- Bolivia’s Bitcoin mining hash price grows to 0.29% globally as inflation devalues the nationwide foreign money.

- Venezuela’s superior USDT adoption provides classes on threat administration and company monetary protocols.

Bolivia’s financial system is navigating a fancy state of affairs marked by a shortage of overseas foreign money. The nationwide foreign money, the boliviano, faces constant stress on its worth. Inside this context, Bitcoin mining and the usage of stablecoins like USDT have gained traction as sensible alternate options for the inhabitants and companies.

Development of Bitcoin Mining in a Difficult Financial Setting

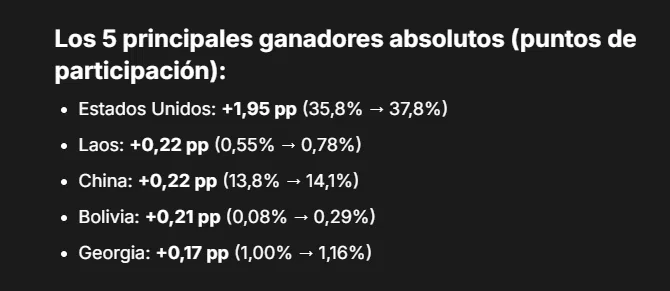

The worldwide warmth map from the Hashrate Index for the fourth quarter of 2025 positioned Bolivia with a 0.29% share of the worldwide Bitcoin hashrate. This determine, though small within the world panorama, represents a quantifiable development in comparison with earlier quarters.

Supply: Hashrate Index

The nation moved from a share of 0.08% to the present 0.29%, a rise of 0.21 share factors. This increment locations Bolivia among the many 5 nations with the very best absolute development in that particular interval, categorizing it as an rising participant in world mining.

The first motivation for this development shouldn’t be present in distinctive mining profitability, however within the native financial scenario. Junior, a miner and activist from Costa Rica, identified that curiosity in Bitcoin mining in Bolivia arises as a way of safety towards foreign money devaluation.

The Bolivian financial system stories inflation that has reached 80%, with a devaluation of the boliviano reaching 50% in 2025. The official alternate price stays at BOL 6.96 per greenback, however within the parallel market, the foreign money trades round BOL 16.50, implying a depreciation of 137% between each markets.

Fidel Torricos, chemistry skilled and CEO of Solvexco

“Harnessing waste fuel for cryptocurrency mining might diversify Bolivia’s financial system, generate important income, and handle challenges similar to overseas foreign money shortages and financial volatility.”

Testimonies from native miners element this actuality. Carlos, a Bolivian miner, reported that revenue in native foreign money was inadequate attributable to inflation of 130% and the devaluation skilled in 2024. For him, digital mining turned a vital possibility. He clarified that, whereas mining in Bolivia doesn’t current the identical profitability as in nations like Paraguay or Costa Rica, excessive inner inflation has made it a viable exercise.

One other miner, Huáscar Miranda, supplied a extra technical perspective on prices. Miranda defined that producing BOL 100 in Bitcoin consumes roughly 72 kWh of vitality, a price equal to 80 {dollars} in electrical energy. After contemplating further bills, the web revenue is decreased to only BOL 10 per operation.

Diego Monroy, Gross sales and Purposes Engineer at Luka Industries LLC.

“Machines that demand excessive ranges of vitality might function effectively and profitably in distant areas.”

This skinny margin highlights the significance of optimizing operational prices. Miranda and different sector actors emphasize that mining is simply aggressive in Bolivia when utilizing residual fuel as an vitality supply. Fidel Torricos, a chemistry skilled and CEO of Solvexco, helps this view. Torricos signifies that leveraging residual fuel for Bitcoin mining can diversify the Bolivian financial system. This follow might generate revenue and concurrently handle challenges like foreign money shortage and financial volatility.

USDT as a Software for Monetary Stability for Residents and Companies

Parallel to mining growth, the usage of the USDT stablecoin has skilled a pronounced improve in Bolivia. This digital foreign money pegged to the US greenback has turn out to be a elementary device for people and companies to guard their capital from the instability of the boliviano. Worldwide automotive manufacturers similar to Toyota, Yamaha, and BYD have begun accepting funds in USDT inside the nation. This phenomenon is replicated in smaller-scale commerce, from native shops to eating places, in cities like La Paz and Santa Cruz.

