USDt hit many new highs in This autumn 2025:

- A market cap of $187.3B

- The eighth consecutive quarter of 30M+ consumer development

- The biggest quarterly improve in on-chain wallets holding USDt

- The best ever degree of month-to-month lively on-chain customers

- The best ever quantity and worth of transfers on-chain

On the similar time, the crypto liquidation cascade of 10 October 2025 has meant the stablecoin ecosystem isn’t rising as quick because it has been. The entire crypto market cap declined greater than ⅓ between 10 October 2025 and 1 February 2026, whereas USDt has grown 3.5% since then, in comparison with the second and third largest stablecoins declining by 2.6% and 57% respectively.

The continued development in USDt comes from various use circumstances past the crypto market, with the information clearly displaying customers’ desire for USDt because the stablecoin to each retailer wealth and transact in.

These insights are based on Tether evaluation of blockchain information, also referred to as on-chain information. On-chain information for 75 stablecoins throughout 15 blockchains is sourced from Chainalysis and Artemis. For ongoing insights into USDt go to usdt.community.

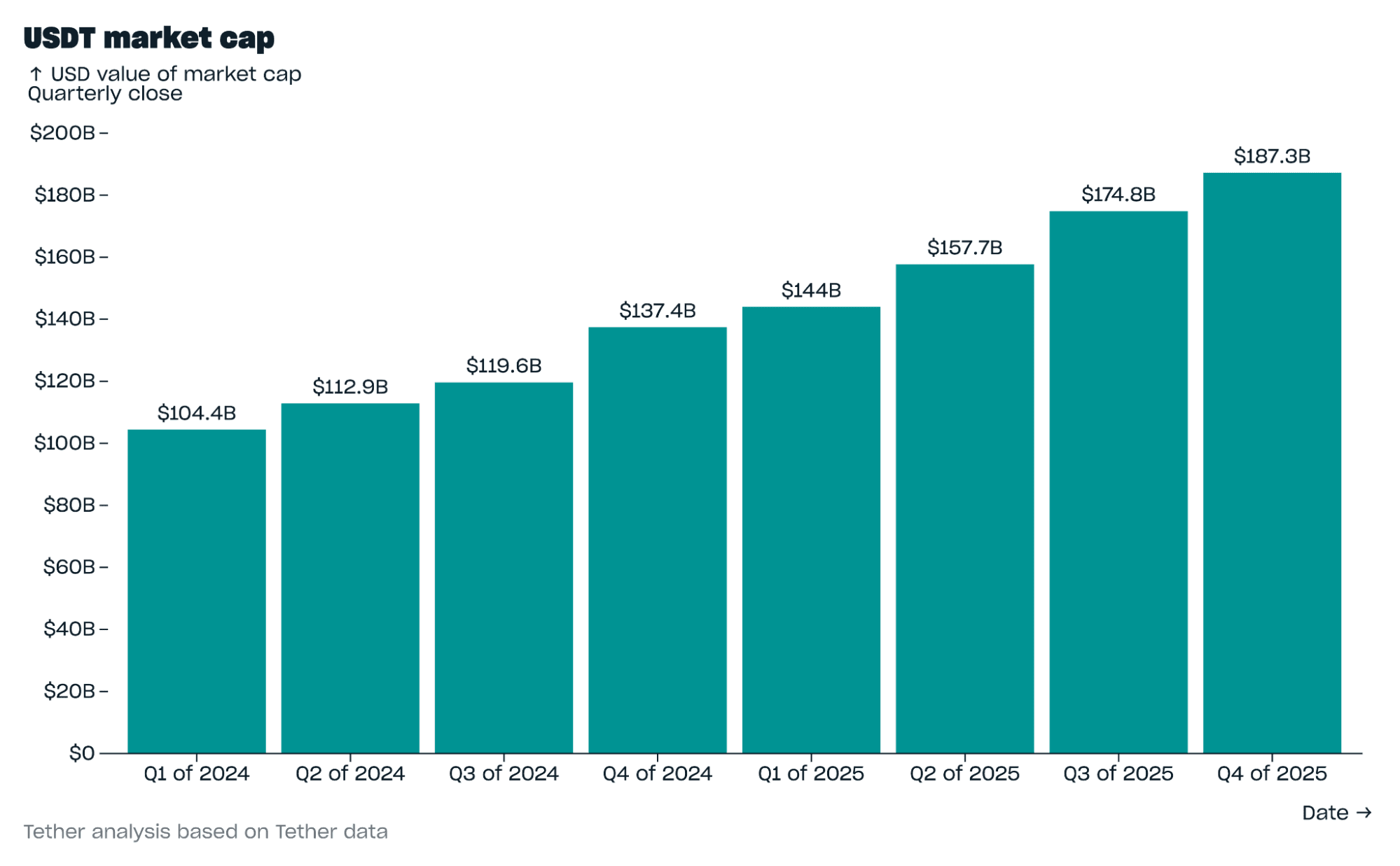

Market cap

The market cap of USDt elevated by $12.4B in This autumn 2025 to $187.3B, with month-on-month development of 4.9% in October earlier than a slower fee of development within the aftermath of the crypto liquidation cascade of 10 October.

