The worldwide stablecoin market is surging in 2025, with institutional giants like SoftBank and ARK Funding pursuing investments in infrastructure gamers like Tether.

Whereas Tether and different stablecoins proceed to increase, analysts warn that fast adoption carries monetary dangers, notably to central banks’ means to regulate rates of interest and preserve change price stability.

Tether’s Growth and Investor Curiosity

Tether is reportedly exploring a $20 billion funding spherical, which may worth the corporate at round $500 billion, doubtlessly inserting it among the many world’s Most worthy non-public companies. Tether goals to make use of the capital to diversify past its core stablecoin enterprise, which presently helps a USDT provide exceeding $170 billion.

SoftBank has been steadily increasing its cryptocurrency investments, whereas ARK Make investments, led by Cathie Wooden, has pursued a number of high-profile crypto funding offers lately.

If accomplished, the spherical would mark Tether’s most in depth seek for exterior capital but. Cantor Fitzgerald, a shareholder in Tether, is advising on the potential transaction. Market observers say the transfer displays the stablecoin issuer’s dominant place and rising institutional confidence in digital asset infrastructure.

SoftBank and Ark Funding Administration are in talks to affix a significant funding spherical for Tether Holdings. The deal may worth the corporate at as much as $500bn, w/Tether aiming to boost $15–20bn by promoting ~3% of the agency. Backing from SoftBank and Ark would give Tether contemporary momentum &… pic.twitter.com/LF7bc8v8Sl

— Holger Zschaepitz (@Schuldensuehner) September 26, 2025

Supported by massive US Treasury holdings and a rising Bitcoin reserve, Tether has emerged as one of the worthwhile companies in crypto. In Q2 2025, it posted $4.9 billion in web earnings, up 277% from a yr earlier.

Institutional Money Pours In as Market Explodes

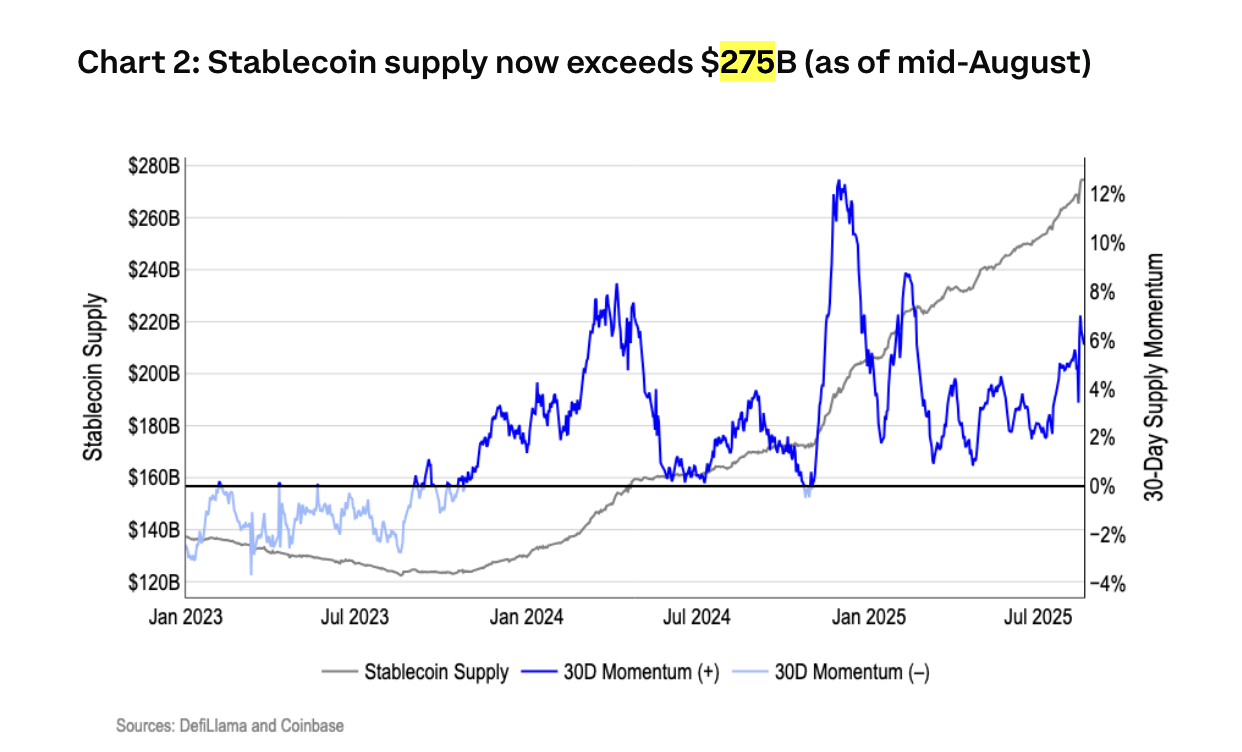

The stablecoin sector is present process an explosive development part in 2025, pushed by unprecedented institutional adoption and rising regulatory readability worldwide. In line with evaluation cited in Coinbase’s August report, the entire market capitalization of stablecoins has surged, reaching over $275 billion. Some analysts undertaking the market may attain $1 trillion by 2028.

