As February unfolds, the cryptocurrency market continues to witness vital developments. Among the many key occasions, Nasdaq’s resolution to overview Grayscale’s purposes for Change Traded Funds (ETFs) primarily based on XRP, Litecoin (LTC), and Solana has captured the eye of traders, analysts, and market members. Moreover, Cardano, a distinguished participant within the blockchain area, continues to indicate power, with rising curiosity from each institutional and retail traders. This information replace gives a complete overview of those developments, their potential affect in the marketplace, and what to anticipate within the coming weeks.

Nasdaq, one of many world’s main inventory exchanges, has begun the method of reviewing Grayscale’s purposes for the creation of cryptocurrency ETFs primarily based on a number of common digital belongings: XRP, Litecoin (LTC), and Solana. This transfer has sparked a renewed sense of optimism inside the cryptocurrency group, notably as institutional curiosity in digital belongings continues to rise.

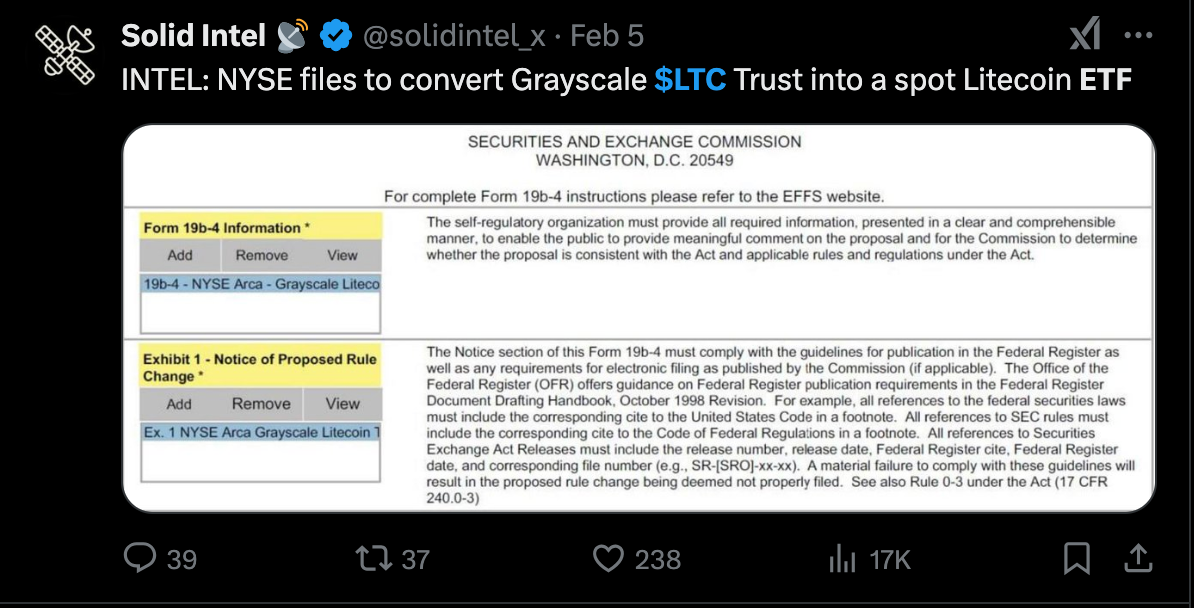

Snap | Supply: Stable Intel on X

Grayscale, a serious participant within the cryptocurrency funding sector, is understood for its profitable Bitcoin and Ethereum Belief merchandise, which have allowed institutional traders to achieve publicity to those digital belongings by conventional monetary markets. Nevertheless, the corporate’s newest push to launch ETFs primarily based on different cryptocurrencies akin to XRP, LTC, and Solana marks a major growth of its product choices.

Grayscale’s Imaginative and prescient for the Way forward for Crypto ETFs

The proposed ETFs are designed to supply traders with easy accessibility to XRP, Litecoin, and Solana in the identical approach they’d put money into conventional shares. These merchandise are particularly interesting to those that are hesitant about immediately buying and managing cryptocurrency holdings. By introducing these ETFs, Grayscale goals to supply a safer and extra regulated approach for traders to take part out there, with out the complexities related to cryptocurrency exchanges, wallets, and the related dangers.

