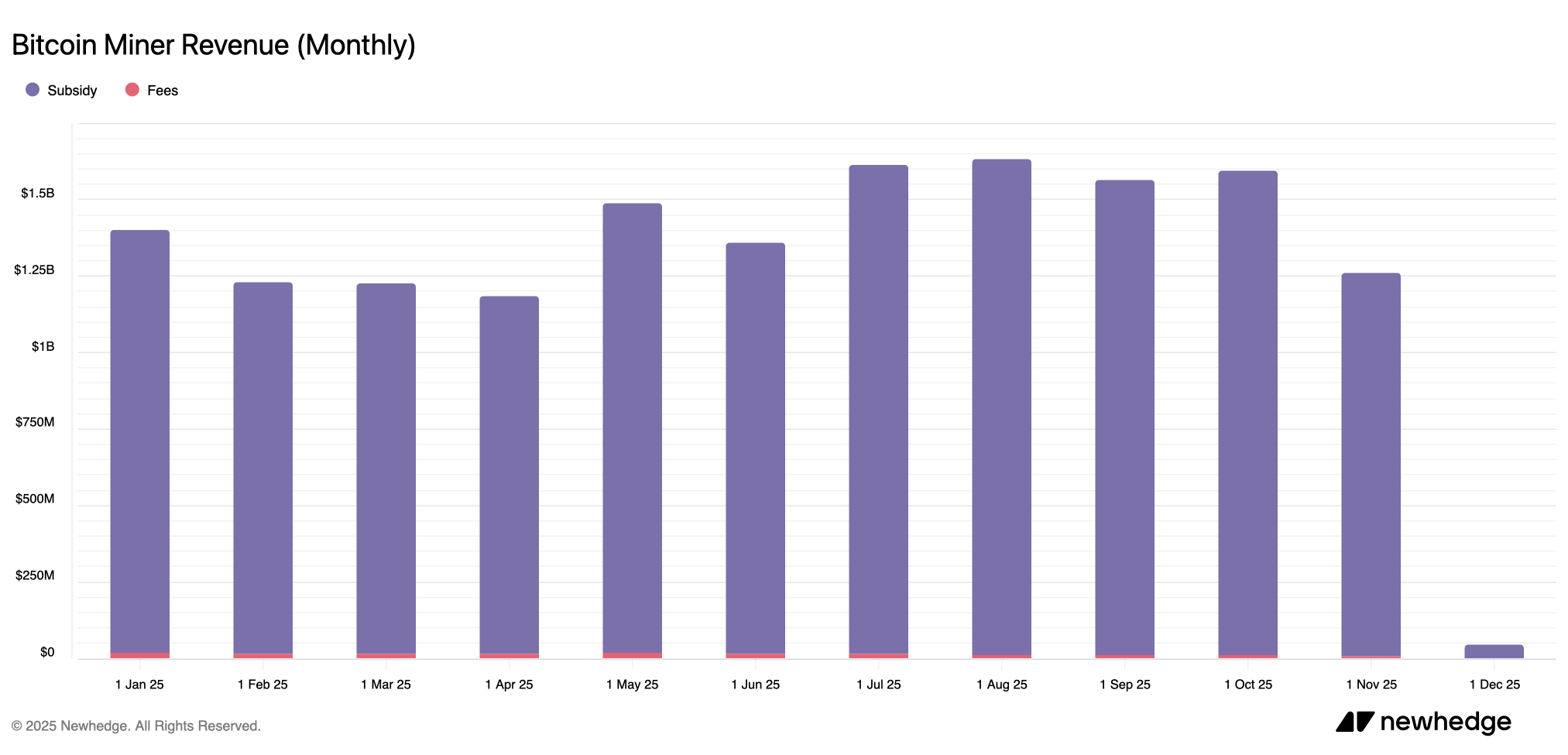

Bitcoin miners trudged by means of November, with information displaying it was the fourth least worthwhile month of 2025. Mining swimming pools processed round 453 blocks from begin to end, amassing a mixed $1.262 billion in income — a complete that folds in each the subsidy and the charges gathered alongside the way in which.

Miners Grapple With Bitcoin’s Steep Spot Market Slide

Sadly for miners, income in November landed about 20.9% beneath October after earnings slipped from $1.595 billion to $1.262 billion, in line with figures logged by newhedge.io. The truth is, November delivered the bottom earnings since April and ranked because the fourth weakest month of 2025.

The yr’s hardest stretch nonetheless belongs to April at $1.18 billion, adopted by March at $1.22 billion, February at $1.23 billion, after which November’s whole. Out of the $1.262 billion gathered over the 30-day span, solely about $9 million got here from onchain charges. That works out to charges contributing roughly 0.71% of the overall block rewards on common.

The three prime canine mining swimming pools — Foundry, Antpool, and F2Pool — pulled in roughly $368.3 million, $239.9 million, and $139.5 million, respectively. Over the 30 days, Foundry logged about 29.14% of the overall hashrate, whereas Antpool’s computing share was round 18.98% and F2Pool’s contribution was round 11.04%. ViaBTC trailed simply behind them, contributing 10.38% of the general hashrate.

Learn extra: Ether ETFs Lead Weekly Beneficial properties as Bitcoin and Solana Keep Inexperienced

What’s not nice is that BTC costs dipped massively once more on Nov. 30 and carried the slide into Dec. 1. The hashprice through hashrateindex.com — or the estimated worth of 1 petahash per second (PH/s) of hashing energy — was already sitting at severe lows, and with bitcoin at $85,879 at 9 a.m. EST on Monday, a single petahash is now price simply $36.39. Bitcoin’s drop in USD worth performed a significant function in November’s income decline in contrast with October and is an enormous a part of the strain miners are feeling proper now.

Regardless of the robust stretch, miners are urgent forward, and so they should adapt to thinner margins and a sluggish hashprice as they look ahead to a friendlier market to return. With income compressed, charges muted, and bitcoin buying and selling softer into early December, the sector is solely leaning on the best in effectivity, scale, and endurance — the one instruments left when the community refuses to chop anybody a break.

FAQ ❓

- How a lot income did bitcoin miners earn in November? They introduced in about $1.262 billion, making it the fourth least worthwhile month of 2025.

- Why did miner earnings drop in contrast with October? Decrease bitcoin costs and weaker hashprice situations drove November’s decline.

- Which swimming pools earned probably the most mining income? Foundry, Antpool, and F2Pool led the month with the very best collective payouts.

- How did charges impression miner income? Onchain charges made up solely about 0.71% of November’s whole rewards.