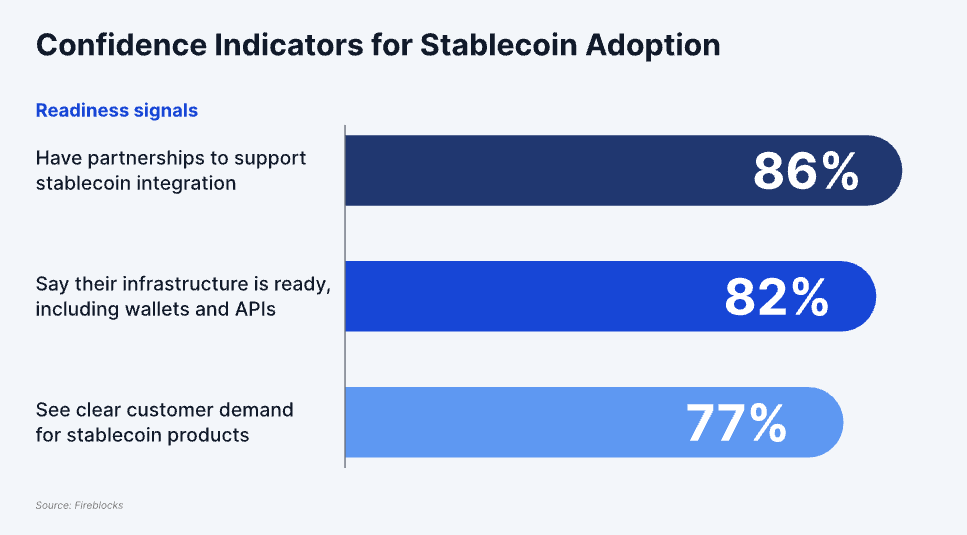

This development is fueled by the stablecoins’ utility in cross-border funds, that are used for over 43% of B2B transactions in Southeast Asia. This yr marks an inflection level the place establishments are actively integrating stablecoins; a Fireblocks survey indicated that 90% of surveyed establishments at the moment are taking motion on stablecoin integration, embracing them for treasury administration and worldwide settlement.

Past Tether’s ambition, different main gamers are reshaping the panorama: 9 main European banks (together with ING, UniCredit, and Danske Financial institution) have joined forces to launch a MiCA-compliant euro-denominated stablecoin, and firms like Finastra have partnered with Circle to combine stablecoins into financial institution fee flows.

The motion is gaining momentum in Asia as effectively. South Korea’s main monetary establishments are deeply engaged in making ready for the stablecoin period, aggressively pursuing a “Two-Observe Technique” involving each inner growth and strategic partnerships to launch their very own Korean Gained-backed stablecoins.

For instance, a gaggle of no less than eight main banks, together with KB Kookmin Financial institution and Shinhan Financial institution, is reportedly forming a consortium to create a three way partnership and infrastructure particularly for the co-issuance of a Gained-backed stablecoin. Moreover, main banks are assembly straight with overseas stablecoin issuers, such because the US firm Circle (USDC issuer), to debate cooperation, whereas concurrently establishing inner activity forces to conduct Proof-of-Idea (PoC) testing for real-world settlement utilizing their very own digital foreign money techniques.

