The College of Michigan Shopper Sentiment Index exhibits that U.S. shopper sentiment dropped to 57.9 in March, down over 6 factors from 64.7 in February.

The sentiment has dropped to the bottom degree in 28 months, the sharpest drop seen since November 2022. The pessimism amongst shoppers has been as a result of a surge of considerations about stagflation, recession, and worsening financial circumstances within the nation as a result of Trump financial insurance policies.

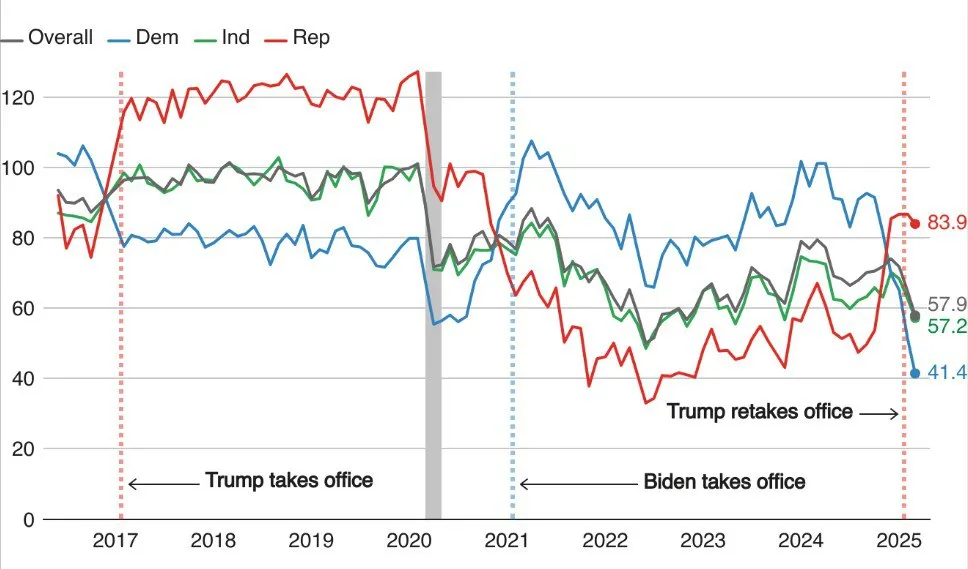

Supply: College of Michigan Survey of Shoppers U.S. shopper sentiment throughout all political affiliations as of March 2025

The present shopper sentiment has sharply declined throughout all ages, gender, training, earnings, wealth, areas, and political affiliations. The College of Michigan Survey of Shoppers led by Joanne Hsu revealed that shopper sentiment amongst Republican shoppers dropped to 83.9. Independents and Democrat shopper sentiment dropped to 57.2 and 41.4 in March, respectively.

The survey additionally indicated that the present decline has been ongoing for 3 consecutive months, with the autumn standing at 22% in comparison with December 2024. The year-on-year decline stood at over 27% in comparison with March 2024, when shopper sentiment was at 79.4. Different metrics, comparable to shopper expectations, have additionally considerably decreased.

The Shopper Expectation Index dropped from 64.0 in February to 54.2 in March, marking a 15.3% month-on-month lower. Shopper expectations are additionally down 30% year-on-year, dropping from 77.4 in March final 12 months. Expectations amongst Republican shoppers declined by 10%, whereas these of Independents and Democrats dropped by 12% and 24%, respectively. Shoppers anticipate the continued insurance policies to have an effect on totally different financial sides, together with private earnings, the inventory market, inflation, employment, and enterprise circumstances.

