The stablecoin-focused GENIUS Act, which was enacted in July, will set off an exodus of deposits from conventional financial institution accounts into higher-yield stablecoins, in accordance with the co-founder of Multicoin Capital.

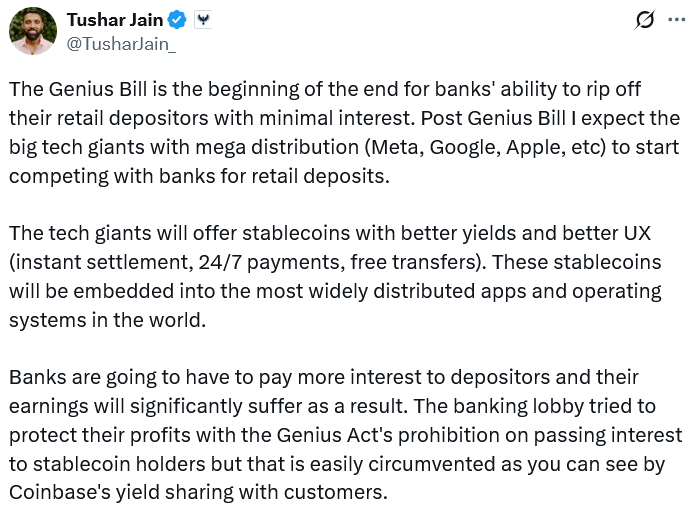

“The GENIUS Invoice is the start of the tip for banks’ skill to tear off their retail depositors with minimal curiosity,” Multicoin Capital’s co-founder and managing companion, Tushar Jain, posted to X on Saturday.

“Put up Genius Invoice, I anticipate the massive tech giants with mega distribution (Meta, Google, Apple, and so forth) to begin competing with banks for retail deposits,” Jain added, arguing that they’d provide higher stablecoin yields with a greater person expertise for fast settlement and 24/7 funds over conventional banking gamers.

He famous that banking teams tried to “defend their income” in mid-August by calling on regulators to shut a so-called loophole which will permit stablecoin issuers to pay curiosity or yields on stablecoins by means of their associates.

Supply: Tushar Jain

The GENIUS Act prohibits stablecoin issuers from providing curiosity or yield to holders of the token however doesn’t explicitly lengthen the ban to crypto exchanges or affiliated companies, doubtlessly enabling issuers to sidestep the legislation by providing yields by means of these companions.

US banking teams are involved that the large adoption of yield-bearing stablecoins may undermine the standard banking system, which depends on banks attracting deposits to fund lending.

$6.6 trillion may depart the banking system

Mass stablecoin adoption may set off round $6.6 trillion in deposit outflows from the standard banking system, the US Division of the Treasury estimated in April.

“The end result will likely be higher deposit flight danger, particularly in occasions of stress, that may undermine credit score creation all through the economic system. The corresponding discount in credit score provide means larger rates of interest, fewer loans, and elevated prices for Predominant Road companies and households,” the Financial institution Coverage Institute mentioned in August.

To remain aggressive, “banks are going to should pay extra curiosity to depositors,” Jain mentioned, including that “their earnings will considerably endure because of this.”

Stablecoins provide customers as much as 10X extra curiosity

The typical rate of interest for US financial savings accounts is 0.40%, and in Europe, the common price on financial savings accounts is 0.25%, Patrick Collison, CEO of on-line funds platform Stripe, mentioned final week.

In the meantime, charges for Tether (USDT) and Circle’s USDC (USDC) on the borrowing and lending platform Aave presently stand at 4.02% and three.69%, respectively.

Huge Tech corporations are reportedly exploring stablecoins

Jain’s wager on the Huge Tech giants follows a Fortune report in June stating that Apple, Google, Airbnb, and X had been among the many prime corporations exploring issuing stablecoins to decrease charges and enhance cross-border funds. There haven’t been any additional developments since.

Associated: All currencies will likely be stablecoins by 2030: Tether co-founder

The stablecoin market presently sits at $308.3 billion, led by USDT and USDC at $177 billion and $75.2 billion, CoinGecko knowledge reveals.

The Treasury Division predicts the stablecoin market cap will increase one other 566% to achieve $2 trillion by 2028.

Journal: Crypto wished to overthrow banks, now it’s turning into them in stablecoin battle