XRP, Litecoin, and Solana every have their very own distinctive traits and communities, and their inclusion within the ETF lineup displays Grayscale’s need to diversify its product portfolio. XRP, as an illustration, is understood for its use in cross-border funds and its robust affiliation with Ripple, whereas Litecoin is usually seen because the ‘silver’ to Bitcoin’s ‘gold.’ Solana, however, has gained recognition as a result of its excessive scalability and low transaction charges, positioning it as a promising platform for decentralized purposes (dApps) and sensible contracts.

The Nasdaq overview course of is essential for the approval of those ETFs, because the trade should consider the purposes to make sure they meet regulatory requirements and align with market practices. Nasdaq’s involvement lends a layer of credibility to the endeavor, offering assurance to institutional traders that these merchandise might be topic to rigorous oversight and compliance measures.

Ought to Nasdaq approve Grayscale’s purposes, these ETFs would mark a historic second within the cryptocurrency market, as they would supply broader market publicity and enhance the liquidity of those digital belongings. Approval may additionally sign a brand new period of mainstream adoption, additional blurring the strains between conventional monetary markets and the decentralized world of cryptocurrencies.

Cardano’s Rising Momentum: A Stable Basis for Future Development

Whereas the highlight has been on Nasdaq and Grayscale’s ETF developments, Cardano (ADA) continues to construct momentum as one of the vital distinguished sensible contract platforms within the cryptocurrency area. Based by Ethereum co-founder Charles Hoskinson, Cardano has steadily gained consideration as a result of its distinctive proof-of-stake consensus mechanism, which is taken into account extra energy-efficient and environmentally pleasant than the proof-of-work methods utilized by Bitcoin and Ethereum.

Cardano’s latest focus has been on enhancing its ecosystem with the launch of a number of key upgrades, together with sensible contract performance and decentralized finance (DeFi) instruments. These developments have allowed Cardano to place itself as a severe contender within the blockchain area, notably for builders looking for a scalable, safe, and sustainable platform for constructing decentralized purposes.

Institutional curiosity in Cardano has been steadily growing, as traders search for different belongings to diversify their portfolios. This rising institutional adoption is mirrored within the rising demand for ADA tokens, which have seen vital worth will increase over the previous 12 months. The community’s robust deal with educational analysis and peer-reviewed growth processes has earned it a fame for being one of the vital methodical and safe blockchain tasks within the trade.

Cardano’s ecosystem can be gaining traction with builders, due to the community’s enhanced capabilities. The launch of sensible contracts has unlocked new use circumstances, notably within the DeFi area, the place platforms like SundaeSwap, a decentralized trade (DEX), have begun to achieve recognition. As Cardano continues to develop its ecosystem, it’s anticipated to play a key position within the ongoing evolution of the blockchain trade.

Trying forward, the long run for Cardano seems promising. The community’s continued growth of scalability options and its deal with interoperability with different blockchains might be vital in driving adoption. Moreover, Cardano’s dedication to increasing its ecosystem of dApps, DeFi tasks, and NFTs will additional solidify its place out there.

Moreover, Cardano’s partnership with main organizations and governments, notably in creating nations, highlights its potential to drive real-world affect. These partnerships, together with its emphasis on sustainability, may place Cardano as a number one blockchain platform within the years to return.

