$XRP emerged as the one high asset to report optimistic ETF flows final week regardless of the massacre that ravaged the market.

The crypto market witnessed considered one of its worst performances final week, with Feb. 5 significantly standing out. Particularly, the market misplaced $310 billion in valuation that day, representing its worst day since Oct. 10, 2025, when it misplaced $383 billion throughout a steep crash that resulted in over $19 billion price of liquidations.

$XRP was one of many hardest hit through the Feb. 5 decline, however institutional adoption continued to trickle upward regardless of the value struggles. Particularly, final week, $XRP emerged as the one high asset to report optimistic ETF flows, pulling in almost $45 million whereas $BTC, $SOL, and $ETH noticed outflows.

Key Factors

- $XRP collapsed by greater than 19% on Feb. 5 amid the market crash that worn out $310 billion price of capital from the crypto market.

- Whereas costs struggled, $XRP noticed elevated institutional curiosity, as $XRP ETF merchandise recorded $45 million price of inflows final week.

- This bullish institutional standing was distinctive to $XRP alone, with Bitcoin, Ethereum, and Solana ETFs seeing outflows as an alternative.

- The most recent efficiency represents $XRP’s first optimistic weekly ETF report up to now three weeks, after dropping $92 million two weeks again.

- The Franklin Templeton $XRP ETF contributed probably the most to the $45 million influx final week, raking in over $20 million alone.

$XRP ETFs File Inflows Regardless of Value Struggles

That is in accordance to market information supplied by Coinglass, as the market eyes a restoration from final week’s turbulence. Particularly, on Feb. 5, $XRP collapsed 19.6% earlier than falling deeper to a 15-month low of $1.11 the following day. Whereas a rebound adopted on Feb. 6, $XRP remained in bearish territory, closing final week with a ten% decline.

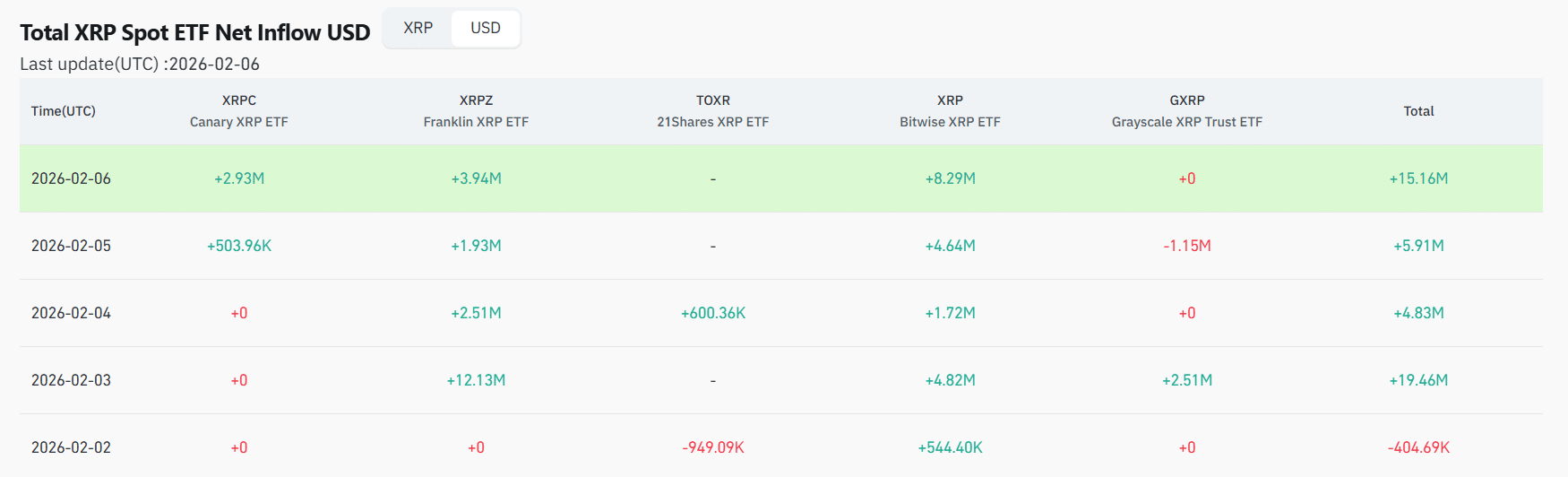

Regardless of this, $XRP ETFs noticed intraday capital inflows 4 occasions out of 5 final week. Notably, the one outflow concerned –$404K on Feb. 2. Because the week progressed, the merchandise solely witnessed inflows, together with $19.46 million on Feb. 3, $4.83 million on Feb. 4, and even $5.91 million on Feb. 5, the day $XRP’s value collapsed 19%. On Feb. 6, the merchandise noticed $15.16 million in inflows.

$XRP ETF Inflows | Coinglass

Collectively, these flows translate to $44.956 million price of web capital inflows final week, representing $XRP’s first optimistic weekly ETF efficiency up to now three weeks. Within the week ending Jan. 23, $XRP ETFs recorded $40.64 million in web outflows. The subsequent week, outflows hit $52.26 million, triggered by the $92 million outflow on Jan. 29. Inside these two weeks, $XRP ETFs misplaced $92.9 million.

Which $XRP ETF Contributed the Most?

Notably, the current restoration largely comes from the contributions of two $XRP ETF merchandise: the Franklin $XRP ETF (XRPZ) and the Bitwise $XRP ETF ($XRP). These merchandise pulled in a mixed $40.5 million, representing over 90% of the entire ETF flows from final week.

Of the $40.5 million mixed move, XRPZ noticed $20.51 million in web inflows, marking the biggest for any $XRP ETF final week. In the meantime, Bitwise’s $XRP recorded $20.014 million price of inflows.

Whereas Canary Capital’s XRPC didn’t report any intraday outflows, it solely noticed $3.43 million in web inflows, seeing no flows on most days. Grayscale’s GXRP witnessed $1.36 million in web inflows. The 21Shares $XRP ETF was the one product that noticed outflows final week, recording $348K price of capital exit.

$BTC, $ETH, $SOL ETFs Seeing Losses

Whereas $XRP moved to get better the ETF losses of the previous few weeks, merchandise tied to Bitcoin, Ethereum, and Solana have continued to see outflows.

Particularly, Bitcoin ETFs recorded $358 million price of outflows final week, whereas Ethereum ETFs noticed $170.4 million in capital exit. In the meantime, Solana ETFs witnessed outflows price $9.3 million, with most of those losses coming on Feb. 6, which launched $11.9 million in capital exit to the Solana merchandise.