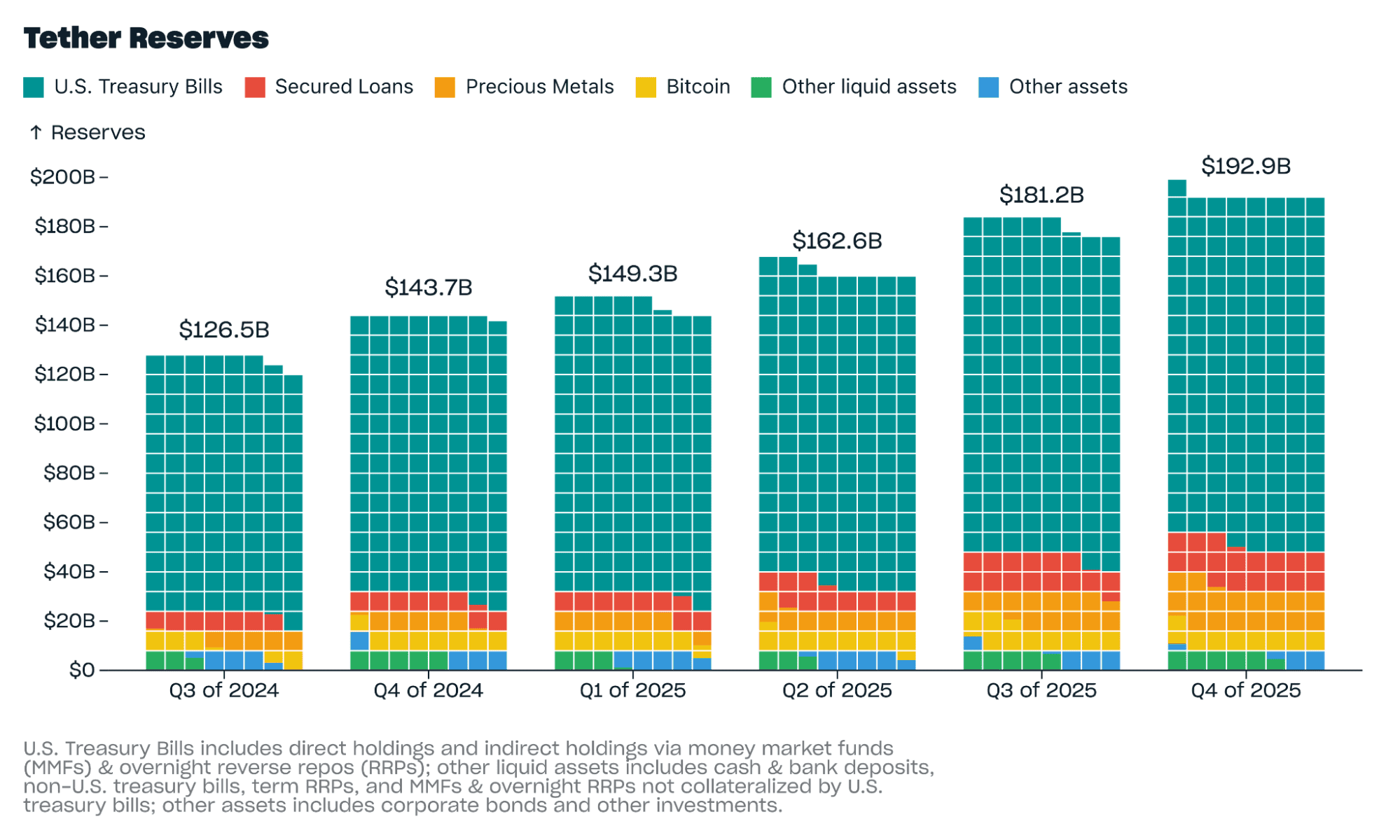

Reserves

Tether’s complete reserves elevated by $11.7B in This autumn to $192.9B, leading to web fairness (belongings higher than liabilities) of $6.3B. Whole reserves included 96,184 bitcoin, rising by 9,850 bitcoin in This autumn, and 127.5 metric tons of gold, rising by 21.9 metric tons in This autumn.

