Credit standing firm Fitch Scores has flagged a excessive diploma of danger related to Bitcoin-backed securities, a warning that would complicate the growth of crypto-linked credit score merchandise amongst institutional traders.

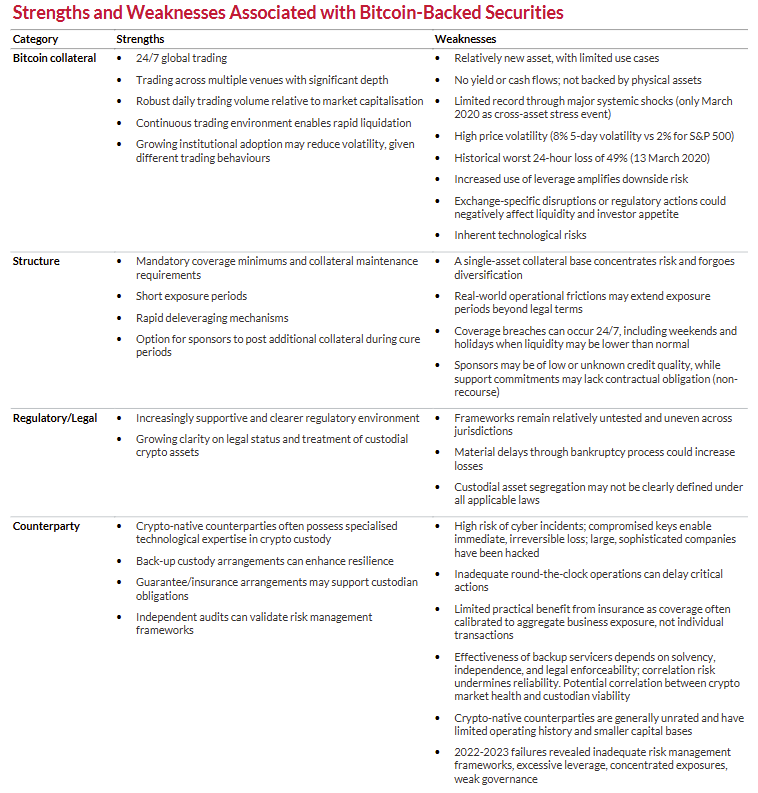

In a Monday evaluation, Fitch stated Bitcoin-backed securities, monetary devices sometimes structured by pooling Bitcoin (BTC) or Bitcoin-linked property and issuing debt towards that collateral, carry “heightened dangers” that “are in step with speculative-grade credit score profiles.”

The company stated such traits might place the merchandise in speculative-grade territory, a designation related to weaker credit score high quality and the next probability of losses.

As one of many three main US credit standing firms, Fitch’s evaluations play an influential function in how banks, asset managers and different establishments assess rising monetary devices, significantly these tied to risky asset courses.

Fitch pointed to the “inherent” worth volatility of Bitcoin in addition to counterparty dangers embedded in these buildings.

The company additionally referenced the wave of crypto lender failures in the course of the 2022–2023 downturn, probably a reference to BlockFi and Celsius, as cautionary examples of how shortly collateral-backed fashions can unravel during times of market stress.

Supply: DustyBC Crypto

“Bitcoin’s worth volatility is a primary danger consideration,” Fitch stated, warning that breaches of protection ranges might quickly erode collateral worth and crystallize losses.

Protection ranges seek advice from the ratio of Bitcoin collateral to the quantity of debt issued towards it. Sharp worth declines may cause that ratio to fall under required thresholds, triggering margin calls and compelled liquidations.

The most recent evaluation follows an earlier warning from Fitch final month, when the company cautioned US banks about elevated dangers tied to vital digital asset publicity. On the time, Fitch cited potential reputational, liquidity and compliance dangers for banks which might be actively engaged in crypto-related actions.

Bitcoin’s rising function in company credit score, and the place Fitch attracts the road

Bitcoin has more and more turn out to be central to the credit score profiles of public firms with massive digital asset holdings, significantly these issuing convertible notes or secured debt.

A outstanding instance is Technique, led by Michael Saylor, which has amassed practically 688,000 Bitcoin.

The corporate has financed this technique by means of repeated capital raises, together with convertible notes, secured debt and fairness issuances, to increase its Bitcoin publicity. Because of this, Technique’s stability sheet and credit score profile are actually correlated with actions in Bitcoin’s market worth.

Fitch’s warning, nevertheless, seems to focus extra narrowly on credit score and securitized devices the place compensation is immediately depending on the worth of underlying collateral. The evaluation doesn’t reference spot Bitcoin exchange-traded funds, that are structured as equity-like funding autos moderately than credit score merchandise.

In reality, Fitch famous that ETF adoption might contribute to “a extra various holder base,” a growth that will “doubtlessly dampen” Bitcoin’s worth volatility during times of market stress.

The strengths and weaknesses of BTC-backed securities. Supply: Fitch Scores