Simply over six months after Shopify partnered with Coinbase, funds utilizing $USDC on Base by way of the combination stay solely a small fraction of the e-commerce big’s exercise.

The mixing, introduced in June of final 12 months and involving Shopify, Coinbase and Stripe, permits retailers at Shopify to simply accept $USDC funds settled on Base. The funds are settled by way of the Commerce Funds Protocol, an open supply protocol developed by Shopify and Coinbase and launched on the time of the combination.

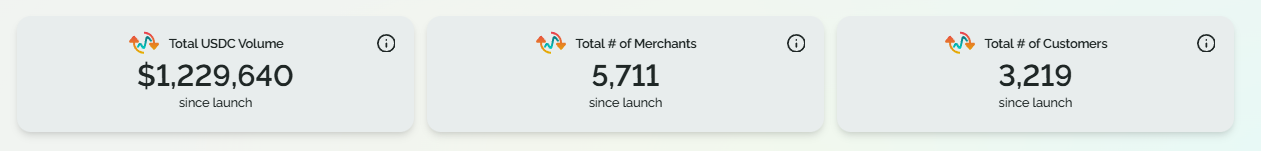

To this point, nonetheless, adoption seems comparatively low. In accordance with knowledge from blockchain analytics platform growthepie, since June, simply $1.2 million in $USDC funds on Base has been processed from about 3,200 clients throughout 5,700 retailers by way of the Commerce Funds Protocol.

Growthepie additionally famous that these figures replicate exercise throughout “a number of firms” that use the Commerce Funds Protocol, not solely Shopify.

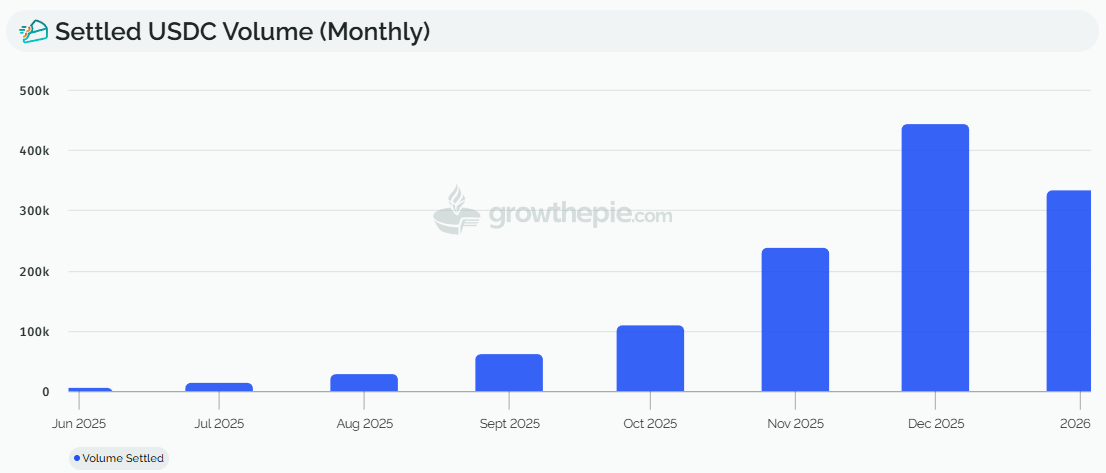

$USDC quantity on Commerce Funds Protocol since June 2025. Supply: growthepie

A Coinbase spokesperson confirmed to The Defiant that growthepie’s knowledge “exhibits a bit of the puzzle,” including that the Shopify rollout is ongoing and early indicators are stable.

“Quantity is trending up and we’re seeing retailers more and more leaning into crypto, particularly for cross-border funds,” the Coinbase spokesperson famous, including that a number of different operators are within the pipeline.

When the partnership was first introduced in June, Shopify described the transfer as an effort to “deliver frictionless, safe stablecoin funds to retailers world wide.”

However the $USDC numbers stay only a tiny fraction of Shopify’s broader footprint. In 2024, the e-commerce big reported greater than 5.5 million retailers, 875 million clients, and roughly $300 billion in annual gross merchandise quantity (GMV).

Development Trajectory

Talking with The Defiant, Lorenz Lehmann, analysis lead at growthepie, stated the small absolute numbers shouldn’t be learn as a failure.

“Whereas absolutely the numbers ($1.2M) are small in comparison with Shopify’s international GMV, the expansion trajectory is what issues in early-stage tech in our opinion,” Lehmann instructed The Defiant.

Month-to-month quantity of $USDC settled by way of Commerce Funds Protocol. Supply: growthepie

He famous that of the $1.2 million settled since Shopify went dwell with $USDC, roughly $750,000 occurred within the final two months alone, describing the progress as “the traditional ‘gradual then quick’ compounding development curve frequent in crypto.” Lehmann elaborated:

“We view this as typical in a pilot-stage. Within the early days of any new fee rail, you see excessive ‘novelty’ utilization (individuals making an attempt it as soon as to see it work). The truth that quantity is accelerating closely within the final 60 days suggests we’re shifting previous the ‘curiosity’ section into extra constant utility.”

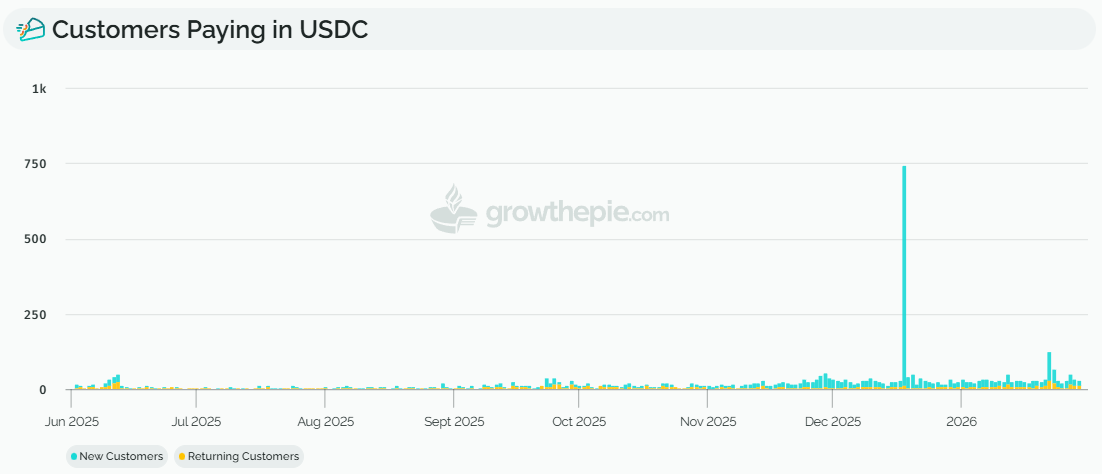

New vs returning clients paying with $USDC on Base by way of Commerce Funds Protocol. Supply: growthepie

Nonetheless, growthepie’s dashboard exhibits restricted repeat utilization, with most wallets transacting solely as soon as. A “returning buyer,” Lehmann defined, is outlined as a pockets making a fee on a unique day after its first transaction, with pockets addresses representing a decrease sure for precise customers.

As Lehmann famous, the “ghost city” danger is “actual for any new tech,” however because the development is accelerating, each service provider curiosity and buyer habit-forming “are trending in the best course.”

The Defiant reached out to Shopify for feedback on the initiative however hasn’t obtained a response by press time.

A latest report by S&P International Scores discovered that simply 5% of the full U.S. dollar-pegged stablecoin provide, which sits simply above $300 billion, is presently used for funds within the personal sector.