After years of dangerous investments, buyers are actually shifting some cash towards safe-haven investments.

They’re pouring money into gold, ultra-short Treasury ETFs, and low-volatility shares on the quickest tempo since March 2023. They’re appearing amid rising concern {that a} international commerce warfare represents a long-lasting menace to financial and earnings progress.

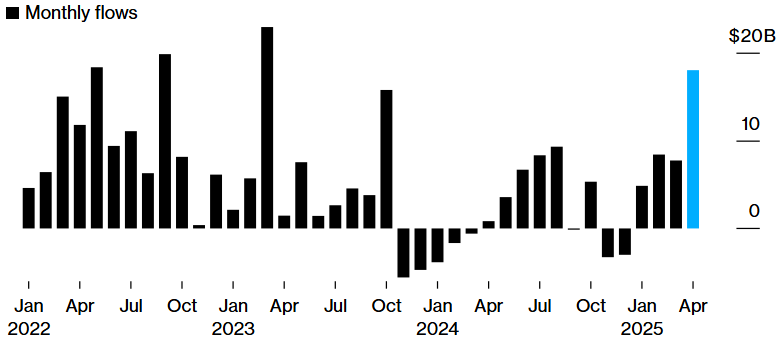

Information compiled by Bloomberg Intelligence present these three teams noticed about $18 billion in complete inflows to this point in April, with roughly two‑thirds flowing into money‑like funds.

The SPDR Bloomberg 1‑3 Month T‑Invoice ETF (BIL) attracted $8 billion this month, adopted by the iShares Brief Treasury Bond ETF (SHV) with $3 billion and the iShares 1‑3 12 months Treasury Bond ETF (SHY) with $1 billion.

Funds linked to gold have seen three straight months of positive aspects, whereas low‑volatility fairness ETFs have rebounded after almost two years of outflows.

Buyers poured $18 billion into protected funds in April. Supply: Bloomberg

Threat‑off sentiment intensified on Monday when considerations over the Federal Reserve’s independence triggered a selloff in U.S. shares, the greenback, and lengthy‑dated Treasury bonds. The S&P 500 Index dropped 3% that day.

Trump’s warning to the Fed triggered buyers to hurry into protected funds

President Donald Trump added to the temper, warning that the U.S. financial system might sluggish if the Fed doesn’t instantly lower rates of interest. Consequently, protected havens just like the Swiss franc and the Japanese yen surged.

“The market is trying to find coverage readability out of Washington, and it stays elusive,” stated Ryan Grabinski, senior funding strategist at Strategas Securities. “Shoppers, companies, and even the Fed are hesitant to make main selections as a result of a lot is unknown.”

Regardless of the danger‑off tilt, broad‑primarily based index funds have continued to draw above‑common inflows. Main the group is the iShares Core S&P 500 ETF (IVV), which pulled in $35 billion over the previous month.

“We proceed to see indicators of warning however not panic,” stated Cayla Seder, a macro multi‑asset strategist at State Road World Markets. “At a excessive degree, this appears like much less flows going into equities and extra demand for each mounted revenue and money. All issues thought-about, if arduous knowledge begin to weaken, there’s extra room to hunt shelter.”

Elsewhere, buyers are nonetheless chasing excessive danger, with shares excellent among the many prime 50 leveraged ETFs by belongings rising 20% since Trump’s so‑referred to as ‘Liberation Day’ on April 2.

“The purchase‑the‑dip mentality of buyers stays,” stated Mark Hackett, chief market strategist at Nationwide. “Regardless of close to file ranges of pessimism, retail buyers proceed to purchase.”