Grayscale revealed in an index that altcoins offered the perfect returns within the third quarter of 2025. Bitcoin’s underperformance turned the quarter’s most defining attribute, whereas BNB Chain, Prometheus, and Avalanche led the rating for high risk-adjusted performers.

The index was typically dominated by tokens used for monetary purposes and sensible contract platforms. Thematic narratives centered on stablecoin adoption, change quantity, and Digital Asset Treasuries (DATs) overwhelmingly drove this outperformance.

Altcoins Dominated Q3 Efficiency

The third quarter of 2025 proved to be a interval of broad-based energy within the digital asset market. In line with an index developed by Grayscale Analysis, some distinct winners generated the perfect volatility-adjusted value returns.

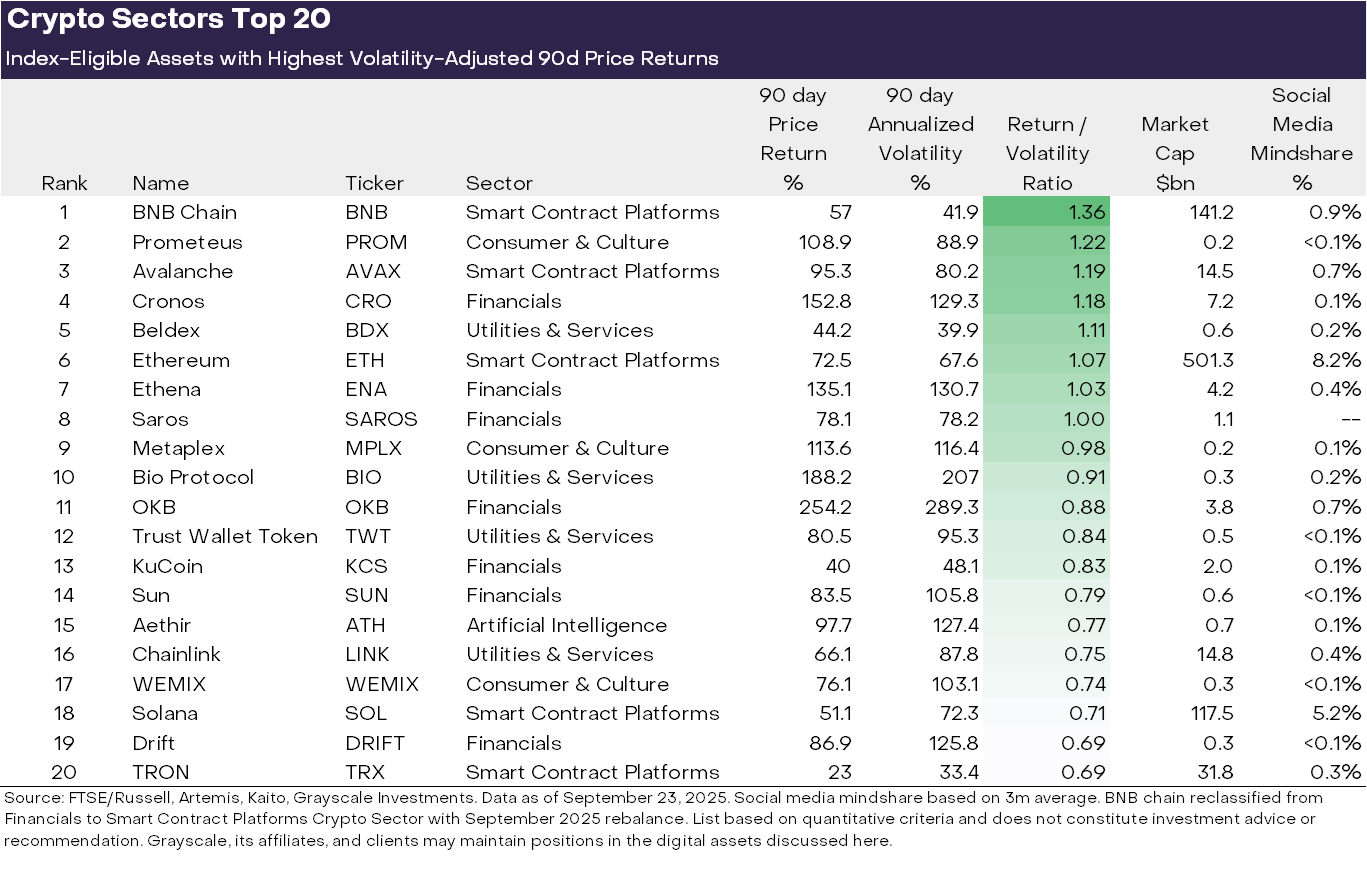

In a rating of the highest 20 best-performing tokens, BNB Chain took the lead, delivering essentially the most favorable returns with relative stability in comparison with these whose positive aspects had been outweighed by extreme danger.

Prometeus, Avalanche, Cronos, Beldex, and Ethereum adopted behind it.

High 20 Performing Tokens. Supply: Grayscale Analysis.

Grayscale organizes the digital asset market into six segments primarily based on the protocol’s core operate and use case: Currencies, Good Contract Platforms, Financials, Shopper and Tradition, Utilities and Companies, and Synthetic Intelligence.

Seven top-performing tokens shaped a part of the Financials section, whereas 5 got here from Good Contract Platforms. These outcomes successfully quantified the shift away from Currencies. Most notably, Bitcoin didn’t make the lower.

