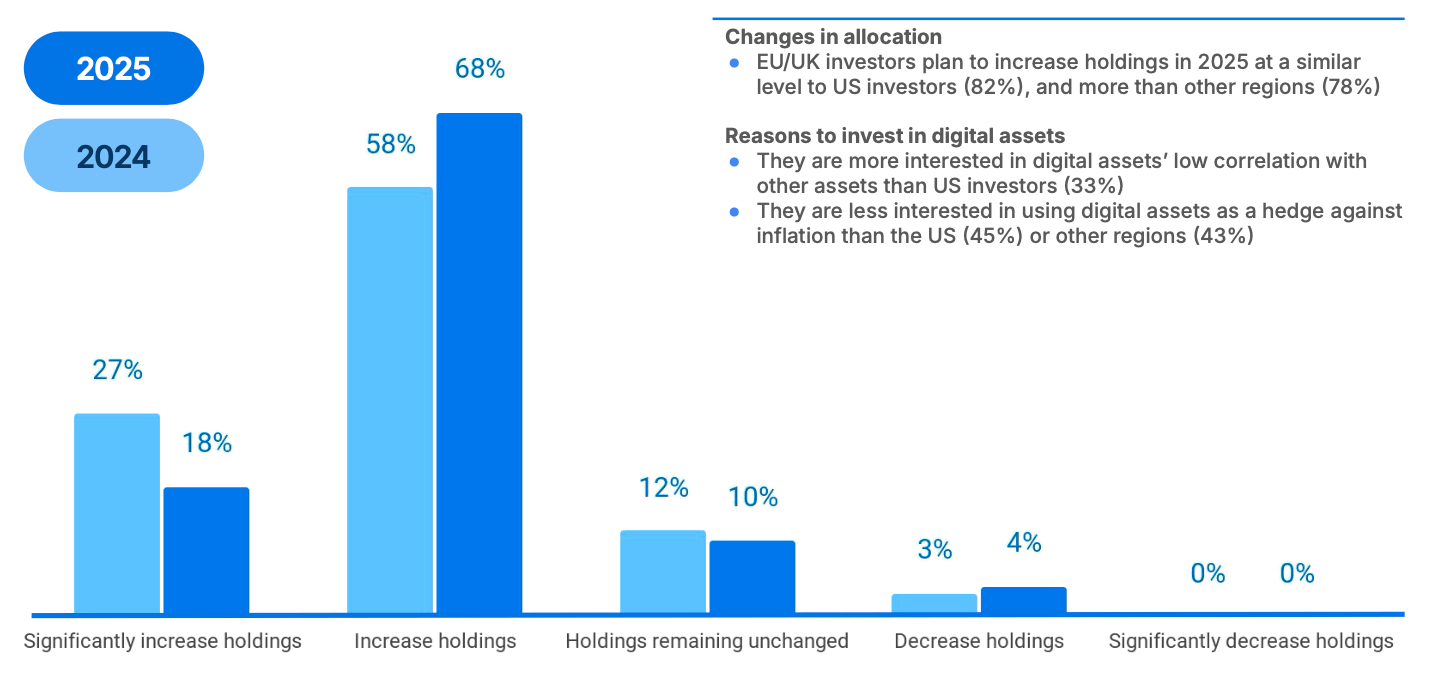

Institutional buyers throughout the EU and UK are considerably rising their cryptocurrency allocations, with 86% planning to spice up holdings or enter the market in 2025, in keeping with a Coinbase and EY-Parthenon survey of 97 establishments.

DeFi Engagement Set to Soar 2.5x in European Establishments

Half of respondents intend to allocate over 5% of their property beneath administration (AUM) to digital property, up from 46% in 2024, signaling a deepening dedication regardless of volatility issues.

Regulatory readability emerged as the highest catalyst for progress (58%), with licensing frameworks, custody guidelines, and tax therapy cited as essential wants. Volatility (51%) and market manipulation dangers (42%) stay key issues, although 71% of establishments already maintain altcoins past bitcoin and ethereum.

“Regulatory readability was cited as the highest concern for digital asset managers, and respondents said that rising regulatory readability can be the primary catalyst to propel the trade ahead,” the Coinbase and EY-Parthenon report notes.

The examine’s authors add:

“Asset managers in Europe additionally place a higher emphasis on anticipating client adoption and higher information of digital property to help adoption.”

Most well-liked funding routes embrace registered automobiles like exchange-traded merchandise (ETPs), favored by 57% of respondents. Tokenization attracted robust curiosity, with 58% “very ” in property like tokenized commodities (56%) and actual property (42%). Practically 70% of those buyers plan allocations by 2026, primarily for portfolio diversification.

DeFi engagement is projected to surge 2.5x to 68% inside two years, although 66% of non-participants cited information gaps as a barrier. Stablecoins see strong utility, with 81% of establishments utilizing or exploring them for international trade (75%) and transactional effectivity (67%).

Regardless of optimism, the Coinbase and EY-Parthenon report states that 66% flagged inside experience shortages as a hurdle to DeFi adoption, whereas 62% highlighted regulatory compliance dangers. The findings level to a maturing European market the place rising allocations coincide with calls for for clearer frameworks and schooling.

Coinbase and EY-Parthenon carried out the worldwide survey in January 2025, with European information reflecting establishments managing over $1 billion in property.