Shopper inflation expectations rise whereas spending drops

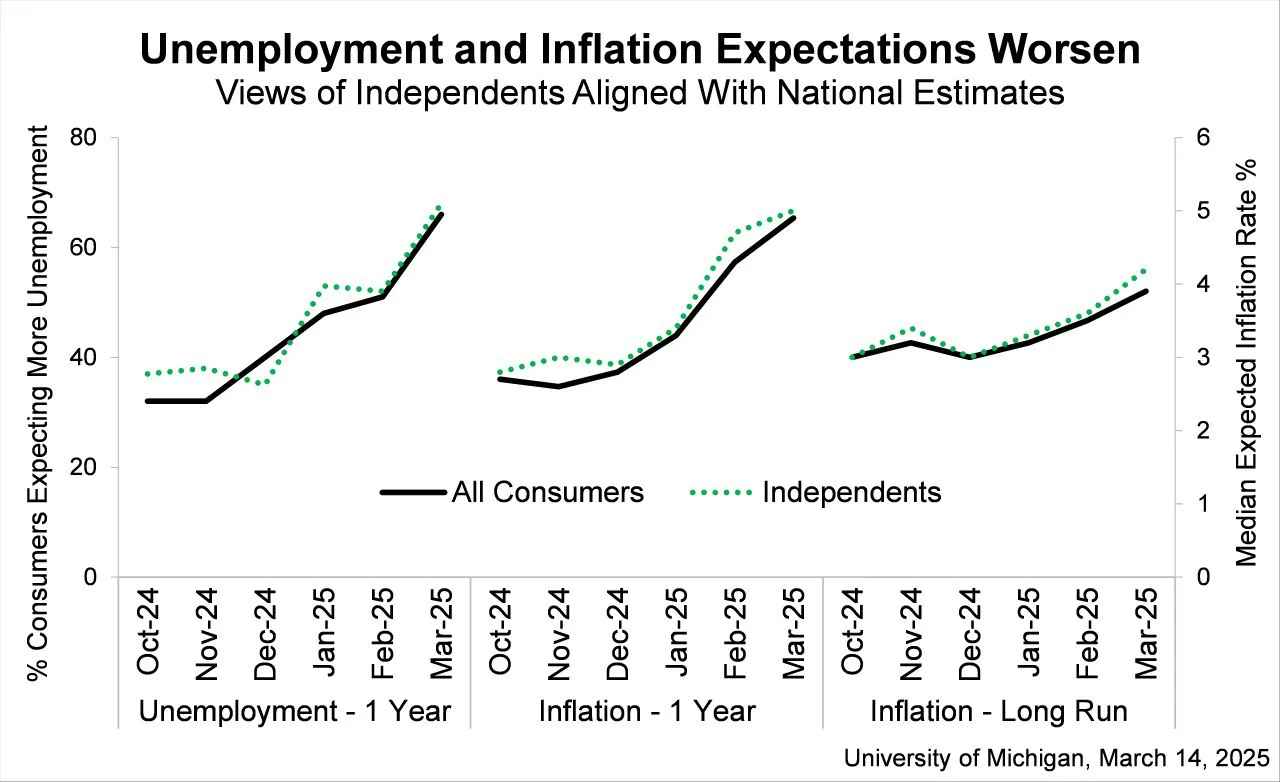

The Survey of Shoppers highlighted a rise within the inflation expectation for the 12 months forward, leaping to 4.9% in March in comparison with 4.5% in February. The survey outlined that the expectation had the best studying recorded since November 2022 and marked the third consecutive month of sharp will increase in expectations.

Shopper inflation expectations in the long term additionally surged from 3.5% in February to three.9% in March. The survey confirmed that the worth marked the best month-on-month recorded since 1993. All political affiliations additionally anticipated that unemployment would worsen within the coming months, with the expectations rising to almost 5% from under 4%.

Supply: College of Michigan Survey of Shoppers Inflation and unemployment expectations amongst shoppers in March 2025

U.S. Treasury Secretary Scott Bessent additionally raised extra considerations a few recession after a press release on the NBC Meet the Press Sunday present. Bessent stated that there was no assure of avoiding a recession. Bessent defined that the federal government was doing an entire reset to stop future monetary crises, including that market corrections had been regular.

U.S. shopper spending has notably dropped by 0.2% in January for the primary time in almost two years. Month-to-month shopper spending additionally dropped for many items, together with motor autos, leisure actions, meals, drinks, clothes, footwear, and extra. Spending on providers nonetheless elevated in January throughout housing, utilities, monetary providers and insurance coverage, lodging, and extra. Spending on items declined by $76.7 billion, whereas spending on providers elevated by $46 billion in January.

Shopper sentiment in different economies, together with China, has been growing whereas the U.S. economic system continues to gradual. Retail gross sales in China elevated in January and February by round 4.0% in comparison with one 12 months in the past. Manufacturing within the nation additionally surged within the first two months of the 12 months, beating earlier expectations.

Trump tariffs elevate financial well being uncertainty

Trump’s erratic tariff coverage is sending financial uncertainty via the roof and tanking markets huge time. Extra imaginative and prescient, much less Brando in Apocalypse Now, please. By way of @purpose https://t.co/RAB5IbLP6X

— Nick Gillespie (@nickgillespie) March 13, 2025

President Trump’s tariffs proceed to boost uncertainty concerning the U.S. financial well being, with the Group of Financial Co-operation and Improvement (OECD) commenting on the nation’s financial slowdown. The OECD quarterly report forecasted a doable plunge in financial well being within the U.S. as a result of Trump’s insurance policies. The report additionally pointed to the sharp decline within the U.S. capital markets over the previous few weeks into the correction zone.

Trump’s tariffs have been cited as one of many main causes of the damaging well being skilled throughout the U.S. markets. The president imposed import taxes on items from Canada, Mexico, the EU, and China, triggering world commerce wars. Trump additionally intends to impose a 25% import tax on world metallic imports with out exceptions, supposed to enter impact on April 2.

The OECD described the tariffs as ‘Trump’s on-again, off-again levy threats,’ including to the uncertainty induced throughout companies globally. The report insisted that uncertainty induced warning amongst companies and their investments within the U.S. Small companies, which contribute largely to the well being of the U.S. economic system, have expressed much less optimism.

The NFIB Small Enterprise Optimism Index fell by over 2% in February to 100.7 as extra companies cited considerations concerning the worsening revenue traits, gross sales expectations, and financial development. Solely 12% of companies notably thought-about it a good time to broaden their operations.