Bitcoin mining firms and synthetic intelligence information facilities are more and more competing for entry to low cost, sustainable power, which might set off renewed institutional funding within the mining sector over the following decade.

AI information facilities with deep capital reserves are starting to outbid miners for energy infrastructure, with extra Bitcoin (BTC) miners getting “priced out” or deprioritizing mining actions, in accordance with a July 31 analysis report from Bitcoin mining infrastructure supplier GoMining Institutional.

Nonetheless, the flexibleness of Bitcoin mining corporations permits them to broaden into extra off-grid places with a scarcity of high-speed web infrastructure, giving them a bonus over AI amenities, in accordance with Jeremy Dreier, managing director and chief enterprise growth officer at GoMining Institutional.

This rising battle for power will result in a renewed wave of institutional funding into Bitcoin mining over the following decade, mentioned Dreier throughout Cointelegraph’s Chain Response each day X areas present on Thursday.

“Within the subsequent 5 to 10 years, due to this new battle with AI, we’re going to see a brand new heyday for Bitcoin mining as a result of we now have actual institutional capital coming into the area.”

Institutional capital has already flowed into US spot Bitcoin exchange-traded funds (ETFs), with Dreier calling mining investments the “subsequent step” for these buyers.

Bitcoin Miners and the Hidden Warfare With AI (feat. GoMining) #CHAINREACTION https://t.co/zLYMxLKZfR

— Cointelegraph (@Cointelegraph) August 13, 2025

Establishments need cheaper “virgin” Bitcoin

An institutional capital rotation into Bitcoin mining corporations will be the subsequent logical step as firms investing in Bitcoin ETFs and treasury corporations look to amass cheaper Bitcoin for his or her stability sheet.

Associated: Bitcoin briefly flips Google market cap as buyers eye rally above $124K

Extra establishments are exploring the potential of buying cheaper, “virgin” Bitcoin, as an alternative of paying the spot costs on exchanges, mentioned Dreier. “[Institutions] wish to get true new newly minted Bitcoins, cheaper than they get it from the market.”

More and more extra establishments are inquiring about Bitcoin mining infrastructure companies from GoMining in an try to amass cheaper Bitcoin for his or her stability sheet, Dreier instructed Cointelegraph.

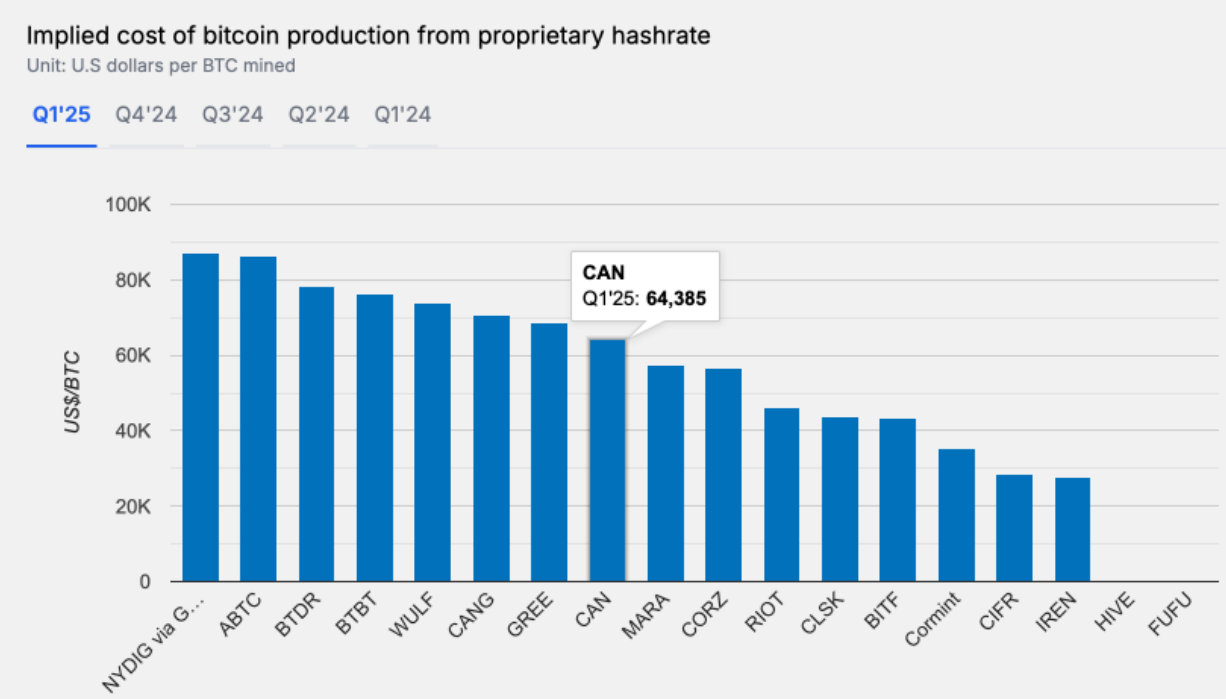

Implied value of Bitcoin manufacturing. Supply: TheMinerMag

Mining a Bitcoin prices a mean of $64,000 throughout the first quarter of 2025 and is predicted to surpass $70,000 by the top of the 12 months, which continues to be 70% cheaper than at the moment’s spot Bitcoin worth of over $119,050, in accordance with a analysis report by TheMinerMag.

Associated: BitMine targets large $24.5B elevate as SharpLink boosts Ether conflict chest

The battle for electrical energy between miners and AI information facilities noticed many Bitcoin mining corporations diversify operations to revenue from this development.

For instance, Riot Platforms has halted its plans to broaden its Bitcoin mining operations in Corsicana, Texas, to discover AI alternatives on the identical website as an alternative.

Iris Power additionally introduced a strategic pivot towards its AI cloud enterprise, putting a self-imposed cap on its mining fleet enlargement, signaling a “main reshuffling of priorities,” in accordance with GoMining Institutional’s report.

Nonetheless, Dreier foresees quite a few public miners “which have jumped over onto the AI bandwagon” to “rapidly begin shifting again into investing extra into Bitcoin mining,” as they see the institutional capital rotation happen.

Others are doubling down on Bitcoin mining innovation. Bitcoin-focused fintech firm Block Inc. launched a brand new cryptocurrency mining system designed to broaden the lifespan of mining rigs and decrease operation prices, flashing a possible enhance for miners struggling to take care of amenities, Cointelegraph reported on Thursday.

Journal: Altcoin season 2025 is nearly right here… however the guidelines have modified