As President Trump alternates between tariff hikes and pauses, the USA continues to witness rising bond yields regardless of a decreased inflation threat index. These inconsistencies reveal deeper structural issues associated to the US financial system’s spending habits.

Steve Hanke, Professor of Utilized Economics at Johns Hopkins College, sat down with BeInCrypto to discover the underlying forces driving bond yields to new heights. The economist cited the US fiscal deficit, tariff uncertainty, and Congressional inaction as central contributors to the present financial outlook.

Why Are Bond Yields on the Rise?

Authorities bond yields have been in a fluctuating frenzy since President Trump began rolling out a largely erratic tariff coverage days after assuming workplace. The coverage’s on-again, off-again nature has spurred uncertainty, shaking investor confidence within the American monetary system.

The numbers communicate for themselves. Since April 30, the US 10-12 months Be aware Bond Yield has risen from 4.17 to 4.43. The unpredictable habits of a market traditionally deemed one of many most secure and most secure on the earth has set off important alarm bells.

US 10-12 months Treasury Bond Be aware Yield. Supply: Buying and selling Economics.

The explanations behind this enhance could differ, however they point out elevated uncertainty over geopolitical turmoil and the worry of an financial slowdown. Rising bond yields are sometimes related to larger inflation, however the newest CPI Index, revealing an easing inflation charge, has proven that this isn’t the present pattern.

Hanke pointed to sure elements that may clarify this uncommon relationship.

“Inflation has moderated during the last 2 years. Since bond yields observe inflation, and inflation is declining, the fly within the ointment that explains the rising bond yields have to be both sovereign credit score threat or a insecurity in fiscal administration,” he informed BeInCrypto.

America’ ballooning fiscal deficit can simply clarify the plausibility of each eventualities.

The Return of the Bond Vigilantes

Up to now, traders have punished the federal government over unsustainable spending by promoting off their bonds, consequently driving up borrowing prices. These “bond vigilantes,” because the economist Ed Yardeni coined them within the Eighties, take motion over worry of an financial downturn or a spike in inflation.

The steep sell-off within the bond market following Trump’s April tariff bulletins, mixed with the present US financial context, marked by a $36 trillion nationwide debt and a funds deficit of $1.8 trillion, offers ample cause to anticipate the return of bond vigilantes.

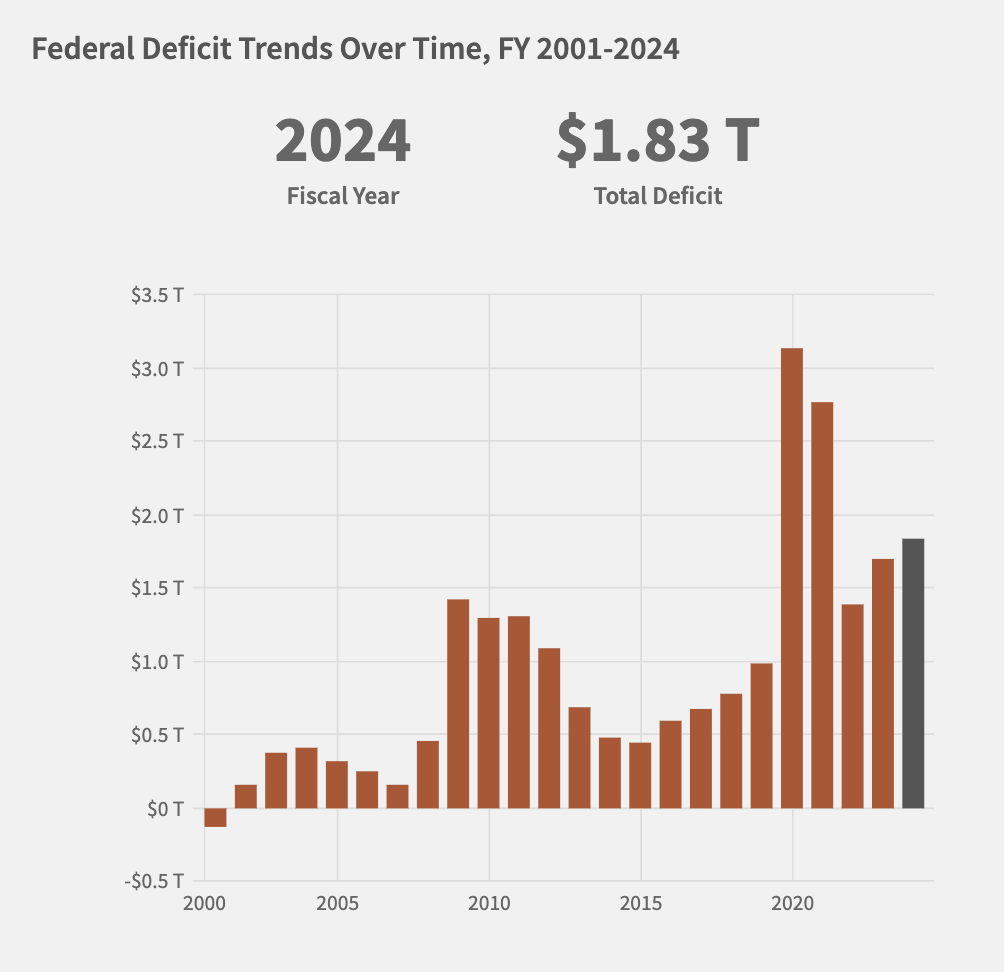

Federal Deficit Tendencies Over Time. Supply: US Treasury.

