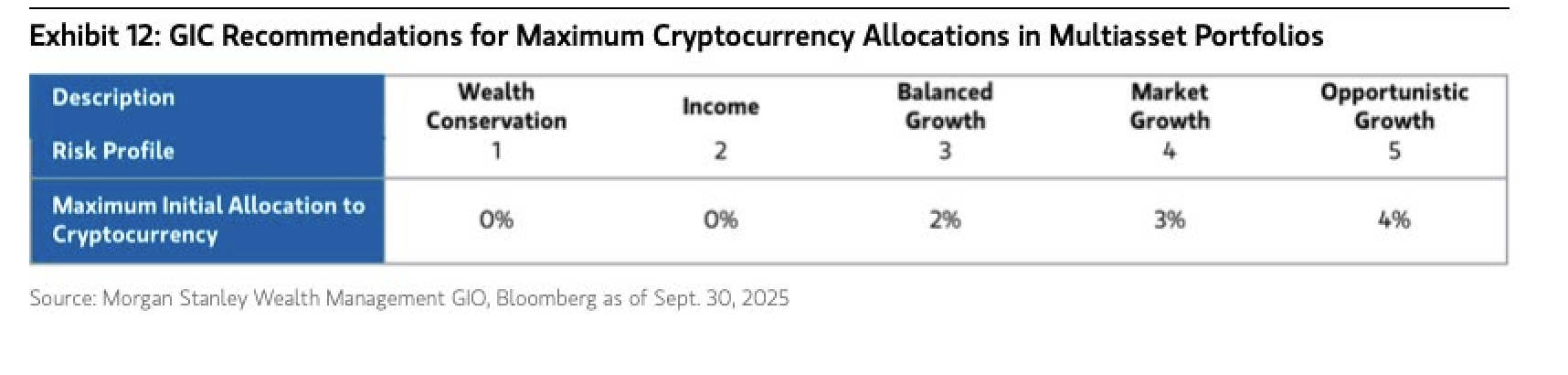

Monetary companies large Morgan Stanley issued pointers for crypto allocations in multi-asset portfolios, recommending a “conservative” method in an October World Funding Committee (GIC) report back to funding advisors.

Analysts at Morgan Stanley advisable as much as a 4% allocation for cryptocurrencies in “Opportunistic Development” portfolios, that are structured for increased dangers and better returns.

The analysts additionally advisable as much as a 2% allocation for “Balanced Development” portfolios that includes a extra average threat profile. Nonetheless, the report advisable a 0% allocation for portfolios oriented towards wealth preservation and revenue. The authors wrote:

“Whereas the rising asset class has skilled outsized whole returns and declining volatility over current years, cryptocurrency may expertise extra elevated volatility and better correlations with different asset courses in intervals of macro and market stress.”

Morgan Stanley GIC pointers for optimum crypto allocations in funding portfolios. Supply: Hunter Horsley

Hunter Horsley, CEO of funding supervisor Bitwise, known as the report “large” information. “GIC guides 16,000 advisors managing $2 trillion in financial savings and wealth for shoppers. We’re coming into the mainstream period,” he wrote.

Morgan Stanley’s report displays the rising institutional adoption and acceptance of crypto, notably amongst massive banks and monetary companies firms, which attracts extra capital into the crypto markets and cements crypto’s legitimacy as an asset class.

Associated: E*Commerce so as to add Bitcoin, Ether, Solana in Morgan Stanley’s crypto enlargement

Morgan Stanley report calls Bitcoin digital gold as BTC hits new all-time excessive

Bitcoin (BTC), which the Morgan Stanley analysts view as a “scarce asset, akin to digital gold,” continues to achieve institutional adoption as a treasury reserve asset and thru funding autos like exchange-traded funds (ETFs).

The value of Bitcoin hit a brand new all-time excessive of over $125,000 on Saturday, as BTC alternate balances, the variety of cash held by exchanges obtainable for buy, hit a six-year low, in accordance with information from Glassnode.

Bitcoin surged to its new all-time excessive amid a authorities shutdown in the US and an increase within the costs of safe-haven, store-of-value, and risk-on belongings.

“There’s a widespread rush into belongings taking place proper now. As inflation rebounds and the labor market weakens,” funding analysts at The Kobeissi Letter wrote on Sunday.

Journal: Metric indicators $250K Bitcoin is ‘greatest case,’ SOL, HYPE tipped for beneficial properties: Commerce Secrets and techniques