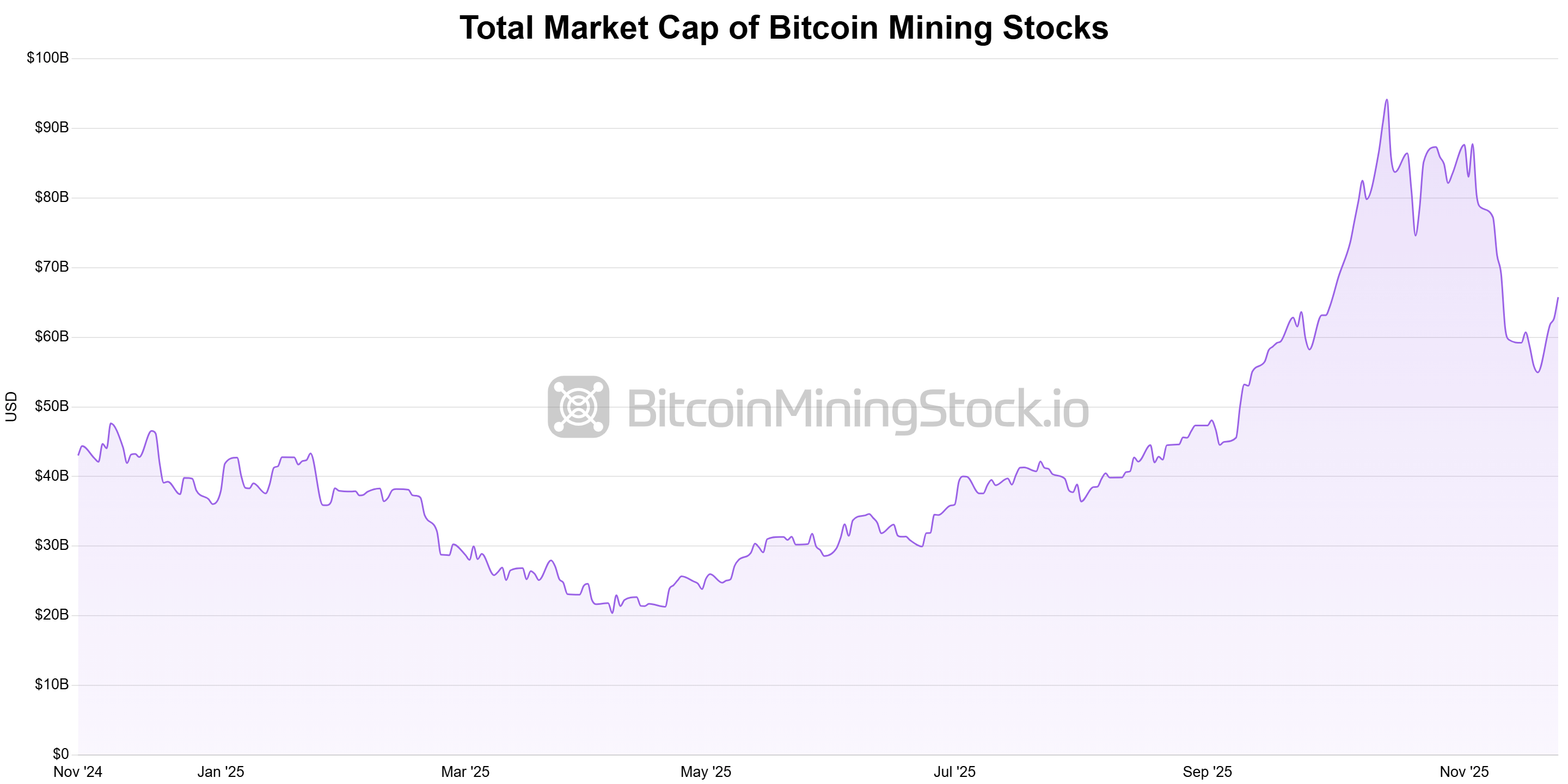

Unsurprisingly, this has impacted their enterprise, with public mining shares erasing almost $30 billion of market worth in November.

These BTC miners noticed their inventory slide from a peak close to $87 billion to about $55 billion earlier than a partial rebound towards $65 billion.

What to Watch Subsequent

Contemplating this, business gamers are monitoring three particular dials to gauge the following part of this restructuring.

The primary is issue: deeper damaging retargets would affirm rolling shutdowns amongst high-cost fleets. A pointy snapback would suggest sidelined capability is re-energizing as energy contracts reprice or as payment spikes return.

The second is transaction charges. Inscription waves and protracted mempool congestion can elevate miner income for weeks at a time, however the base case is a lean payment atmosphere that retains hashprice pinned close to breakeven for a lot of fleets.

The third is coverage and provide chain. Any escalation in export controls, safety critiques, or grid interconnection guidelines may shift the price of capital in a single day.

Miners have already begun adapting by broadening their enterprise combine. Many are repositioning as information infrastructure corporations, signing multiyear contracts for AI and high-performance computing to easy money stream that Bitcoin alone can not assure.

That mannequin can protect marginal websites and retain upside publicity if the hash value recovers. Nonetheless, it additionally pulls scarce energy towards steadier margins, leaving Bitcoin because the versatile sink that absorbs volatility.

For Bitcoin, the rapid threat just isn’t a collapse in safety. The zettahash period has delivered file combination work, and the protocol continues to calibrate on schedule.

The danger is structural: a system that appears more healthy by combination metrics whereas counting on fewer actors to supply the work.

If capital stays tight and vitality prices keep elevated, extra asset gross sales, mergers, and migrations towards pleasant jurisdictions are probably. Nevertheless, if costs and costs rebound, a few of right now’s idled capability will return, however usually below new house owners and new energy phrases.

That’s the paradox of the zettahash age. On the protocol stage, Bitcoin has by no means regarded stronger. Beneath the floor, the mining enterprise is going through important misery.