Why Bitcoin Lagged Behind

Essentially the most telling knowledge level of Grayscale’s analysis was not a lot who made the checklist as who was conspicuously absent: Bitcoin.

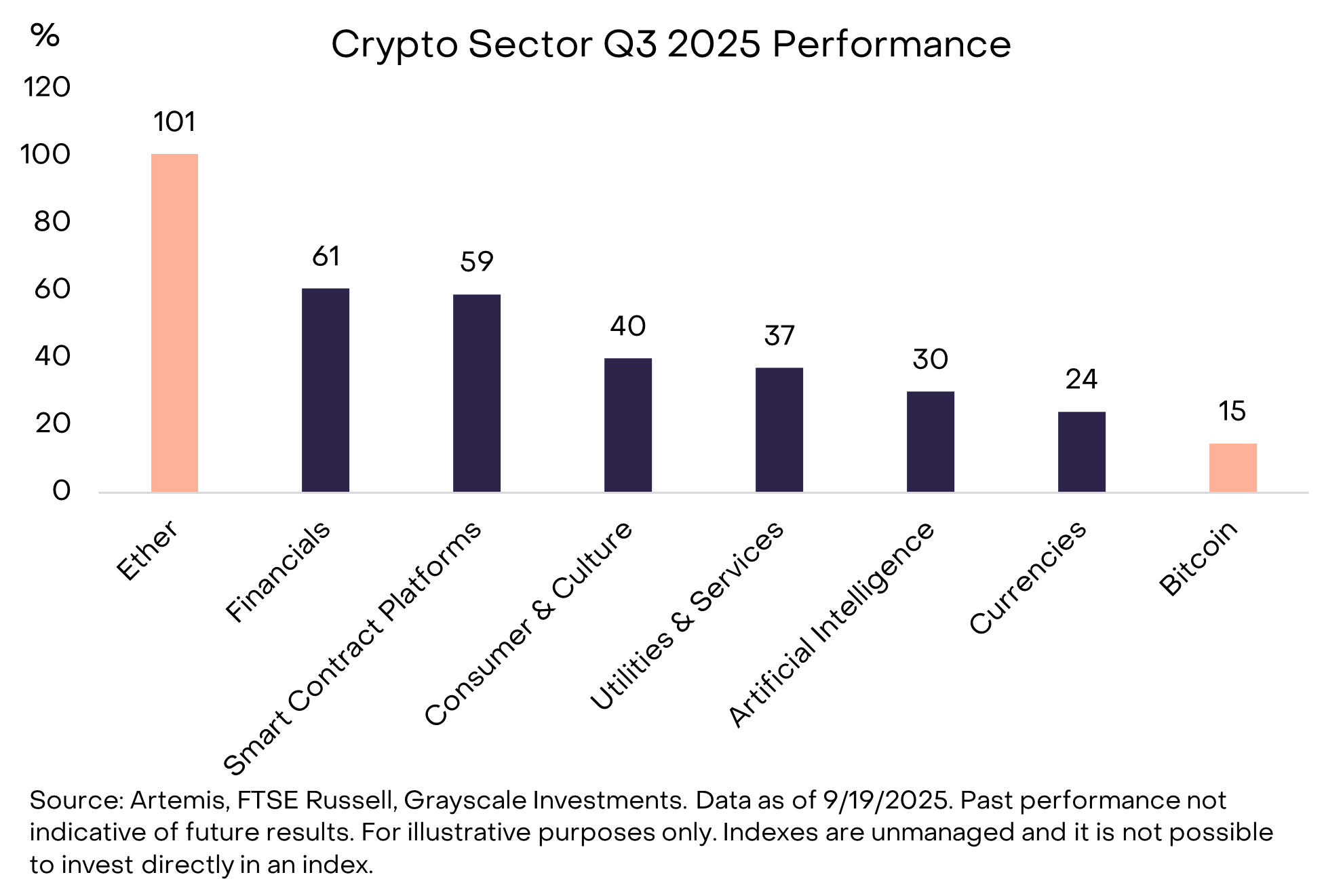

Whereas all six sectors produced optimistic returns, Currencies notably lagged, reflecting Bitcoin’s comparatively modest value achieve in comparison with different segments. When measuring efficiency by danger, Bitcoin didn’t supply a compelling profile.

Crypto Sector Q3 2025 Efficiency: Supply: Grayscale Analysis.

The property that made the checklist had been overwhelmingly pushed by thematic narratives associated to new utility and regulatory readability. These narratives particularly centered on stablecoin adoption, change quantity, and DATs.

In line with Grayscale Analysis, the rising quantity on centralized exchanges benefited tokens like BNB and CRO. In the meantime, rising DATs and widespread stablecoin adoption fueled demand for platforms like Ethereum, Solana, and Avalanche.

Particular decentralized finance (DeFi) classes additionally confirmed energy, equivalent to decentralized perpetual futures exchanges like Hyperliquid and Drift, which contributed to the energy of the Financials sector.

Bitcoin was much less uncovered to those particular catalysts as a peer-to-peer digital money and store-of-value asset. This lack of publicity allowed altcoins tied to purposeful platforms and monetary companies to surge in risk-adjusted efficiency.

The put up Grayscale Ranks The High 20 Tokens That Supplied The Finest Returns In Q3 appeared first on BeInCrypto.