Bitcoin reached a report in computing energy, however rising block issue continues to harm miners’ earnings.

Abstract

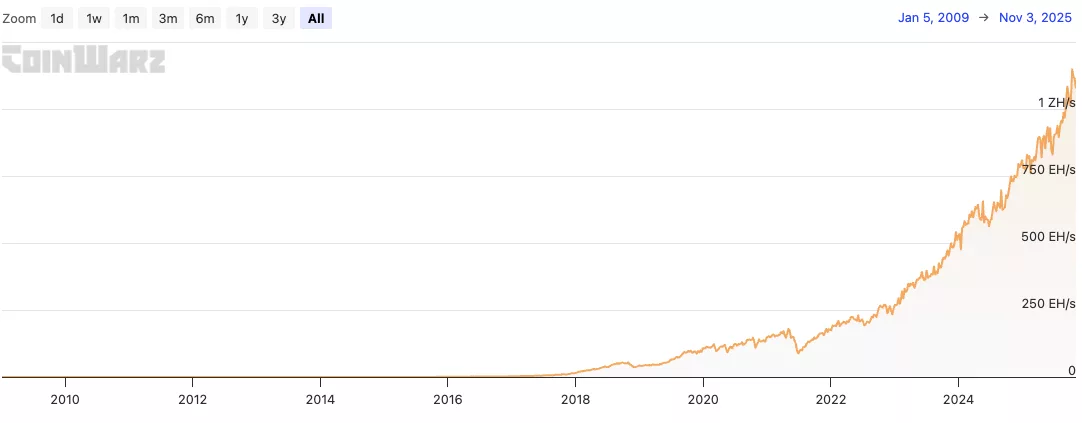

- Bitcoin mining hashrate reached a report 1.13 Zh/s in October.

- Geographically, this enlargement was pushed by Kazakhstan and the Center East

- Nonetheless, mining profitability fell 7% on account of rising block issue

Bitcoin miners discovered themselves beneath stress from all sides in October. The sector posted a report 1.13 Zh/s hashrate in October, which signifies elevated participation in Bitcoin mining. Nonetheless, elevated mining issue, rising power costs, and report $19B in liquidations reduce into miners’ earnings.

Bitcoin hashrate since its launch | Supply: CoinWarz

“October was a exceptional month for the Bitcoin mining market,” analysts at TeraHash advised crypto.information, highlighting that the hashrate briefly crossed 1.13 Zh/s. “This progress was largely pushed by North American infrastructure expansions and rising participation from Kazakhstan and the Center East.”

Hashrate refers back to the quantity of computational energy that participates in Bitcoin mining. That is essential for decentralization and safety, as a excessive hashrate makes assaults in opposition to the community tougher. Nonetheless, the metric doesn’t routinely translate into extra mining earnings.

Notably, each day income per exahash per second (EH/s) dropped 7% in comparison with September, from $52,000 to $48,000. What’s extra, the declining Bitcoin value reduce into miners’ rewards, with the hashprice falling almost 12% month-to-date.

Bitcoin miners battle to remain afloat

Falling Bitcoin costs additionally coincided with an increase in power prices. The rise in oil and fuel costs affected miners not tied to {the electrical} grid. In some areas, particularly in Europe and the U.S., miners additionally needed to cope with energy curtailment. For that reason, the hashrate will probably fall within the close to future.

“Wanting forward, a quick slowdown in hashrate progress seems probably in November, primarily on account of larger power prices and weather-related constraints. The subsequent issue adjustment is predicted to carry a minor decline, providing momentary reduction to smaller miners,” Terahash analysts.