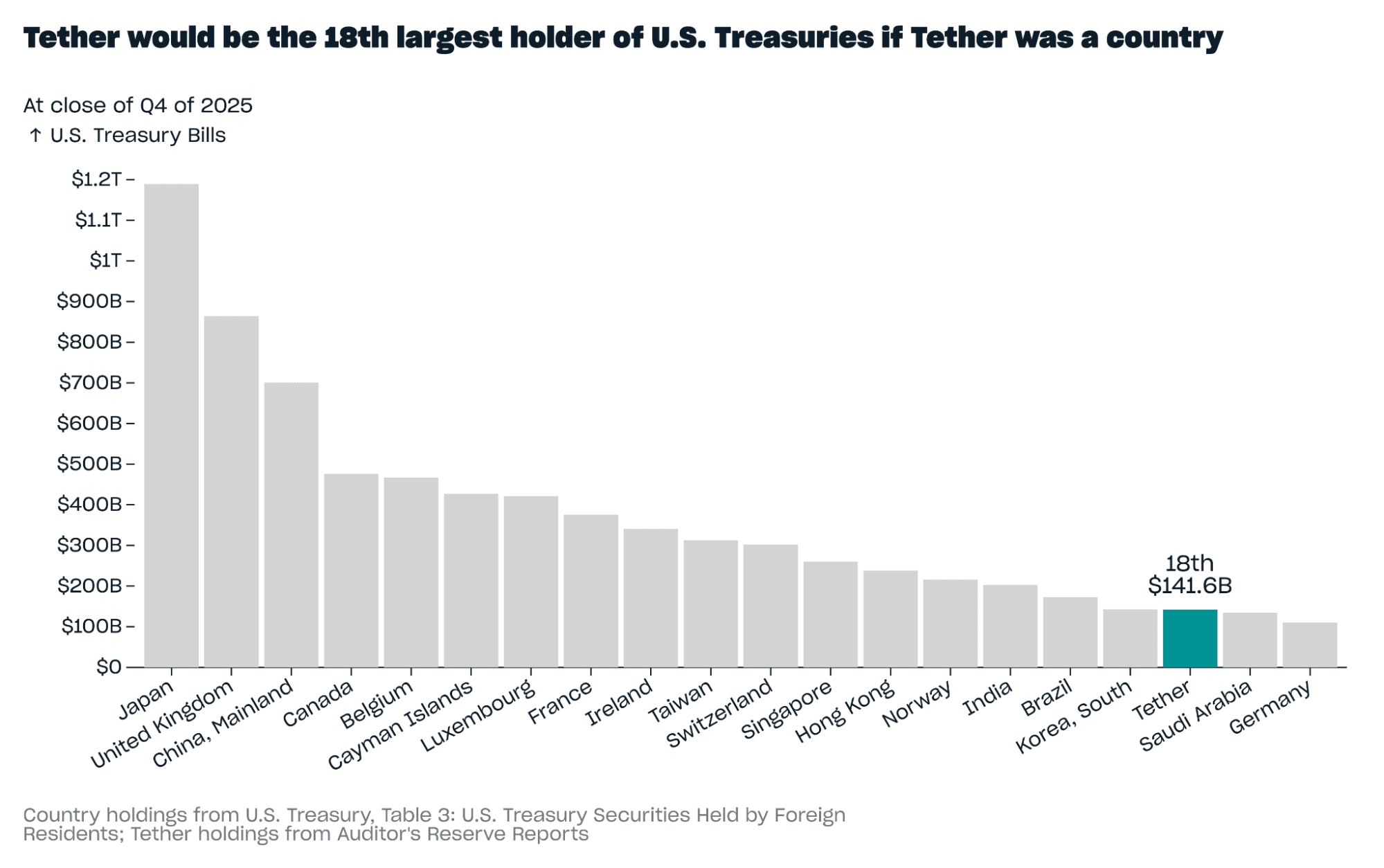

Tether’s complete publicity to U.S. Treasuries elevated by $6.5B in This autumn to $141.6B, making Tether the 18th largest holder of US Treasuries if Tether was a rustic, forward of Saudi Arabia and Germany.

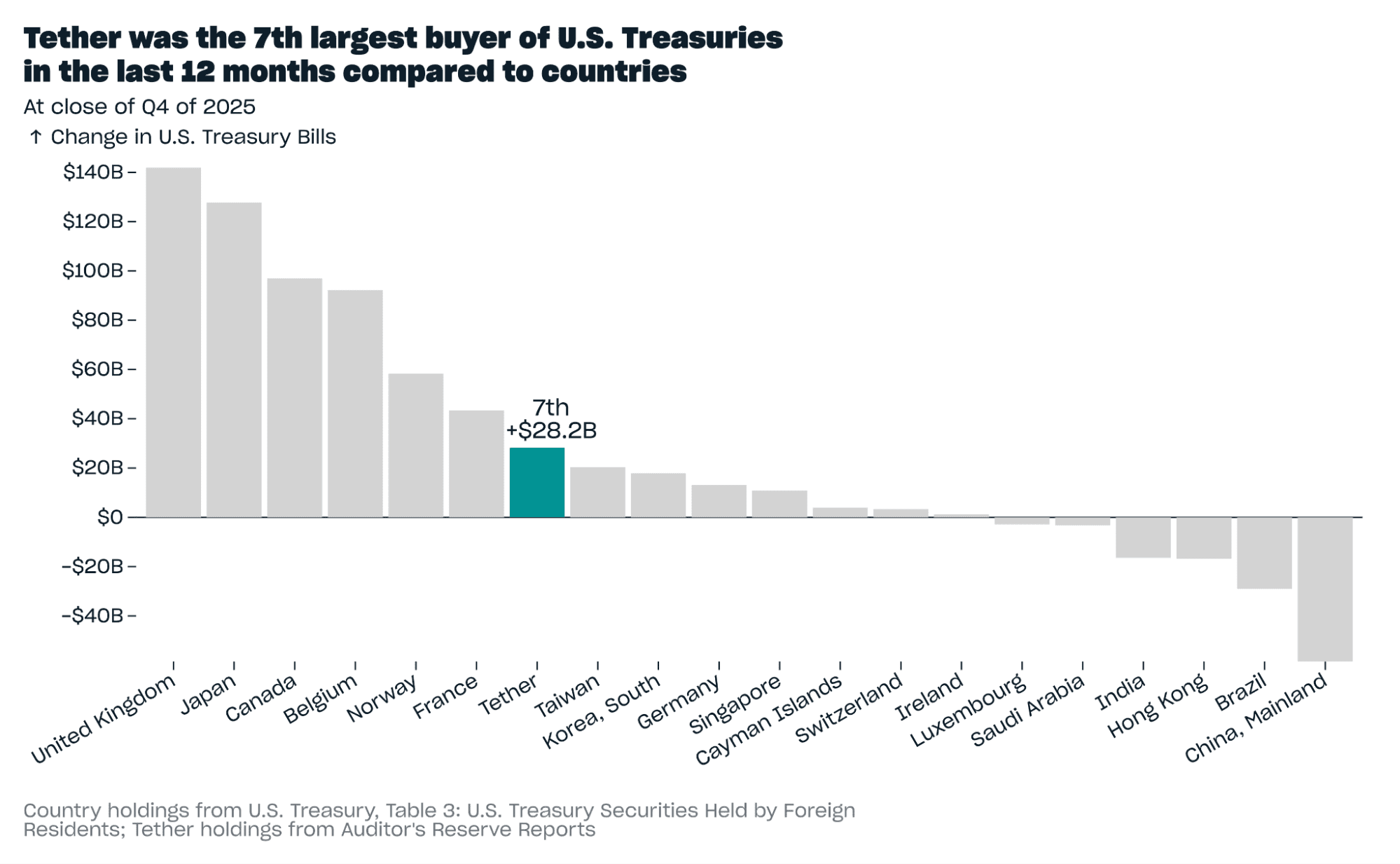

Tether added a complete of $28.2B of U.S. Treasuries in 2025, making Tether the seventh largest purchaser of U.S. Treasuries within the final 12 months in comparison with nations, shopping for greater than Taiwan and South Korea.

Whole customers

The entire estimated variety of USDt customers elevated by 35.2M in This autumn 2025 to 534.5M, making This autumn the eighth quarter in a row so as to add greater than 30M customers. This estimate consists of each customers of on-chain wallets (people who have ever obtained USDt and held it for at the least 24 hours) and estimates of customers which have obtained USDt on centralized companies, reminiscent of exchanges.