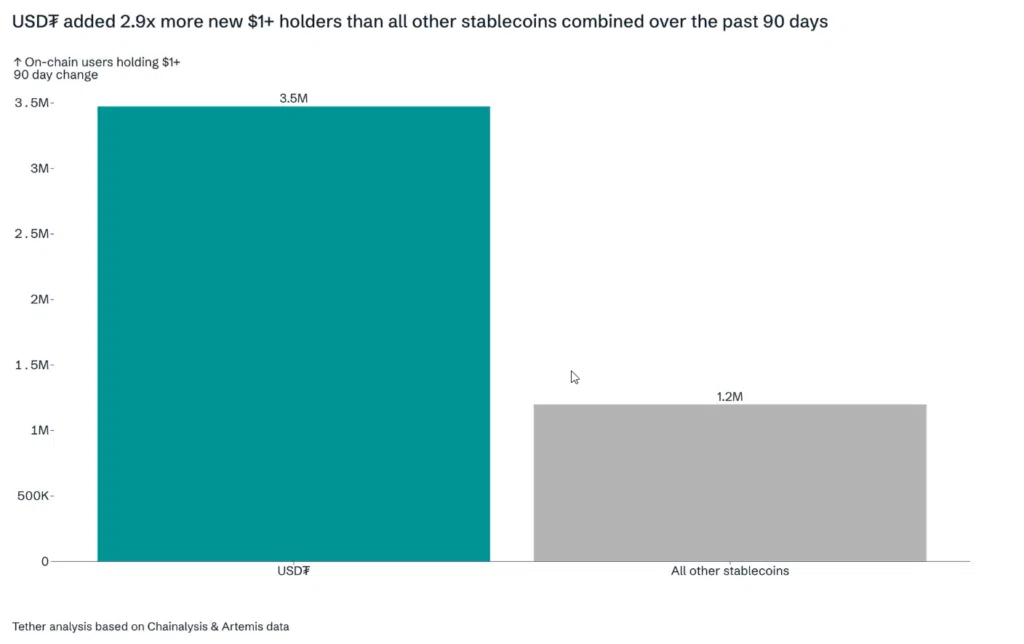

For Tether, the corporate issuing USDT, the Bolivian case validates its technique in rising markets. World information from the corporate signifies that its stablecoin has added 2.9 instances extra holders with balances over $1 within the final three months, in comparison with all different stablecoins mixed.

Supply: X/Paolo Ardoino.

In Bolivia, USDT is consolidating alongside Bitcoin as a digital refuge towards the erosion of the native foreign money’s buying energy. In an interview, economist César Vargas Díaz revealed that the nation’s gold reserves suffered a drastic discount, falling from 40,000 tons to only 0.9 tons within the state’s vaults.

Vargas Díaz said that the present financial base lacks strong backing. He specified that cash issuance reaches 9,000 million {dollars}, however the actual financial base is located close to 3,000 million, making the scenario unsustainable. The economist proposed a elementary change: switching the gold backing for lithium.

He urged the creation of a brand new foreign money, the BSL, composed of 80% in paper format and 20% digital, backed by lithium reserves that he estimates at 184,000 million {dollars}. Whereas this proposal is debated, the inhabitants has already made sensible choices. Bolivians carried out transactions value 430 million {dollars} in Bitcoin and different cryptocurrencies inside a twelve-month interval.

Classes from Venezuela: The Accountable Administration of Stablecoins

In Venezuela, USDT has turn out to be deeply built-in into the each day operations of companies. José Miguel Farías, a Venezuelan monetary commentator, confirms that an increasing number of corporations use the stablecoin for funds, treasury administration, and operations with shoppers or companions exterior the nation. Farías points a vital warning: the straightforward adoption of the digital asset doesn’t assure ample dealing with. He emphasizes that USDT is a device that calls for administration, management, and utilized monetary standards.

Cada vez más empresas en Venezuela están incorporando USDT en su operativa diaria: para pagos, gestión de tesorería u operaciones con aliados o clientes fuera del país. Pero hacerlo bien no se trata de subirse a una tendencia, sino de incorporar una herramienta que exige gestión,…

— José Miguel Farías (@Jmfariasu) October 9, 2025

Farías expressed that digital operations don’t exempt the necessity for an operational construction; quite the opposite, they demand it to a larger extent. He urges following the instance of corporations that handle USDT responsibly.

Increasingly corporations in Venezuela are incorporating USDT into their each day operations: for funds, money administration, or transactions with companions or clients exterior the nation. However doing it proper shouldn’t be about leaping on a pattern, however somewhat incorporating a device that requires administration, management, and monetary judgment. Digital doesn’t exempt you from construction: it calls for extra.

These corporations set up clear inner insurance policies that outline the proportion of their treasury held within the asset, choose the platforms on which they function, and decide custody protocols for the funds. Farías emphasised that documenting each transaction, recording alternate charges, and backing the origin of funds shouldn’t be mere paperwork, however a type of important safety.

Step one is to acknowledge that utilizing stablecoins shouldn’t be an experiment, however a administration device. Firms that do it proper set up clear insurance policies: what share of their treasury will likely be in USDT, on which platforms it will likely be traded, and who has custody. Documenting each transaction, recording charges, and backing up sources of funds shouldn’t be paperwork: it’s safety.

The commentator clarified that utilizing USDT shouldn’t be equal to easily shopping for bodily {dollars}. Behind the stablecoin there’s a expertise, a blockchain community, and an operational logic that corporations should perceive to take care of management over their assets.

Utilizing USDT shouldn’t be the identical as shopping for {dollars}. Behind it lies a expertise, a community, and an working logic that corporations should make an effort to grasp. Those that don’t perceive how the cash they handle strikes round take dangers they can not see. And on this surroundings, ignorance shouldn’t be paid for with devaluation, however with a direct lack of management.

Ignorance of how digital cash strikes generates invisible dangers, such because the mismanagement of personal keys or non-compliance with tax obligations. Farías recommends that corporations develop inner capabilities, practice their accounting groups, set up custody protocols, and consider the tax impacts of working with digital property.

🚨 ¿El Banco Central de Venezuela 🇻🇪 y el Banco de Venezuela van a añadir USDT a su sistema?

Te explico en este video versión extendida lo que realmente está pasando 👀 pic.twitter.com/FNt4r6Uq4m

— Criptolawyer (@criptolawyer) September 9, 2025

Economist Criptolawyer identified that the Venezuelan state more and more makes use of USDT to make settlements, even above bodily {dollars}, particularly in operations linked to non-public corporations and the oil sector.

Information from Chainalysis locations Venezuela among the many Latin American economies with the very best retail exercise in cryptocurrencies, with over 44,600 million {dollars} in transactions recorded between July 2022 and June 2025. The demand for USDT is such that its value in Venezuelan bolívars surpassed 300 bolívars per unit in September, after a rise of just about 44% from the 208 bolívars recorded originally of the identical month.