Anthony Scaramucci, founding father of SkyBridge Capital and former White Home Communications Director, has remained considered one of Bitcoin’s (BTC) most vocal advocates, standing agency in his bullish stance on the main cryptocurrency.

Early final 12 months, he predicted that Bitcoin would surpass $100,000 in 2024, pushed by surging demand for Bitcoin exchange-traded funds (ETFs).

Wanting forward, he believes pro-crypto insurance policies below the Trump administration might propel Bitcoin to double its worth by 2025, additional highlighting his confidence in BTC’s long-term potential.

Whereas Bitcoin stays Scaramucci’s largest holding, with over 50% of his portfolio allotted to BTC, he has additionally invested in Solana (SOL), Avalanche (AVAX), and Polkadot (DOT), belongings chosen primarily for his or her utility.

Talking on the Bankless podcast in early January, he doubled down on Solana as his best choice amongst layer-one blockchains, citing its velocity and low transaction prices.

Anthony Scaramucci’s portfolio — A risky begin to 2025

Thus far in 2025, Scaramucci’s portfolio has delivered blended outcomes. Because the starting of the 12 months, Bitcoin has managed to submit a modest achieve of 1.48% to commerce at $95,000 regardless of macroeconomic headwinds.

Nonetheless, Solana, which Scaramucci and SkyBridge Capital have favored over Ethereum (ETH), noticed a slight decline of 0.66%, buying and selling at $191 as of press time.

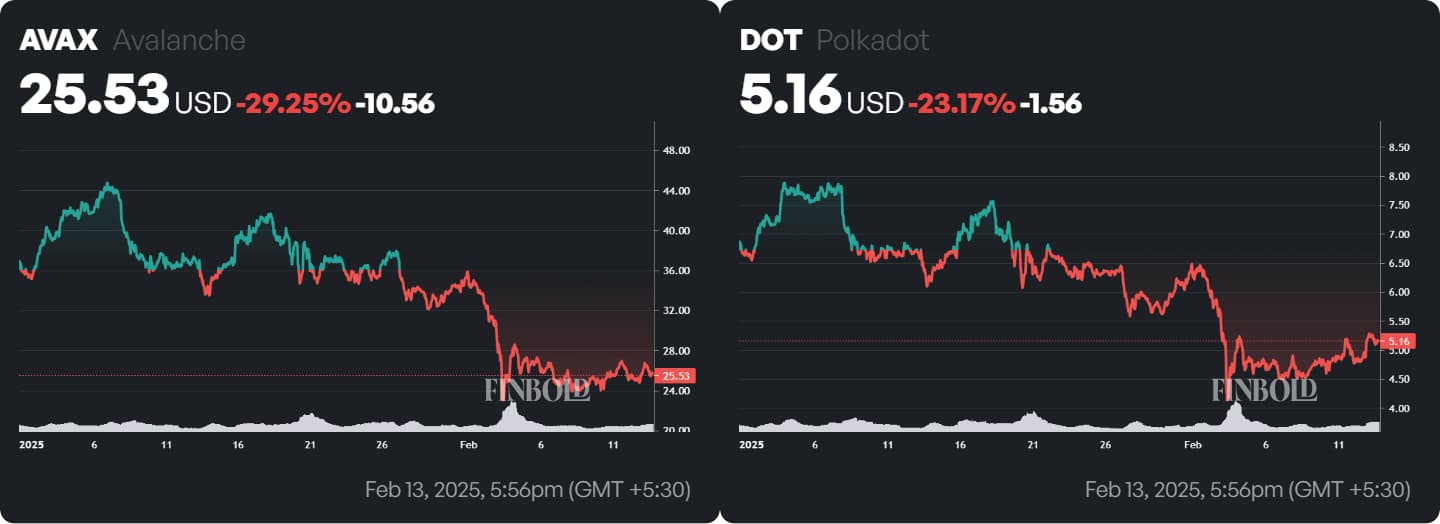

The altcoins in his portfolio, Avalanche and Polkadot, have fared a lot worse. AVAX has plunged by 29.28%, buying and selling at $25.53, whereas DOT has misplaced 23.17%, buying and selling at $5.16, primarily attributable to broader risk-off sentiment within the crypto market.

The downturn in these belongings intensified following the announcement of latest Trump administration tariffs on February 1, which triggered a broad selloff throughout threat belongings.

The discharge of hotter-than-expected CPI knowledge additionally stoked inflation fears, resulting in sharp corrections throughout the crypto market.

A $1,000 funding — The place does it stand now?

To place the portfolio’s efficiency into perspective, a hypothetical $1,000 funding evenly cut up throughout the belongings made at the beginning of 2025 would now be price $870.93.

Whereas Bitcoin’s achieve and Solana’s minor dip provided some stability, the steep losses in AVAX and DOT dragged down total efficiency, leading to a 12.91% decline.

The portfolio’s potential to recuperate will possible hinge on Bitcoin’s trajectory, regulatory readability on the chosen belongings, and shifting investor sentiment.

Nonetheless, its efficiency to date serves as a stark reminder of the dangers related to concentrated crypto investments.

As for buyers, a diversified strategy stays the most secure wager, balancing potential rewards with the unpredictability of the digital asset area.

Featured picture from Shutterstock