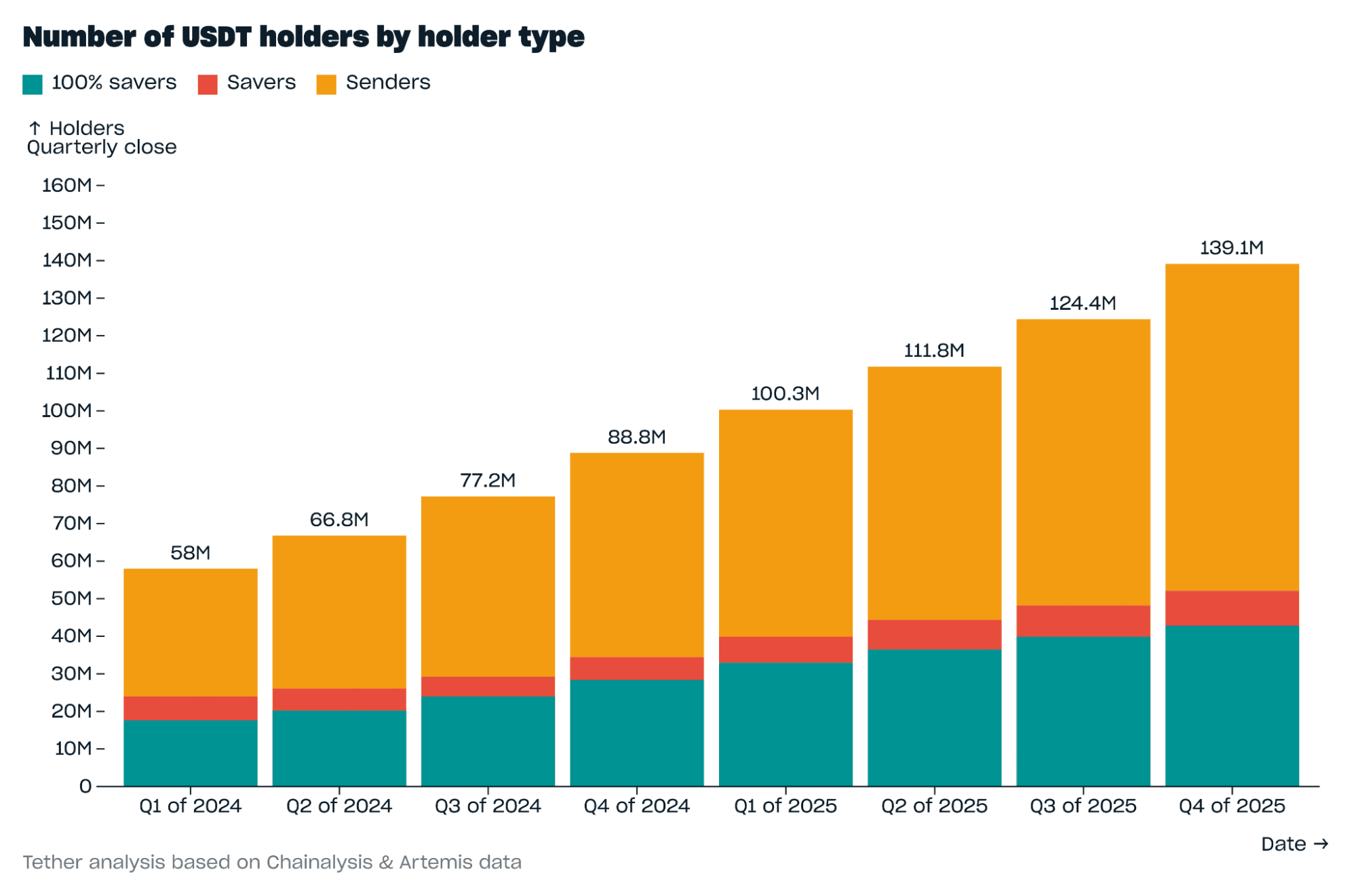

On-chain holders

The variety of on-chain holders of USDt elevated by 14.7M in This autumn to 139.1M, the most important quarterly improve ever. Wallets holding USDt accounted for 70.7% of all wallets holding stablecoins. Along with customers holding USDt in on-chain wallets, we estimate that over 100 million customers additionally maintain USDt inside centralized companies, reminiscent of exchanges.

The composition of on-chain holders of USDt remained pretty fixed with 100% savers (wallets that retain all of the USDt they obtain) at 30.8% of holders, savers (wallets that on common retain lower than 100% however greater than ⅔ of the USDt they obtain) at 6.7% of holders, and senders (wallets that on common retain lower than ⅔ of the USDt they obtain) at 62.6% of holders. A higher share of USDt wallets are savers or 100% savers in comparison with all different stablecoins, at 37.5% vs 30%, and 75.1% of stablecoins saver wallets select USDt, displaying that USDt continues to be the stablecoin that’s most popular as a retailer of wealth.

On-chain lively customers

Month-to-month lively on-chain customers (wallets that obtain USDt at the least as soon as in a 30 day rolling window) reached an all-time excessive of 24.8M on common within the quarter, displaying ever higher ranges of exercise in USDt. This accounts for 68.4% of all stablecoin month-to-month lively customers.

Balances held by sort of consumer

The best share of USDt, 36%, was held in centralized exchanges (CEXs) on the shut of This autumn, a rise of two.8 share factors on the shut of Q3. This was partially resulting from a lower in USDt held in decentralized exchanges (DEXs) and decentralized finance (DeFi) following the ten October crypto liquidation cascade, with USDt held in DEXs & DeFi lowering by $3B (2 share factors) in This autumn to $7.1B (3.8% share of USDt).

The following largest share of USDt, 33%, is held by savers, of which 17.4% is held by 100% savers and 15.6% by different savers. Savers added $2.9B of USDt to their holdings in This autumn, bringing their complete to $62.1B on the shut of This autumn. USDt attracts not simply essentially the most savers, as described earlier, but additionally the best quantity of USD worth saved, with 59.9% of all worth saved in stablecoins, and 77.3% if wallets every holding $10M+ are excluded (which are sometimes chilly wallets of exchanges).

Senders held the third largest share of USDt, at 26.5% on the shut of This autumn. This share was comparatively fixed between Q3 and This autumn, with senders including $2.2B of USDt to their holdings in This autumn, reflecting rising liquidity for transactional use circumstances of USDt.

