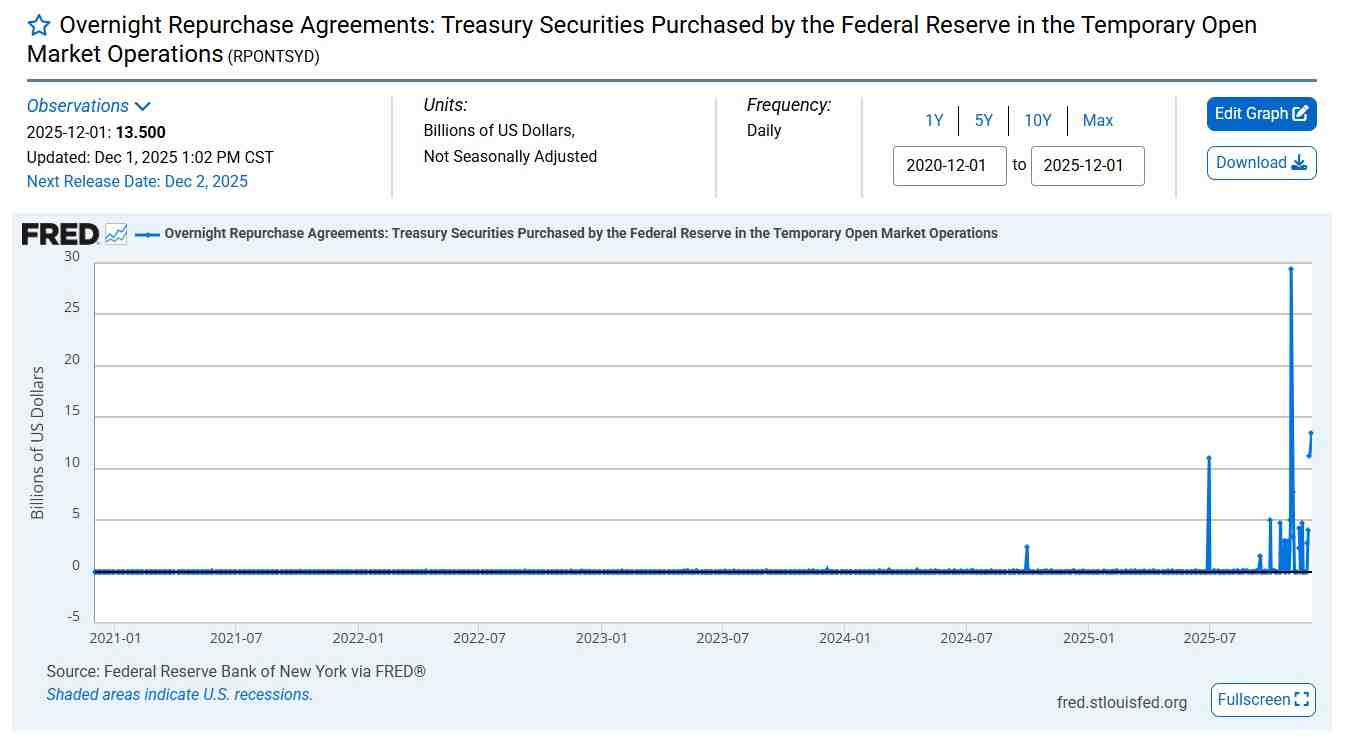

The U.S. Federal Reserve wrapped up its quantitative tightening (QT) program on Monday, December 1, punctuating it with $13.5 billion pumped into the U.S. banking system by in a single day repos.

The determine was the second-largest liquidity injection because the COVID-19 period and surpasses even the Dot Com Bubble peaks, in keeping with Federal Reserve Financial Information (FRED).

In consequence, traders and analysts have been left questioning whether or not danger belongings akin to equities and cryptocurrencies are going to be affected, particularly as liquidity begins to loosen.

Analysts bullish on crypto and shares

Fundstrat’s Tom Lee stays optimistic on crypto and shares, noting in a CNBC interview that the central financial institution goes to offer the most important tailwind within the following weeks.

“I believe the most important tailwind that’s gonna emerge within the subsequent couple of weeks is across the central financial institution. The Fed is ready to chop in December, but additionally in the present day’s the day that quantitative tightening ends, and as you already know, the Fed has been shrinking its stability sheet since April 2022. It’s been a fairly large tailwind for market liquidity,” stated Lee.

With liquidity now not being drained from the system, capital flows may start accelerating into danger belongings.

“The final time we had an finish to quantitative tightening was September 2012, and for those who look again at that interval, the markets actually responded effectively,” he additional famous.

New Bitcoin all-time excessive in January?

Lee seems particularly satisfied with regards to Bitcoin (BTC), arguing that larger liquidity traditionally correlates with stronger efficiency in risk-on belongings.

Accordingly, he believes {that a} new all-time excessive for “digital gold” is feasible by late January, despite the fact that the results of the October hunch are nonetheless noticeable and the Financial institution of Japan appears “hawkish.” With regards to the S&P 500, he argued that 7,200-7,300 is probably going in December.

All consideration is, after all, on the December Federal Open Market Committee (FOMC) assembly, which the market hopes will make clear the Fed’s upcoming rate-cut path.

Featured picture by way of Shutterstock