For Hanke, the outcomes of a latest Treasury public sale illustrate the extent of dissatisfaction with the USA’ fiscal mismanagement.

“Final month’s ten-year Treasury public sale was a catastrophe. It noticed just about no central financial institution or main vendor shopping for,” he mentioned.

The dearth of demand for US financial debt will increase fears over steeper borrowing prices and indicators that traders have gotten apprehensive in regards to the authorities’s skill to handle its funds.

That mentioned, Hanke said that the reducing sum of money circulating within the financial system issues him much more than the bond sell-off.

Past Bond Yields: The Cash Provide Disaster

Although a bond sell-off suggests rising rates of interest, Hanke recommended that solely specializing in this misses a bigger, extra systemic situation. What’s much more regarding is a diminished cash provide.

Business banks are the most important contributors to the sum of money circulating within the financial system. Nonetheless, lending has slowed significantly lately.

“At this time, business financial institution credit score at a snail’s tempo: 2.3% per 12 months. That, and the truth that general cash development is just 4.1%, point out {that a} critical slowdown within the US financial system is baked within the cake,” Hanke informed BeInCrypto.

The financial system slows when much less cash circulates, making it more durable for companies to get loans and customers to spend. This example worsens if authorities spending is seen as unsustainable, additional eroding financial confidence, particularly when it fails to compensate for inadequate non-public sector lending.

Although some translate this insecurity into the erosion of US greenback dominance, Hanke discarded the gravity of those claims.

How Safe Is the Greenback’s Future?

Persistent volatility within the US Treasury market, mixed with latest strikes by G7 nations to cut back their reliance on the greenback, has raised issues about long-term harm to its dominance.

In keeping with Hanke, these are wild exaggerations.

“For the reason that seventh century BC, there have solely been fourteen dominant worldwide currencies. As this timeline suggests, it’s very laborious to knock a dominant worldwide forex off its throne. This implies that each one challengers to the greenback, be it the euro, Japanese yen, Chinese language yuan, or the yet-to-be-delivered BRICS forex, will discover they face a really troublesome job. Certainly, though there may be fixed speak about de-dollarization, it merely hasn’t occurred, because the greenback is the cleanest soiled shirt round,” he mentioned.

Hanke argued that as an alternative of specializing in fluctuating bond yields, consideration ought to deal with addressing the underlying trigger: outsized spending. In his view, this duty lies not with Trump however with Congress, which has persistently uncared for its duty on this matter.

Addressing Persistent US Spending

America has an extended historical past of durations with important authorities spending, typically pushed by wars, financial recessions, or social packages.

In latest a long time, elements like rising healthcare prices, entitlement packages, and elevated protection spending have additionally contributed to the extent of the American fiscal deficit.

Provided that this drawback is demonstrably power, Hanke argues that Congress should create a devoted Committee to deal with the problems at coronary heart.

“Congress ought to enact a statutory Fiscal Sustainability Fee that can actively interact the American individuals and suggest a spread of spending reductions and tax reforms mandatory to cut back debt-to-GDP to an inexpensive and sustainable degree. The Fee’s suggestions ought to obtain a assured vote in Congress. Such a Fee ought to be included within the Finances Reconciliation invoice,” he defined.

Nonetheless, Hanke additionally acknowledged that Congress has traditionally refused to behave prudently and promptly.

Breaking the Gridlock: The Case for a Constitutional Treatment

Political gridlock typically creates a deep divide over methods to collectively tackle the troublesome decisions required to curb federal expenditures, hindering efficient fiscal policymaking.

To curb the issue, Hanke recommended a Constitutional Modification that will successfully impose long-term fiscal self-discipline on Congress.

“The one factor that can constrain Congress to keep away from unsustainable spending sooner or later is a Constitutional Modification,” he mentioned, including, “Due to this fact, Congress must go H. Con. Res. 15 that re-enforces Congress’ duty and states’ rights to suggest such a Fiscal Accountability Constitutional Modification beneath Article V of the Structure. This must also be included within the Finances Reconciliation invoice.”

Because the American financial system continues to navigate the compound issues of rising bond yields, financial slowdown, and financial deficits, the present scenario signifies that even short-term options aren’t enough fixes to systemic issues.

The longer term course of the USA hinges on the present authorities and its congressional constituents, who should select between decisive motion and continued uncertainty. Their resolution will inevitably have a profound affect on the nation’s future.

Steve H. Hanke is a Professor of Utilized Economics at Johns Hopkins College. His most up-to-date ebook, with Matt Sekerke, is Making Cash Work: Tips on how to Rewrite the Guidelines of our Monetary System, and was launched by Wiley on Could 6.