Observe that complete balances proven listed here are barely higher than market cap as balances embody USDt that’s held in Tether Treasuries however not but issued whereas market cap solely consists of USDt in web circulation.

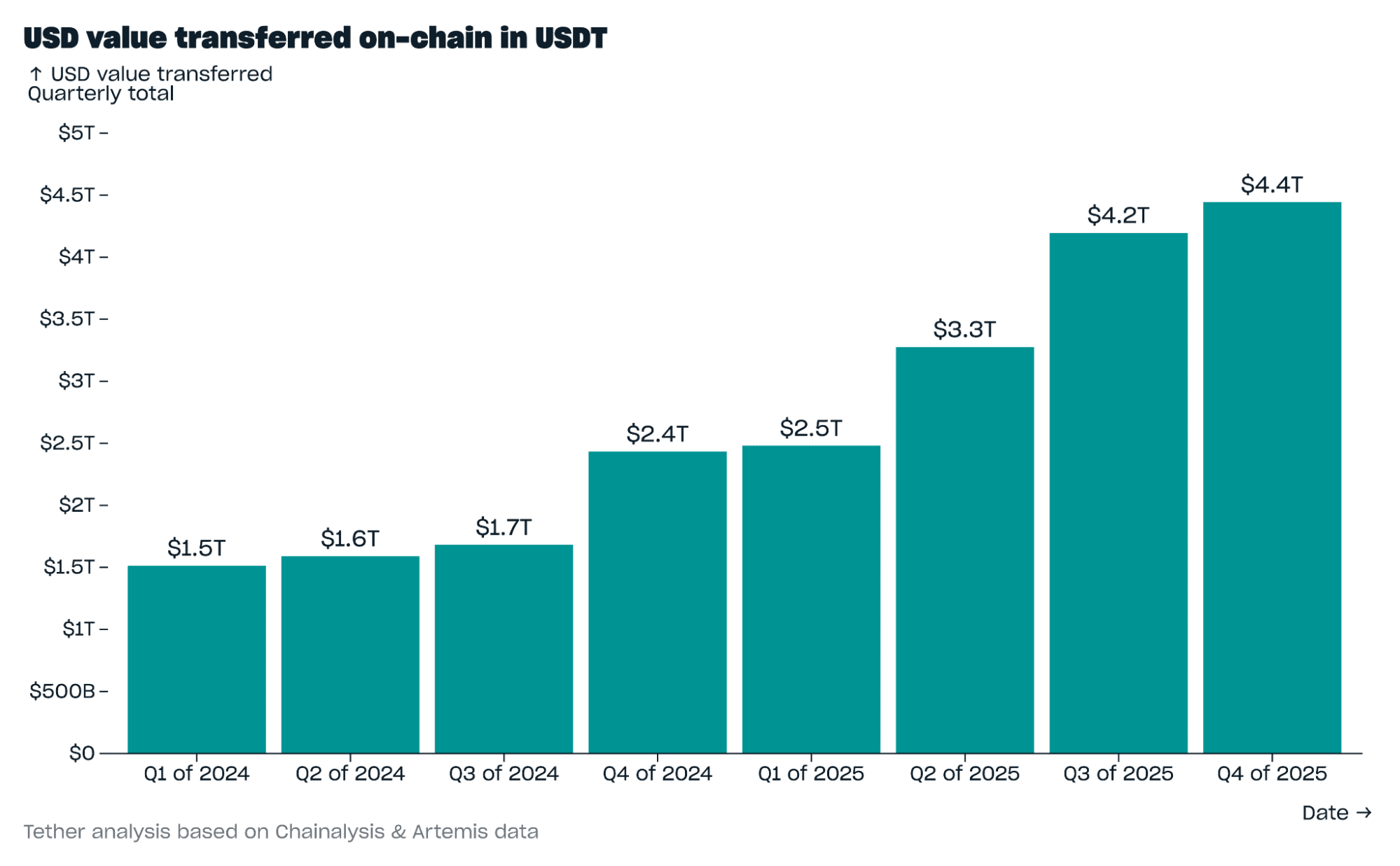

USD worth transferred on-chain

The USD worth transferred on-chain in USDt per quarter elevated by $248.6B in This autumn to $4.4T, the very best degree ever. Of this $4.4T quarterly complete, $2.8T (63.6%) was in transactions the place USDt was the one asset transferred, and $1.6T (36.4%) was in transactions the place a number of belongings had been transferred (sometimes in DeFi swaps). USDt accounted for 65.9% of the worth of single-asset transactions involving stablecoins, and 34.6% of the worth of multi-asset transactions involving stablecoins. This means that USDt continues to be the popular stablecoin to switch worth, whereas different stablecoins are extra used to swap worth, typically for USDt.

