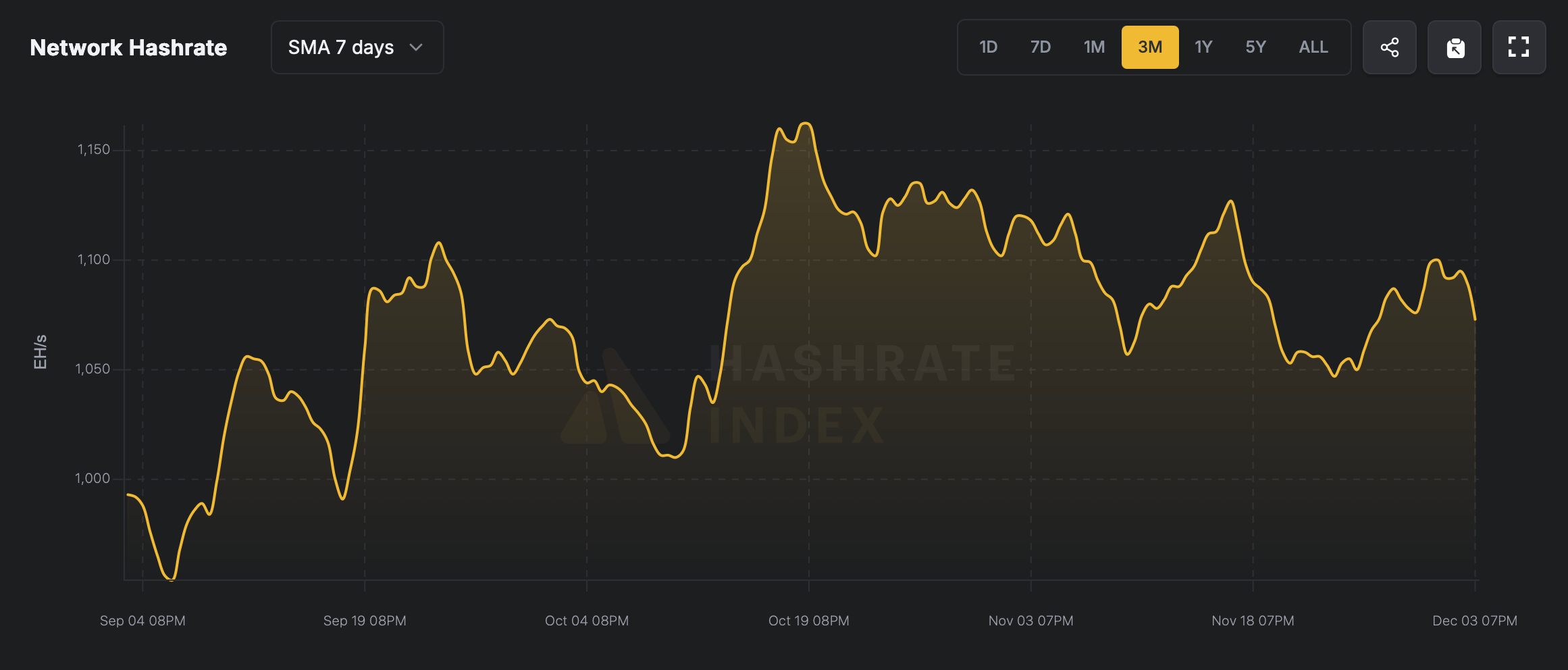

Bitcoin miners are lastly catching a breather as hashprice lifts off the basement flooring after hitting punishing lows simply days in the past that squeezed operations to the sting. Even with that income dip, the community’s hashrate has held its floor, hovering in a good band between 1,050 exahash per second (EH/s) and 1,100 EH/s.

