Bitcoin miner outflows skyrocketed to 48k $BTC price greater than $3 billion between February 5 and 6. Nonetheless, the large outflows don’t characterize miner capitulation in keeping with January disclosures from main company $BTC mining corporations.

Bitcoin miners moved 48,774 Bitcoin price $3.2 billion from their wallets between February 5 and 6, in keeping with onchain information. Nonetheless, the transactions don’t routinely replicate miner capitulation or speedy spot market promoting. The info accounts for transfers to exchanges, inside pockets actions, and transfers to different entities. Subsequently, the miner outflows don’t indicate that Bitcoin miners had been offloading their belongings within the open market because the crypto winter continues to unfold.

Bitcoin miner-linked wallets transfer 48K $BTC, valued at $3.2 billion, in 2 days

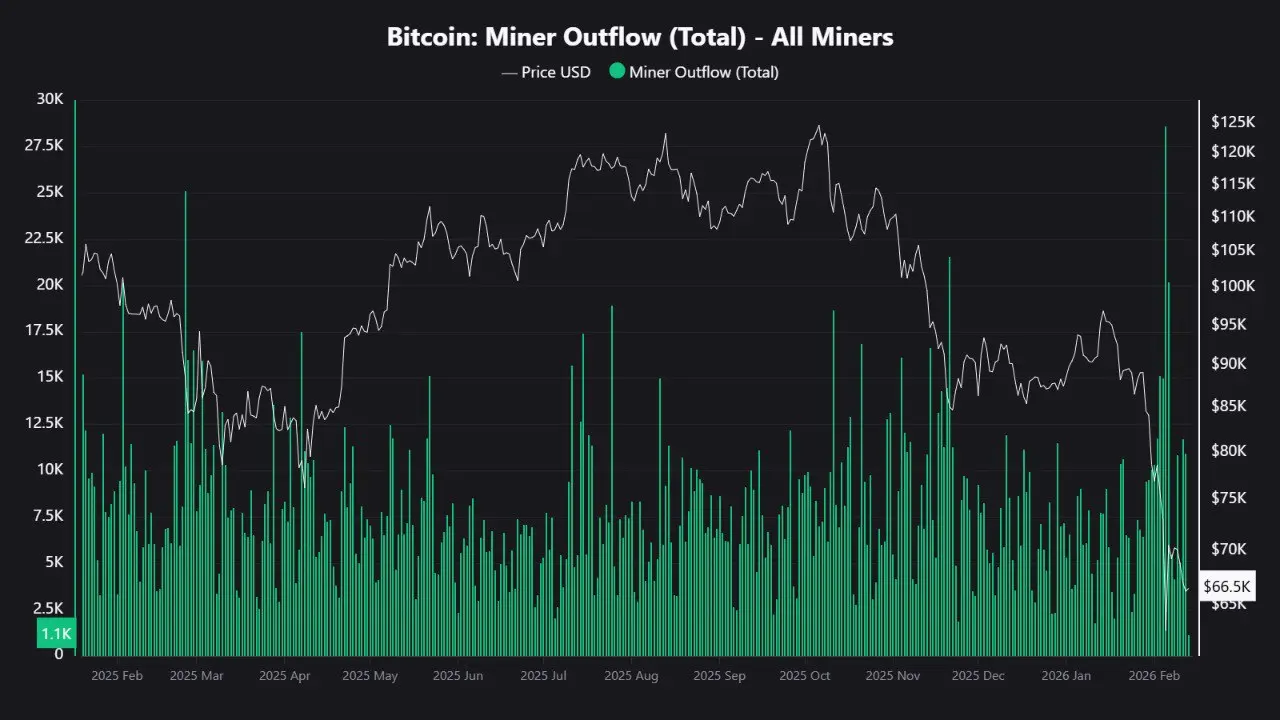

Supply: CryptoQuant Bitcoin Miner Outflow (Whole) All Miners

On February 5, Bitcoin miner outflows spiked to twenty-eight,605 $BTC valued at $1.8 billion. The worth represents probably the most vital single-day transactions involving miner pockets addresses since November 2024. Miner-linked wallets additionally recorded one other 20,169 $BTC in outflows price $1.4 billion on February 6, with a earlier related spike occurring on November 12, 2024, as per onchain information.

The spike on February 5 and 6 coincided with Bitcoin’s latest worth decline that noticed the asset contact $62.2k earlier than recovering to $66.4k. Whale transactions amid market volatility draw vital consideration and will sign potential promoting stress.

Regardless of onchain information exhibiting miner-linked addresses moved large quantities of Bitcoin over the 2 days, firm paperwork from publicly listed mining corporations don’t present heavy promoting stress from miners. Eight miners, together with CleanSpark, Bitdeer, Hive Digital Applied sciences, BitFuFu, Canaan, LM Funding America, Cango, and DMG Blockchain Options, have reported a mixed manufacturing of two,377 $BTC of their monetary statements for the month. Nonetheless, the determine is way under what was recorded on February 5 and 6.

The mining corporations didn’t promote a considerable quantity of Bitcoin in the identical interval. The full variety of $BTC offered by CleanSpark, Cango, and DMG matched solely a fraction of the miner outflows registered on both February 5 or 6. CleanSpark reported mining 573 $BTC and promoting 158.63 $BTC throughout January, whereas Cango mined 496.35 $BTC and disclosed promoting 550.03 $BTC.

LM Funding mined 7.8 $BTC and reported that it didn’t promote any Bitcoin. Different corporations like BitDeer, BitFuFu, and Canaan didn’t disclose the $BTC offered, however, primarily based on projections, it will be troublesome to match the outflows recorded on February 5 and 6 with the corporations’ data.

Bitcoin miners face stress as $BTC worth slides under manufacturing price

The information comes at a troublesome time for miners. Based on information from Checkonchain, Bitcoin’s flooring worth fell under the problem regression mannequin, which represents the typical manufacturing price of Bitcoin on January 26, and has remained under it since then. The info exhibits that the price of producing 1 $BTC is $79.242k, whereas $BTC is buying and selling at $66.485k on the time of this publication.

The Royal Authorities of Bhutan prolonged its $BTC selloff spree by transferring 100 $BTC to QCP Capital’s WBTC service provider deposit tackle (bc1qt) on Thursday, in keeping with blockchain analytics agency Arkham. Cryptopolitan reported that the motive of the transaction stays unknown; it means that the federal government is doubtlessly participating in liquidity administration or getting ready for gross sales into liquid markets. The Royal Authorities of Bhutan actively undertakes state-sponsored $BTC mining actions and may very well be unwinding because of elevated promoting stress.

Based on information from CoinMarketCap, Bitcoin has been in a steep decline since clocking its highest worth of the 12 months at $97,860 on January 14. The crypto asset has shed greater than 30% since then amid continued intense promoting stress.