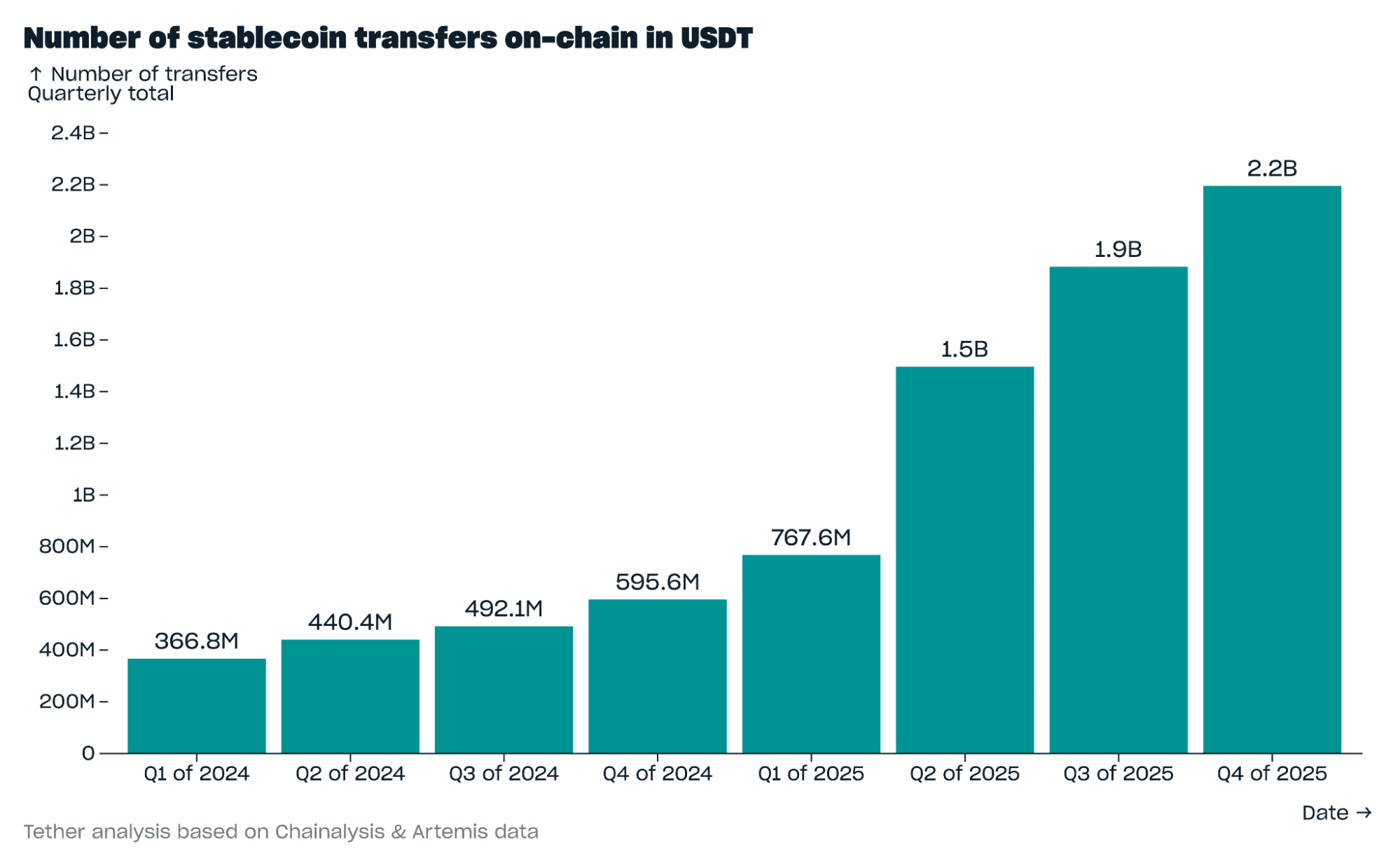

Variety of transfers on-chain

The variety of transfers on-chain in USDt per quarter elevated by 313.1M in This autumn to 2.2B, the very best degree ever. Of this 2.2B quarterly complete, 1.94B (88.2%) had been transfers of lower than $1,000 every, 256M (11.6%) had been transfers of between $1,000 and $100,000 every, and 4.6M (0.2%) had been transfers of greater than $100,000 every.

