eToro (NASDAQ: ETOR) filed a registration assertion with the U.S. Securities and Alternate Fee (SEC) on Tuesday to register shares for its newly established worker share buy plan, following its current public itemizing earlier this month.

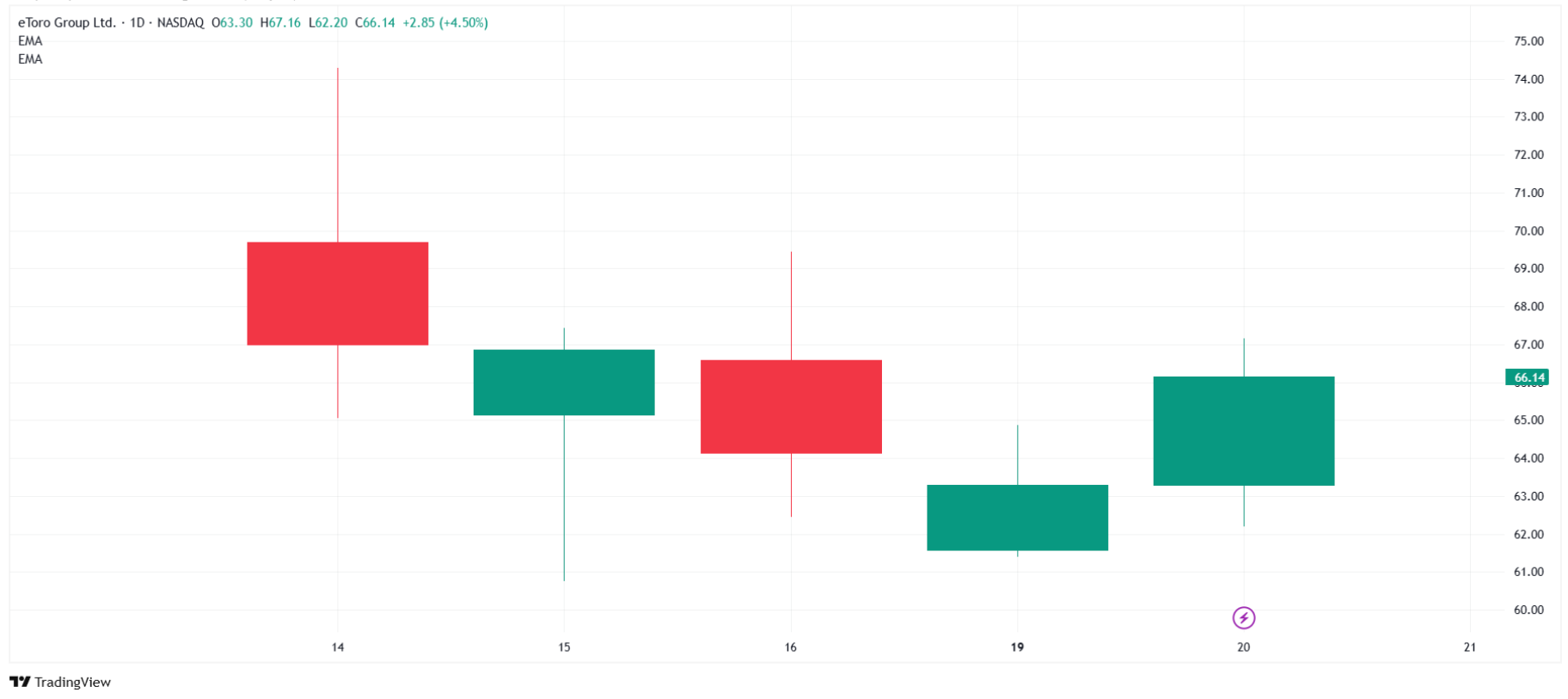

On the similar time, the fintech’s share worth rebounded by 4.5% on Wall Avenue throughout yesterday’s session, closing at $66.14. It marked the biggest single-day acquire since final week’s IPO.

The British Virgin Islands-incorporated eToro Group Ltd., which operates a social buying and selling and funding platform, submitted an S-8 registration assertion dated Could 20 to register shares below three worker profit plans, together with its 2025 Worker Share Buy Plan (ESPP).

The submitting comes simply days after eToro accomplished its preliminary public providing, with its prospectus having been filed with the SEC on Could 13, 2025, and its shares starting buying and selling on Could 15.

The 2025 ESPP authorizes the issuance of two,201,301 Class A standard shares, with provisions for potential annual will increase by January 2035. Every January 1 starting in 2026, the plan permits for extra shares equal to the lesser of 1% of excellent shares or a smaller quantity decided by the board.

“The aim of this Plan is to help Eligible Staff of the Firm and its Designated Subsidiaries in buying a share possession curiosity within the Firm,” the submitting states.

eToro’s Worker Share Buy Plan Particulars

The plan consists of two parts: a Part 423 Element meant to qualify below U.S. tax code, and a Non-Part 423 Element for worldwide staff. Eligible staff can contribute as much as 20% of their compensation by payroll deductions to buy firm shares at a reduction.

Based on the plan paperwork, the acquisition worth might be at the least 85% of the honest market worth of a share on both the enrollment date or buy date, whichever is decrease.

The corporate’s Chairman and CEO Jonathan Alexander Assia signed the registration assertion together with CFO Meron Shani and different board members.

The corporate’s dual-class share construction grants Class B shares ten votes per share in comparison with one vote for Class A shares, in line with its company paperwork. This construction permits founders and early buyers to keep up management whereas elevating capital from public markets.

eToro Shares Rise 4.5%

Throughout Tuesday’s session, eToro’s share worth rose by 4.5%, closing the day at $66.14, regardless of modest declines within the Nasdaq 100 and S&P 500 indices. The inventory is rebounding after a higher-than-expected IPO valuation triggered fast profit-taking final week, pushing the value right down to $61.40 on Monday.

eToro shares chart. Supply: Tradingview.com

eToro, nonetheless, is actively working to maintain buyers engaged. This week alone, the platform launched a recurring purchase function for shares, ETFs, and crypto. A day earlier, it launched a brand new financial savings service for purchasers in France. To help this providing, the corporate opened an area department and partnered with Generali.

eToro’s Wall Avenue debut additionally caught the eye of well-known buyers. Cathie Wooden’s Ark Make investments bought almost $10 million value of shares throughout the IPO, which raised near $620 million in complete.