Rising Stablecoin Use Poses Monetary Dangers

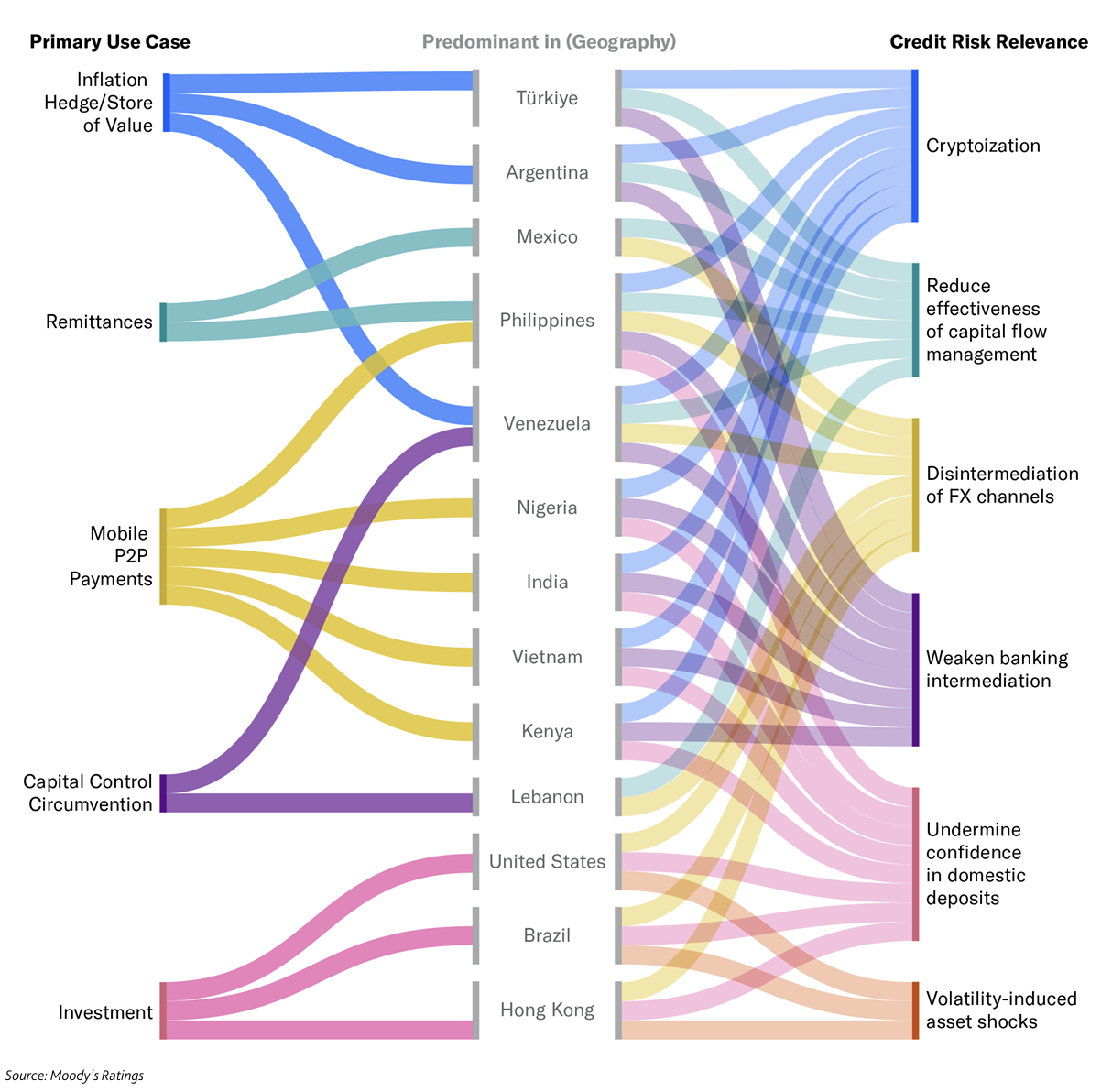

A brand new report from Moody’s Scores, revealed on September 25, warns that digital foreign money possession has surged globally, reaching 562 million individuals by 2024, up 33% from the earlier yr. Rising markets in Southeast Asia, Africa, and Latin America are main adoption, typically utilizing cryptocurrencies for inflation hedging, remittances, and monetary inclusion.

The fast growth of stablecoins introduces systemic vulnerabilities. Widespread use may cut back central banks’ management over rates of interest and foreign money stability, a development termed “cryptoization.” Banks might expertise deposit erosion as financial savings shift into stablecoins or crypto wallets, and underregulated reserves may set off liquidity runs requiring authorities intervention.

Cryptocurrency adoption carries completely different dangers in several markets / Supply: Moody’s Scores

Nonetheless, uneven regulatory frameworks go away nations uncovered. Superior economies are starting to manage stablecoins extra rigorously, with Europe implementing MiCA and the US passing the GENIUS Act, whereas Singapore applies a tiered framework. In distinction, many rising markets lack complete guidelines, and fewer than one-third of nations have full-spectrum regulation in place.

The submit Tether Eyes $500B Valuation Amid Explosive Stablecoin Market Development appeared first on BeInCrypto.