Velocity

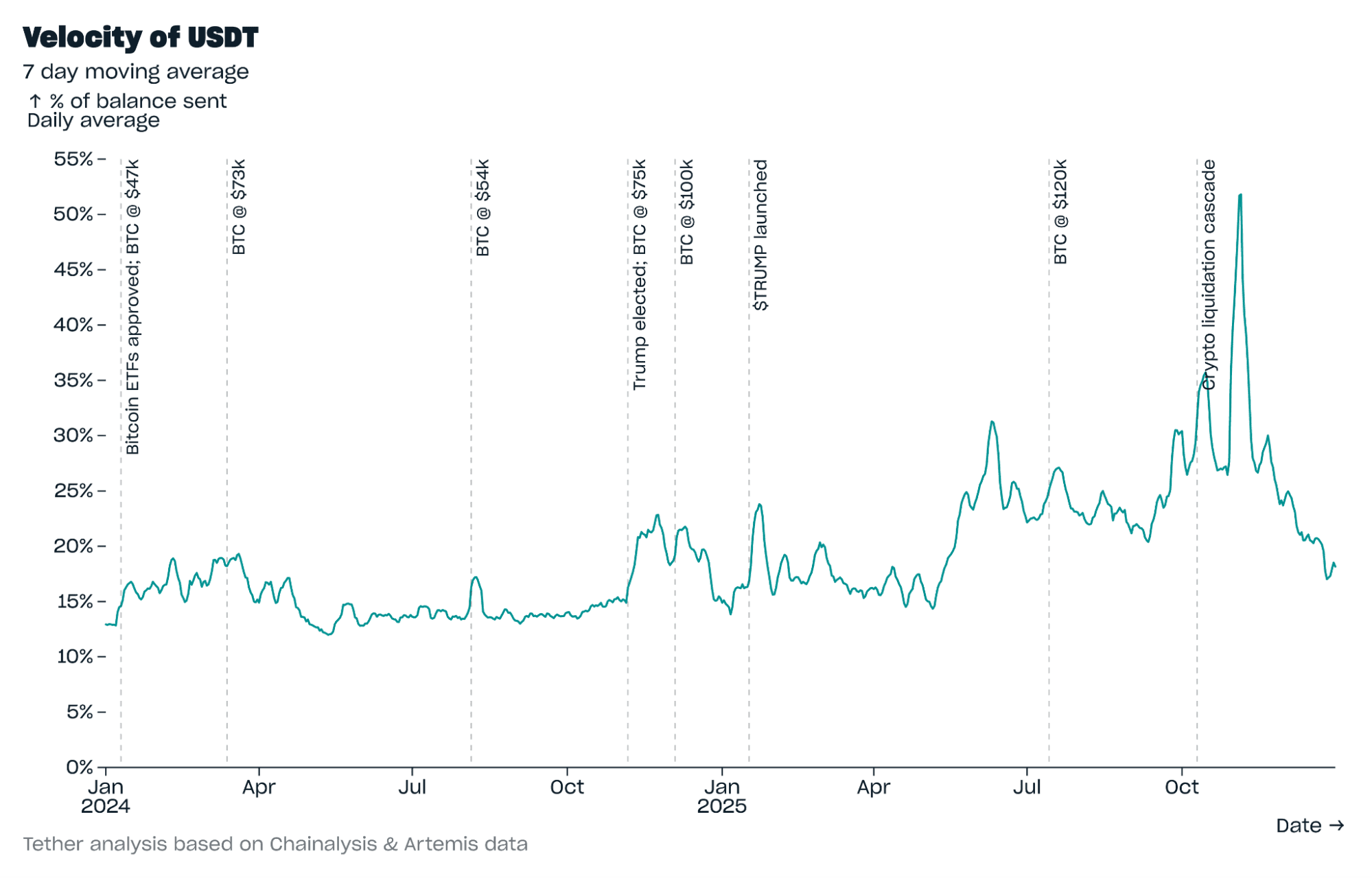

The rate of USDt, the % of stability despatched every day, was 18.2% on the shut of This autumn, on a seven day transferring common foundation. This was down from a peak of 51.8% on 5 November, which was pushed by a spike in DeFi exercise, and much like ranges final seen previous to Q2 2025, when bitcoin worth ranges had been related. The typical velocity of USDt within the quarter was 28%, significantly decrease than the 151% velocity of the subsequent largest stablecoin by market cap. The comparatively low velocity of USDt suggests it has a stickier, extra steady, consumer base and, as described beneath, has a various set of use circumstances.

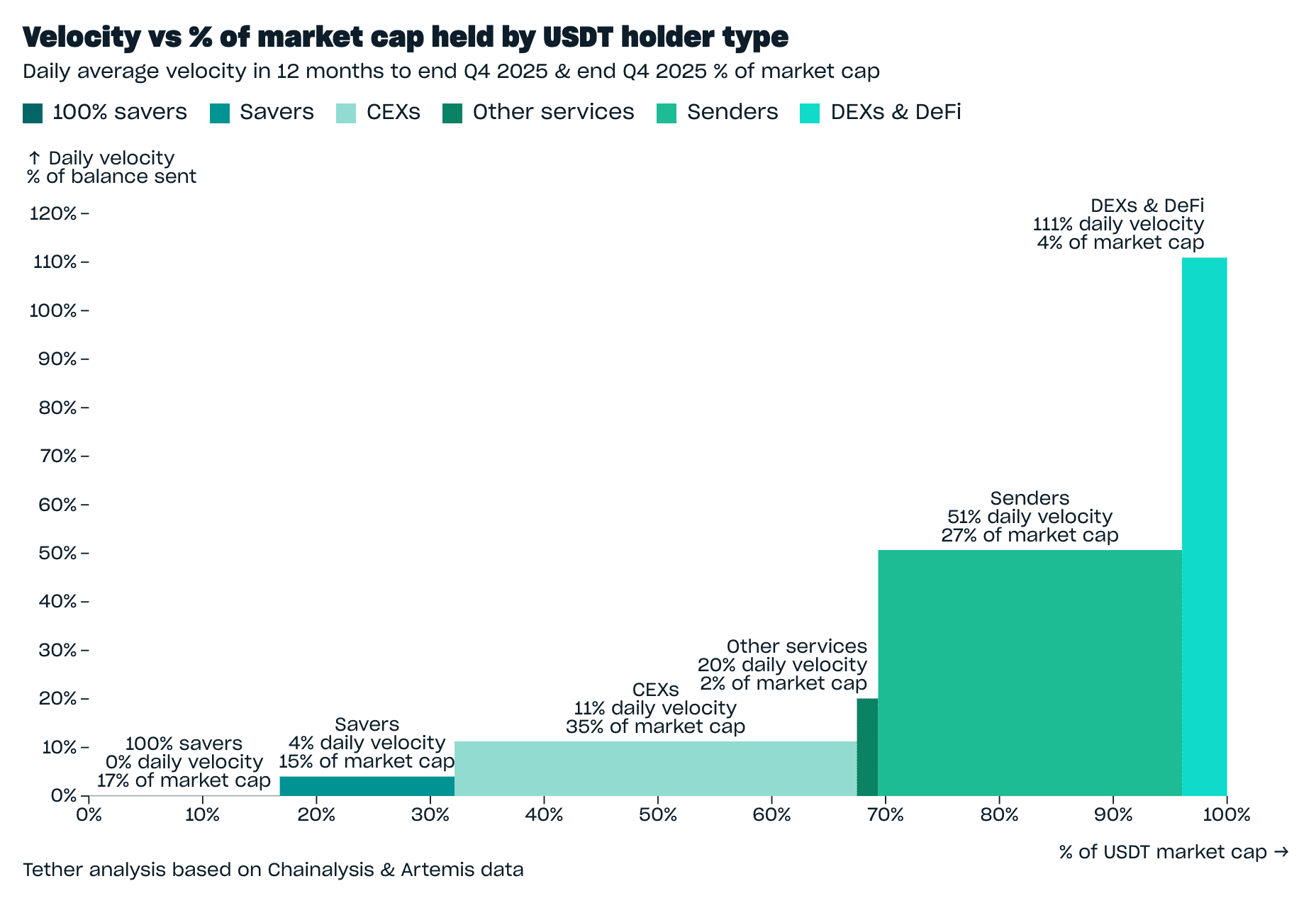

The rate of USDt naturally varies throughout its use circumstances. Customers that maintain USDt for financial savings have a decrease velocity as a result of they sometimes maintain moderately than ship. 100% savers naturally have zero velocity, whereas savers had a 4% each day velocity in 2025. Centralized exchanges even have a low on-chain velocity, at 11% each day velocity in 2025, as a result of customers each maintain USDt as financial savings on exchanges and for buying and selling – however the buying and selling quantity, described within the subsequent part, is recorded in a centralized order e book moderately than on the blockchain. So the USDt transferred out of centralized exchanges by way of the blockchain is low relative to the quantity of USDt held in them.