Nasdaq ETF Approvals and Cardano: Cryptocurrency Turning Level

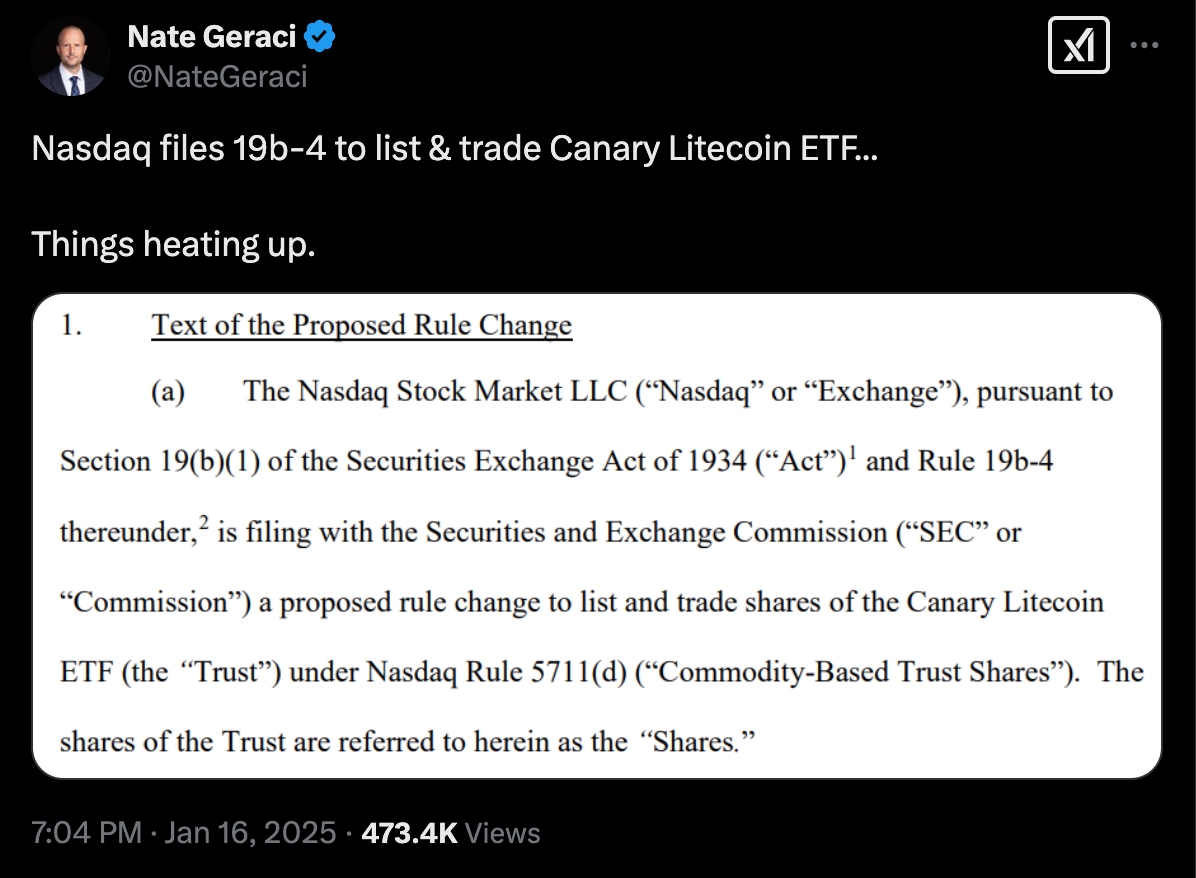

The potential approval of Grayscale’s ETF purposes for XRP, Litecoin, and Solana, mixed with Cardano’s rising affect, may have a profound affect on the cryptocurrency market as a complete. These developments counsel that institutional adoption of digital belongings is accelerating, paving the way in which for additional innovation and funding alternatives.

The introduction of ETFs centered on XRP, Litecoin, and Solana would probably drive elevated buying and selling volumes and liquidity, offering larger entry to those belongings for traders who could have beforehand been hesitant to enter the market. Moreover, the approval of those ETFs may entice extra institutional gamers to the cryptocurrency area, probably resulting in elevated worth stability and broader acceptance of digital belongings in conventional monetary markets.

Snap | Supply: Nate Geraci on X

For Cardano, the continued progress of its ecosystem and its institutional adoption may result in larger integration of ADA into mainstream finance and enterprise options. If the community can proceed to ship on its guarantees of scalability, safety, and sustainability, Cardano may emerge as a number one platform for decentralized purposes and sensible contracts, additional cementing its place within the world blockchain panorama.

As February progresses, Nasdaq’s overview of Grayscale’s ETF purposes for XRP, Litecoin, and Solana, mixed with Cardano’s rising prominence, indicators a pivotal second for the cryptocurrency market. With the potential for mainstream adoption on the horizon, these developments are reshaping the panorama of digital belongings and creating new alternatives for traders, builders, and entrepreneurs alike.

The cryptocurrency market is evolving quickly, and the approaching months will probably witness much more groundbreaking developments. Whether or not by the approval of recent ETFs or the continued progress of blockchain ecosystems like Cardano, the way forward for digital belongings is more and more intertwined with the broader monetary panorama. For traders and market members, staying knowledgeable on these developments might be key to navigating the thrilling and ever-changing world of cryptocurrency.