Bitdeer Applied sciences Group priced an upsized personal providing of $330 million in convertible senior notes due 2031. The Singapore-based bitcoin mining firm elevated the providing measurement from an initially introduced $300 million.

Bitdeer Upsizes Convertible Be aware Providing

The 4.875% notes, maturing July 1, 2031, had been bought to certified institutional patrons. Preliminary purchasers maintain a 13-day possibility to purchase as much as an extra $45 million principal quantity. The sale is anticipated to shut on June 23, 2025. The bitcoin mining firm stated the notes are convertible into Class A peculiar shares at an preliminary worth of roughly $15.88 per share, representing a 25% premium over the June 17 closing worth.

Bitdeer estimates internet proceeds of roughly $319.6 million, or $363.3 million if the choice is totally exercised. After deducting charges and bills, the corporate plans three major makes use of: $129.6 million to pay for a associated zero-strike name possibility transaction, $36.1 million for money consideration in concurrent be aware exchanges, and the rest for knowledge middle enlargement, ASIC-based mining rig growth, manufacturing, working capital, and normal company functions.

Concurrently with the pricing, Bitdeer entered a zero-strike name possibility transaction with an affiliate of an preliminary purchaser. The corporate paid a $129.6 million premium for the appropriate to obtain roughly 10.2 million shares at expiry. This transaction facilitates hedging actions by sure be aware traders, which might affect the market worth of Bitdeer shares or notes.

Bitdeer additionally accomplished personal transactions exchanging roughly $75.7 million principal quantity of its current 8.50% notes due 2029 for $36.1 million in money and eight.1 million Class A peculiar shares. The corporate famous holders of the exchanged notes unwinding hedges might considerably affect its share worth.

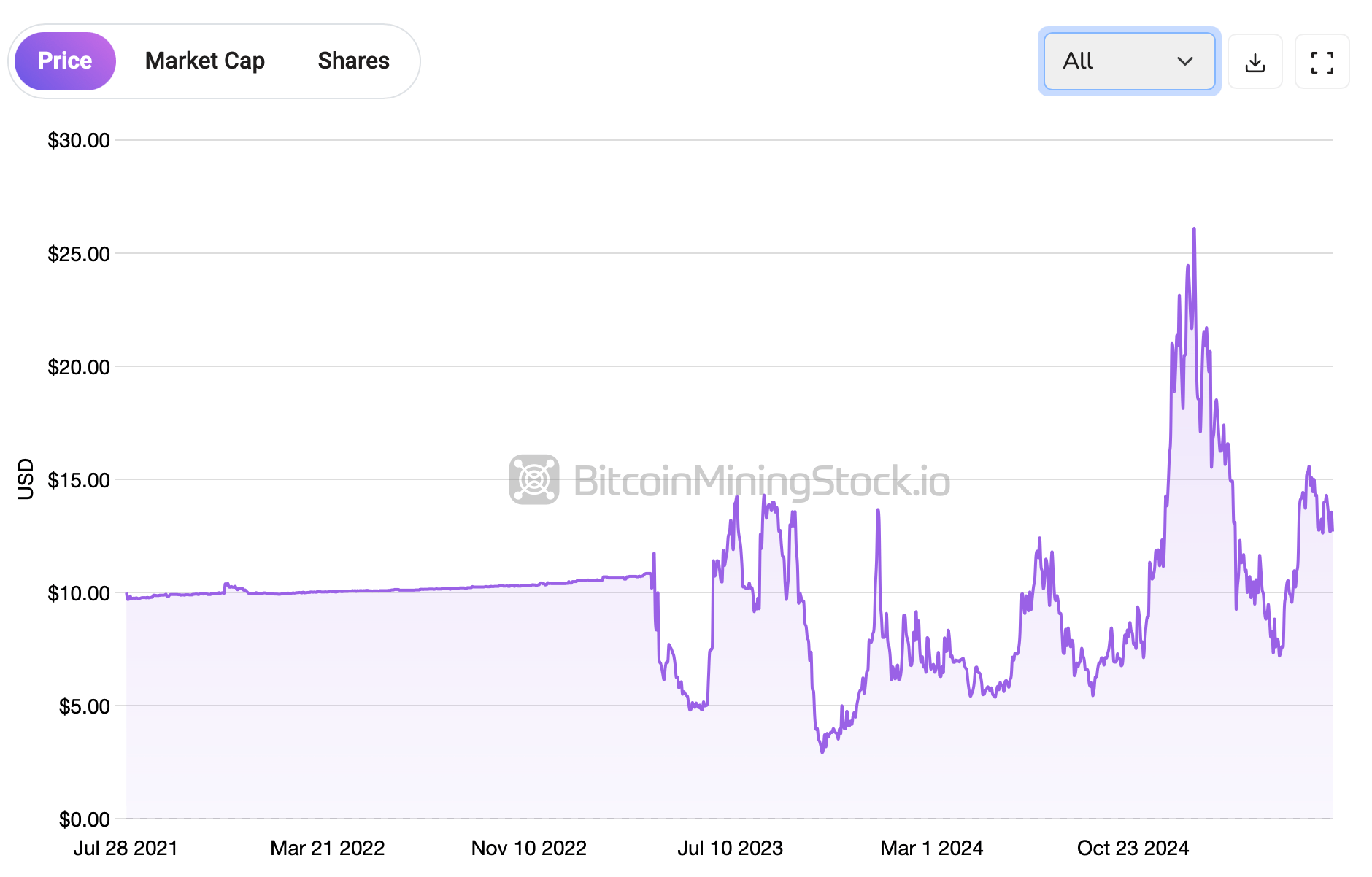

Bitdeer (Nasdaq: BTDR) has hit a tough patch this 12 months, with shares slipping 6.5% in simply the previous day. Over the past 5 buying and selling classes, the bitcoin miner has seen its worth drop by greater than 14%, and since January, it’s taken successful of over 45%. However right here’s the twist: regardless of the current droop, BTDR remains to be sitting fairly with a 27% acquire since its market debut.