The upper velocity use circumstances of USDt are sender wallets, with a 51% each day velocity in 2025, which ship USDt for a wide range of causes reminiscent of funds, remittances, and transferring USDt between exchanges, and DEXs & DeFi, with a 111% each day velocity in 2025, the place the speed is usually very excessive as a result of DEX trades are recorded on the blockchain and customers could make a number of trades a day, leading to a velocity of over 100%.

USDt has 67% of its market cap in low velocity use circumstances, and 33% in increased velocity use circumstances. This combine supplies each stability, from low velocity use circumstances, and liquidity, from excessive velocity use circumstances.

Spot market

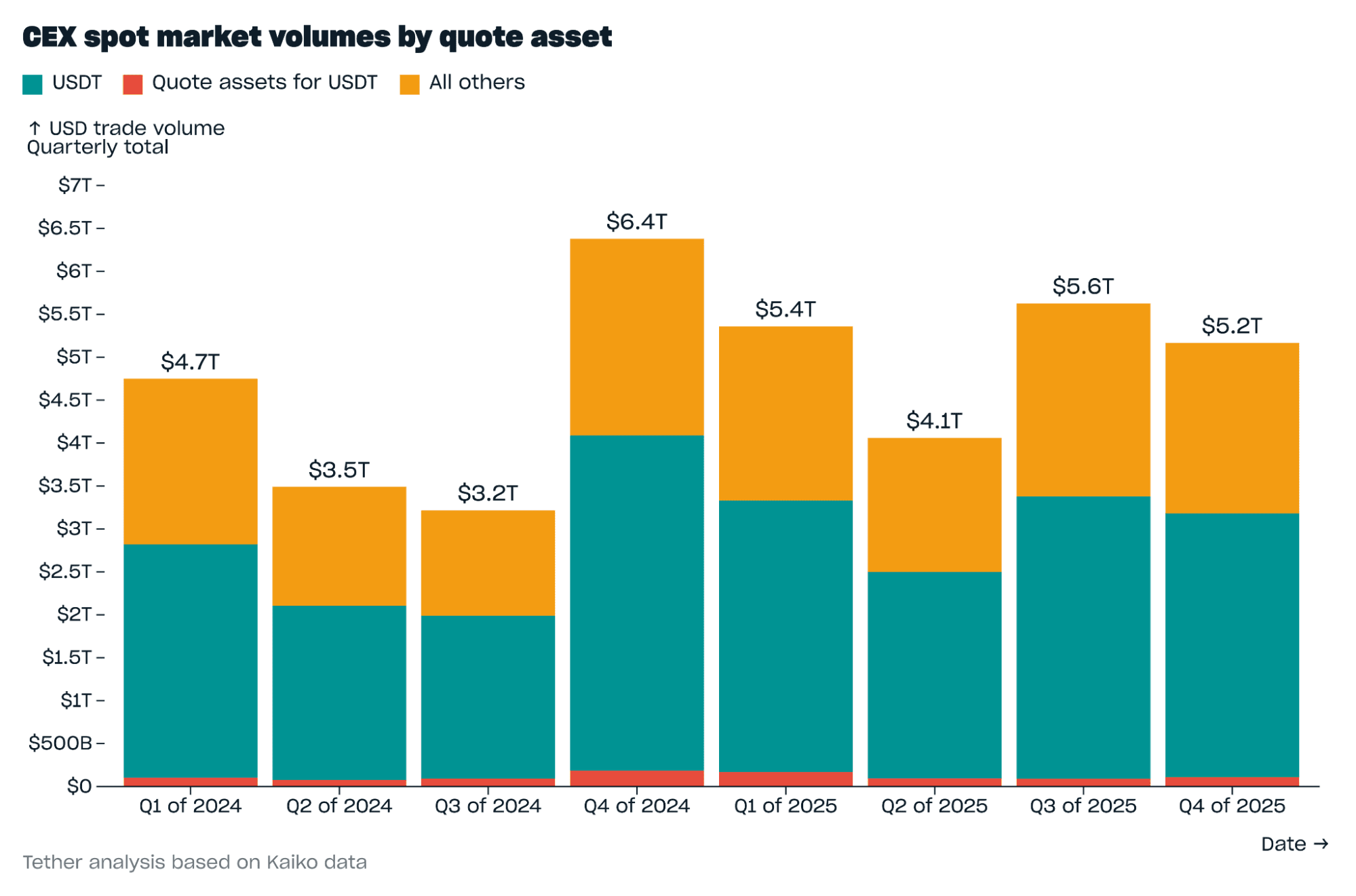

Spot market buying and selling volumes of USDt on centralized exchanges in This autumn was $3.2T, 96.5% of which was with USDt because the quote asset and the rest from different quote belongings for USDt. This was a 5.9% lower on Q3 as buying and selling volumes declined following the ten October crypto liquidation cascade. Nevertheless buying and selling volumes for all different belongings decreased by 11.5% vs Q3, so USDt elevated its general share of spot market volumes by 1.5 share factors to 61.5%. There have been 14.1B spot trades in USDt in This autumn, which was 80% of all spot trades within the quarter.

Conclusion

USDt hit many new highs in This autumn 2025, though development slowed after the crypto liquidation cascade of 10 October 2025. Nevertheless, the information exhibits that the crypto market isn’t the one driver of USDt development. Customers want to save lots of in USDt vs different stablecoins by a large margin (USDt is 75% of stablecoin saver wallets and 77% of USD worth saved in sub-$10M wallets), which supplies a steady, low velocity, supply of demand.

USDt additionally leads in increased velocity, means-of-exchange use circumstances, with USDt accounting for 65.9% of the worth of single-asset transactions involving stablecoins, however solely 34.6% of the worth of multi-asset transactions involving stablecoins. This means that USDt continues to be the popular stablecoin to switch worth, whereas different stablecoins are extra used to swap worth, typically for USDt. These increased velocity USDt use circumstances present liquidity that ensures USDt is extensively accessible and accepted.

For ongoing insights into USDt go to usdt.community.

Philip Gradwell

VP Economics, Tether