Bitcoin miners face monetary stress because the hash value drops to costs which will drive them out of the market. The cryptocurrency mining sector is going through challenges stemming from declining Bitcoin costs, rising power prices, and rising community problem, leaving miners in a state of survival.

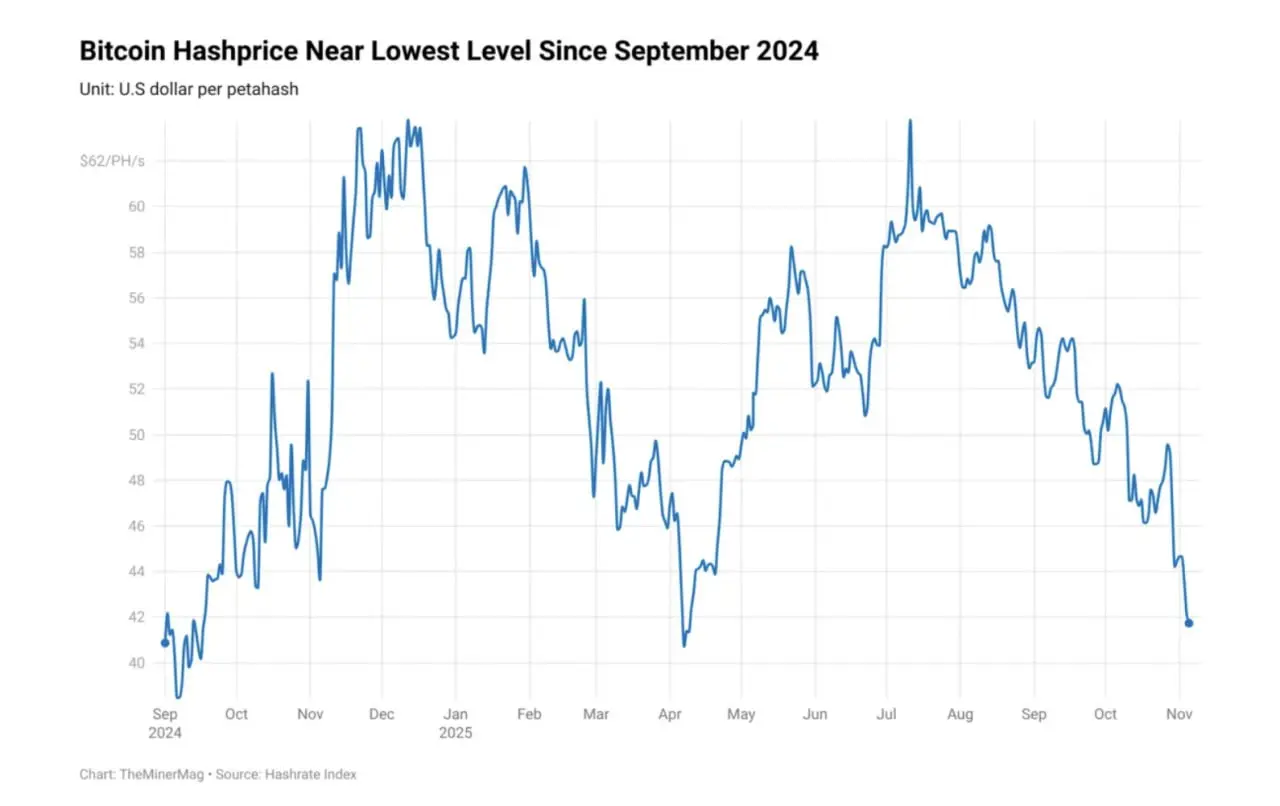

TheMinerMag confirmed that BTC mining hash value has declined to $42 per petahash per second (PH/s). The hasprice PH/s determine determines the anticipated each day income earned per unit of computational energy, serving to miners to measure mining profitability. In July, PH/s was roughly $62, marking a decline of greater than 30% on the present fee.

Some BTC miners shift focus to AI and knowledge heart infrastructure companies

Smaller miners could also be pressured out of the market resulting from excessive working prices. Thus far, most miners are cutting down operations and exploring new avenues of income technology to behave as a buffer in opposition to potential losses.

Bitcoin hash value close to $40. Supply: TheMinerMag

The drop in hash value started to floor when mining {hardware} operators and suppliers began reporting fewer orders resulting from monetary pressure. The October crash elevated the influence, significantly for miners who performed the gross sales in BTC.

Bitdeer, one of many mining firms, has shifted its focus towards self-mining to generate income instantly, reasonably than relying totally on {hardware} gross sales. Some analysts have warned that the technique is not going to be worthwhile within the long-term because the hashrate value is squeezed, affecting all the sector.

The prices of buying and upgrading high-performance application-specific built-in circuit (ASIC) {hardware} type a part of the challenges affecting miners. One other problem is the surge in electrical energy prices, which leaves miners barely breaking even.

Some mining corporations have additionally shifted their focus to AI options, knowledge facilities, and high-performance computing (HPC) companies to achieve entry to various income streams. AI and knowledge heart sectors depend on large-scale computing infrastructure that’s just like crypto mining.

As an illustration, Cipher Mining signed a $5.5 billion deal to provide Amazon Internet Companies cloud infrastructure with computing energy for 15 years. IREN additionally signed a $9.7 billion GPU computing cope with Microsoft. Some analysts, nonetheless, have warned that counting on AI infrastructure companies requires giant upfront capital and specialised experience, which can restrict participation to giant mining corporations.

BTC community hashrate climbs above one zetahash per second

The Bitcoin halving occasion, which occurred in April 2024, elevated competitors amongst miners for the restricted block rewards, lowering from 6.25 BTC to three.125 BTC per block.

Based mostly on CryptoQuant evaluation, Bitcoin’s community whole hashrate, which measures the mixed computational energy required to safe the community, rose above one zetahash per second (ZH/s). The rise is because of vital participation from industrial-scale miners and improved {hardware} effectivity.

Rising hashrates improve the issue of mining new blocks; therefore, the associated fee to mine a single Bitcoin block is climbing, whatever the market value of BTC.

Hashrate climbs above one zetahash per second. Supply: CryptoQuant

Bitcoin mining has advanced from CPU-based setups in 2009 to right this moment’s large-scale ASIC-based operations, leaving the market to buyers with vital capital investments and substantial power assets.

Initially, mining a block would lead to a reward of fifty BTC, however this has steadily decreased to the present 3.125 BTC per block, creating financial stress that rewards solely probably the most environment friendly and capital-intensive operators.

BTC remained risky over the weekend, following a decline under $100,000 on Friday. Thus far, the token is buying and selling above $102,000 with a progress of 0.84% on the each day chart. BTC has additionally misplaced 7.2% via the week, falling from a buying and selling value above the $104,000 assist stage to its present stage of $102,330.