MicroStrategy (MSTR) insiders have bought $40 million value of inventory during the last 90 days. Averaging a couple of sale per enterprise day during the last three months, insiders’ promoting transactions outnumber their purchases 10 to 1.

Their gross sales have additionally been bigger than any purchases, with about $40.3 million in gross sales versus $2.3 million in purchases per information from InsiderScreener.

Gross sales of inventory value thousands and thousands of {dollars} originated from choices by the corporate’s vice chairman, chief monetary officer, and director, amongst others. A lot of their liquidations took benefit of MSTR at far greater costs than at the moment.

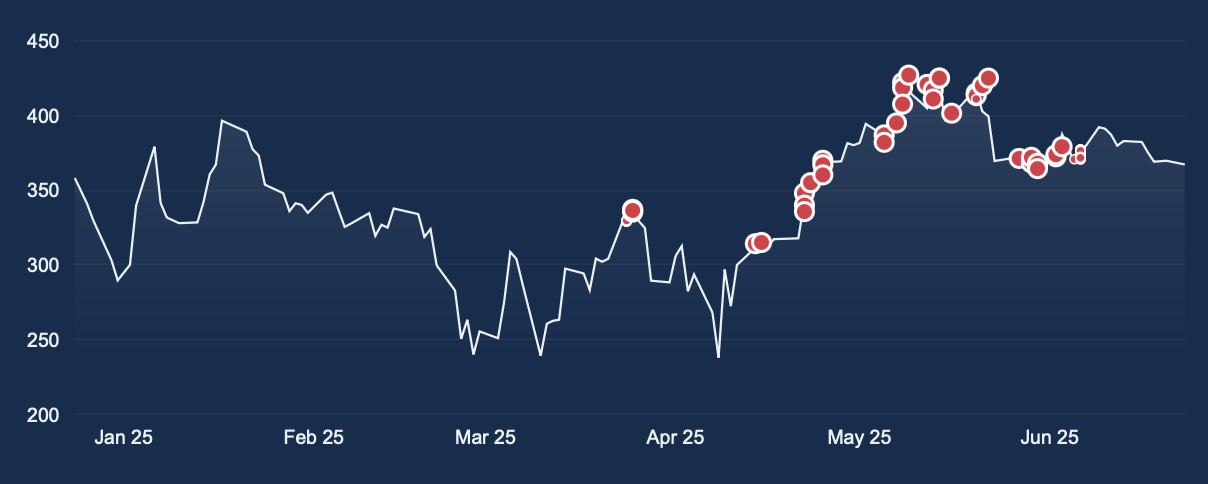

Certainly, insiders bought greater than a dozen occasions above $400 per share.

Learn extra: We made a dictionary of MicroStrategy’s invented terminology

Insiders at MicroStrategy are promoting

Accountants marked some transactions with a deliberate sale code on Securities and Change Fee Type 4, indicating that these insiders have been dumping shares programmatically via the inventory choices, directed share packages, or different kinds of installment-based compensation packages.

Nonetheless different transactions have been coded as easy gross sales — a number of of which coincided with a rally final month that briefly sustained MSTR above $400.

Chart of MicroStrategy inventory gross sales by firm administrators (InsiderScreener).

Nonetheless, these insider gross sales solely signify a small proportion of general govt and director possession. For instance, Founder and Government Chairman Michael Saylor nonetheless owns about 19.6 million shares of Class B inventory in addition to 382,000 Class A shares, value billions.

Total, Bloomberg estimates that he owns 8% of MicroStrategy’s fairness.

Saylor additionally instructed Bloomberg that he owns not less than 17,732 bitcoins personally. Analysts estimate his whole web value to be north of $8 billion.

Though insider gross sales at MicroStrategy are frequent, they’re not notably uncommon for public corporations. Certainly, daily, dozens of officers at public corporations are promoting shares — most of which they obtain via pre-planned compensation packages.

For insiders, the choice of whether or not to promote their newly vested shares on schedule or voluntarily waive their proper usually comes right down to an evaluation of their private state of affairs or familial obligations that don’t have anything to do with their outlook on the corporate’s inventory itself.