Miners Welcome a Hashprice Rebound

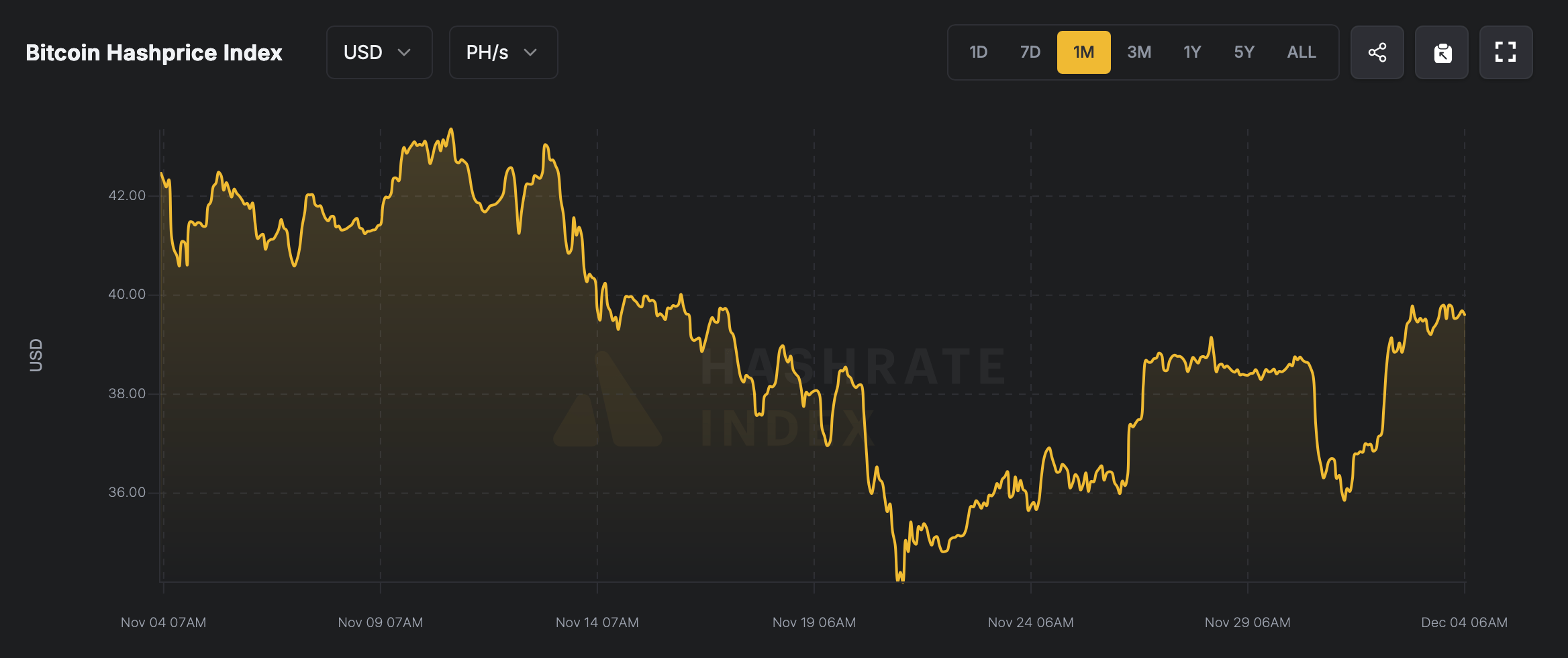

The current elevate in bitcoin costs has handed BTC miners a much-needed gulp of recent air after weeks of pinched income. On the tail finish of November, on the ultimate day, hashprice scraped the underside at $36.35 per petahash per second (PH/s), in line with figures from hashrateindex.com.

In easy phrases, hashprice is the sticker value for a single petahash of computational muscle — mainly what a miner expects to tug in for all that output. Only a few days later, on Dec. 1, hashprice was nonetheless slumped at $35.85 per petahash. The newest value pop over the previous day flipped the script, with miners pulling in about $39.79 per PH/s as hashprice inched its approach again towards the $40 zone.

Bitcoin hashprice during the last 30 days.

Regardless of the dips in every day income, Bitcoin’s general hashrate has stayed rock-solid above the 1 zettahash per second (ZH/s) mark for fairly some time — and it hasn’t slipped beneath that threshold in what looks like ages. Due to that stability, block intervals have stayed comparatively detached as nicely, and the issue adjustment anticipated on Dec. 11 could not convey a lot in the best way of reduction.

Proper now, miners nonetheless have roughly half of the two,016-block issue epoch forward of them, so issues may shift, however present estimates level to a gentle 1.34% dip. Block intervals are operating a contact slower than the ten-minute goal, and on Wednesday, the common clocked in at about 10 minutes and eight seconds. If income improves, block occasions may decide up tempo alongside a rising hashrate, and the issue epoch’s estimate may simply shift with it.

Bitcoin hashrate during the last three months.

At at the moment’s hashprice ranges, the metric remains to be 7.98% beneath the place it stood 30 days in the past. On prime of that, November ranked because the fourth-weakest month for miner income in 2025. Miners have been capable of navigate the squeeze in numerous methods, and being publicly listed has provided a severe benefit. These outdoors the non-public realm leaned closely on debt financing this yr to fortify their warchests, with many steering deeper into synthetic intelligence (AI) and high-performance computing (HPC) providers.

Learn extra: Charles Schwab Plans Crypto Buying and selling Growth for First Half of 2026

AI and HPC have saved many bitcoin mining operations fortified by pumping in an additional stream of income. Lastly, bitcoin mining rigs hold leveling up, with producers pushing the boundaries of application-specific built-in circuit (ASIC) efficiency. At this time’s machines are cranking out half a petahash (1,000 terahash per second) or extra, and full 1 PH/s models are already lining up on the horizon.

Altogether, the sector is wobbling by way of tight margins with a mixture of grit, innovation, and borrowed oxygen, however miners can by no means stand nonetheless. With steadier hashprice, diversified income streams, and next-gen ASIC horsepower, miners have been driving a streak of plain previous luck.

FAQ ❓

- What’s hashprice?Hashprice measures how a lot income a miner earns for every petahash (or TH/s or EH/s) of computational energy.

- Why did miner income dip lately?Income cooled as bitcoin costs softened and hashprice slipped to a few of its lowest ranges of the yr.

- How are miners staying afloat?Many miners have leaned on debt financing, AI providers, and high-performance computing (HPC) to pad their earnings.

- Are mining machines getting extra environment friendly?Sure — all yr producers have been rolling out stronger ASIC rigs, with half-petahash models now widespread and 1 PH/s fashions on the horizon.