Considerations about stablecoin issuer Tether’s monetary stability resurfaced this week after BitMEX founder Arthur Hayes warned the corporate may face critical bother if the worth of its reserve property had been to fall. However CoinShares’ head of analysis, James Butterfill, pushed again on these claims.

In a Dec. 5 market replace, Butterfill stated fears over Tether’s solvency “look misplaced.”

He pointed to Tether’s newest attestation, which reviews $181 billion in reserves in opposition to roughly $174.45 billion in liabilities, leaving a surplus of practically $6.8 billion.

“Though stablecoin dangers ought to by no means be dismissed outright, the present information don’t point out systemic vulnerability,” Butterfill wrote.

Tether stays one of the vital worthwhile firms within the sector, producing $10 billion within the first three quarters of the yr — an unusually excessive determine on a per-employee foundation.

Associated: Arthur Hayes tells Zcash holders to withdraw from CEXs and ‘protect’ property

The newest supply of Tether nervousness

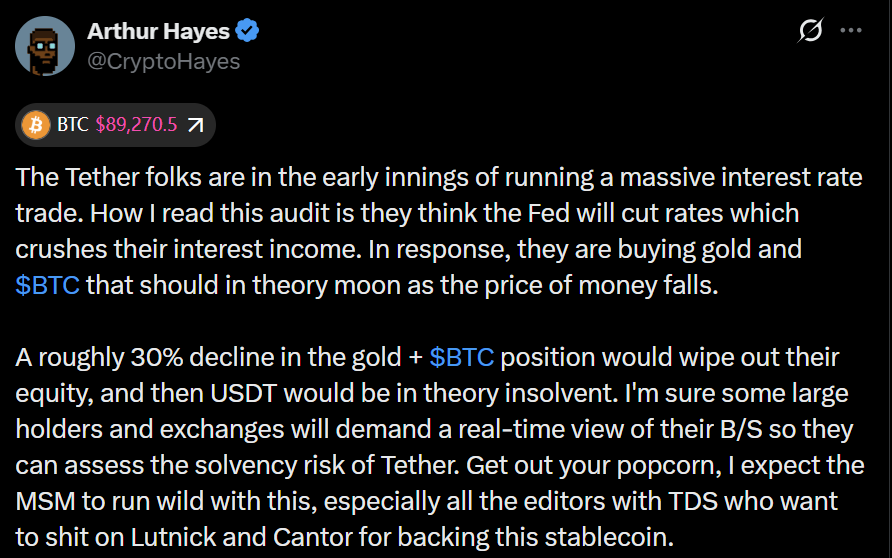

Whereas hypothesis about Tether’s monetary well being is hardly new — media shops have probed its reserves and asset backing for years — the most recent spherical of solvency worries seems to stem from Arthur Hayes.

The BitMEX co-founder stated final week that Tether was “within the early innings of working a large interest-rate commerce,” arguing {that a} 30% drop in its Bitcoin (BTC) and gold holdings would “wipe out their fairness” and go away its USDt (USDT) stablecoin technically “bancrupt.”

Each property make up a considerable portion of Tether’s reserves, with the corporate growing its gold publicity in recent times.

Supply: Arthur Hayes

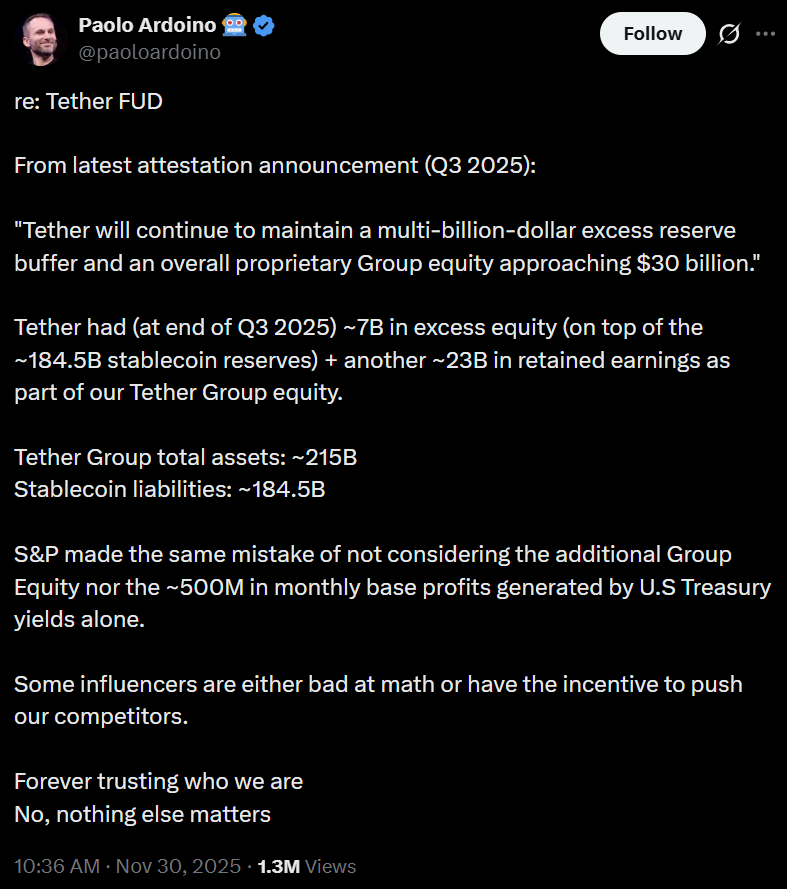

Tether is going through criticism from extra than simply Hayes. CEO Paolo Ardoino lately pushed again on S&P International’s downgrade of USDt’s capability to defend its US greenback peg, dismissing the transfer as “Tether FUD” — shorthand for concern, uncertainty, and doubt — and citing the corporate’s third-quarter attestation report in its protection.

S&P International downgraded the stablecoin over stability issues, citing its publicity to “higher-risk” property comparable to gold, loans and Bitcoin.

Supply: Paolo Ardoino

Tether’s USDt stays the most important stablecoin within the cryptocurrency market, with $185.5 billion in circulation and a market share of practically 59%, based on CoinMarketCap.

Journal: China formally hates stablecoins, DBS trades Bitcoin choices: Asia Specific