Artemis, a blockchain analytics platform, pressured that whereas a number of issuers tried to make inroads within the non-USD stablecoin market, they’ve did not dent the greenback hegemony within the asset class. Nonetheless, euro stablecoins have proven constant development.

Artemis: Non-USD Stablecoins Are Just about Non-Existent, Euro Stablecoins Present Constant Development

The Details

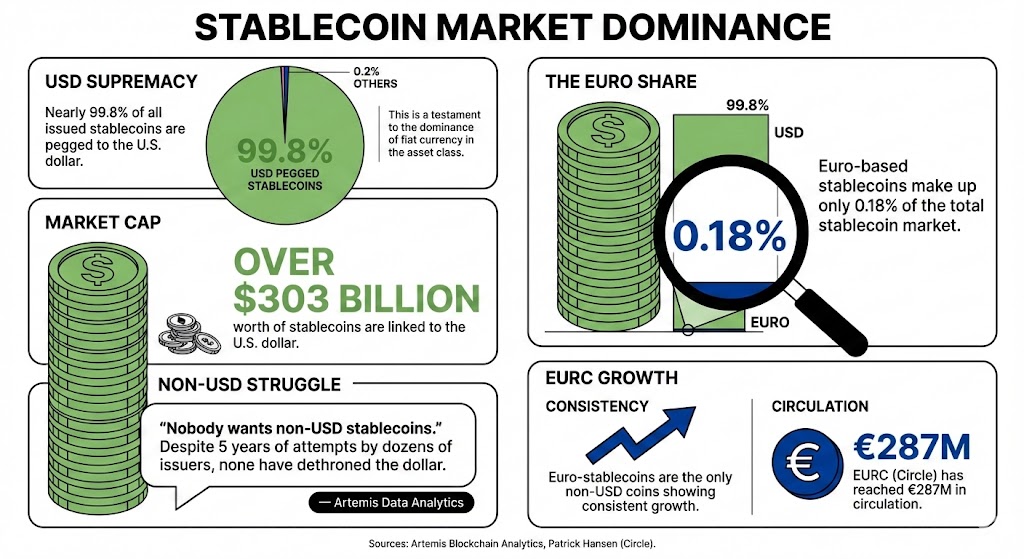

Information from Artemis, a platform that gives blockchain analytics, reveals that just about 99.8% of all of the stablecoins issued are pegged to the U.S. greenback, a testomony to the dominance of the fiat forex within the asset class.

Over $303 billion value of stablecoins are linked to the U.S. greenback, figures that dwarf all different currencies mixed. On social media, Artemis referred to this truth, claiming that makes an attempt to introduce stablecoins linked to currencies have been unsuccessful to this point.

It acknowledged:

No one needs non-USD stablecoins. 5 years, dozens of latest issuers, each main forex tried, and none have made any progress in dethroning the greenback.

Euro-based stablecoins solely reached 0.18% of the stablecoin market, a marginal quantity in comparison with the greenback stablecoin share. Nonetheless, Circle’s Patrick Hansen highlighted that this quantity was poised to develop.

Hansen defined that whereas the greenback’s dominance was certainly true, the evolution of euro-pegged stablecoins was vital. “Euro-stablecoins are basically the one non-USD stablecoins displaying constant development over the previous yr, pushed primarily by EURC, which has now reached €287M in circulation,” he identified.

Why It Is Related

The simple dominance of the U.S. greenback within the stablecoin ecosystem would possibly provide an perception into the true worth of those devices. Whereas it’s undoubtedly true that they provide transactional enhancements over conventional {dollars}, their true worth lies in increasing the provide of U.S. forex to jurisdictions dealing with difficulties in accessing precise {dollars}.

It’s because the worth of the underlying fiat forex is transferred to stablecoins, providing holders the identical properties that the greenback has as an inflation and devaluation hedge.

Learn extra: Historic: Bolivia to Combine Stablecoins Into Its Banking System, Use Them as Authorized Tender

Wanting Ahead

Whereas the dominance of U.S. stablecoins is unlikely to be defied within the brief time period, stablecoins pegged to different currencies, just like the euro, are anticipated to continue to grow as extra markets begin adopting nationwide stablecoins for funds and different transactions.

FAQ

What share of stablecoins are pegged to the U.S. greenback?

Practically 99.8% of all issued stablecoins are linked to the U.S. greenback, highlighting its dominance available in the market.How a lot worth do dollar-pegged stablecoins signify?

Over $303 billion value of stablecoins are related to the U.S. greenback, considerably surpassing these linked to some other forex.What’s the market share of euro-based stablecoins?

Euro-based stablecoins account for less than 0.18% of the stablecoin market, reflecting the challenges they face in gaining traction in opposition to dollar-pegged options.What traits are rising for euro-pegged stablecoins?

Regardless of the dominance of the greenback, euro-pegged stablecoins, significantly EURC, are displaying constant development, with €287M now in circulation.