The robust demand for crypto-based ETFs introduced new merchandise, together with a not too long ago filed foundation commerce ETF for BTC and ETH. Defiance, one of many present ETF issuers, has filed with the US SEC for 2 extra ETFs tapping the premise commerce.

The ETF market will supply extra advanced merchandise, because the carry commerce technique is packaged for crypto traders. Defiance Investments, an issuer of various ETFs, has filed for 2 new merchandise constructed across the foundation commerce, tied to BTC and ETH.

The 2 new ETFs purpose to automate the technique of cashing in on the value hole between crypto spot markets and futures. With permissionless crypto, traders can purchase the spot asset, promote a futures contract, and revenue from the distinction, relying on the unfold. As crypto is a smaller market, the disparity between spot and futures could be vital.

Defiance has already proposed the NBIT and DETH tickers for its ETF and ETH merchandise. The newly launched entities will wrap the premise commerce right into a single buy, simplifying the funding. For traders, this method can be simpler than shopping for a spot ETF like IBIT, then shorting BTC on the CME. The Defiance merchandise might supply the identical return.

‘It brings a comparatively superior technique into ‘one-click’ for particular person traders,’ stated Steve Sosnick, chief strategist at Interactive Brokers, cited by Bloomberg. ‘The ETF house has gotten so saturated that folks want to consider methods to be extra artistic — and it is a delicate commerce, which to me makes it fairly attention-grabbing.’

As crypto adoption widened, the premise commerce drew in additional funds, crypto-native desks, and native traders. The Defiance ETF may also method retail immediately, with lowered administrative and buying and selling prices.

Defiance’s ETF relies on a bull market

Defiance’s ETF technique is profitable throughout a bull market with a transparent route, the place premiums on futures are often excessive. In 2025, the carry commerce has been worthwhile for the majority of merchants.

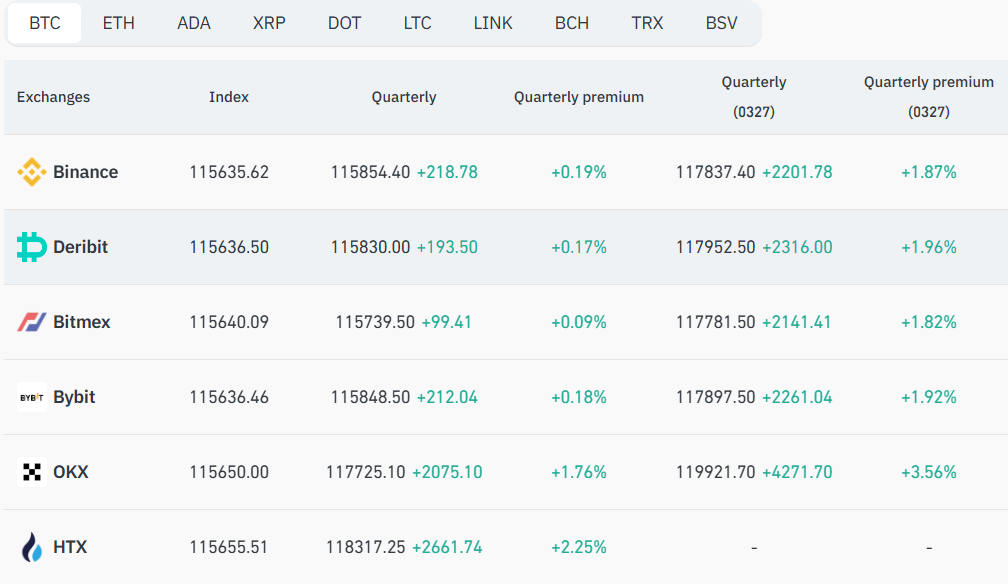

The chance for tapping a futures premium relies on the markets, as some exchanges supply larger danger and extra profitable futures premiums. Throughout peak market exuberance occasions, premiums on futures markets rose as excessive as 20%.

BTC premiums on futures towards the spot market are constantly excessive for BTC | Supply: Coinglass

ETH premiums are extra unpredictable, but in addition supply potential earnings. Ethereum’s markets additionally usually have futures costs under the spot market, breaking down Defiance’s technique. Nonetheless, on a long-term scale, each property are retaining their bullish route.

The premise commerce and the general bullish pattern are additionally what made Ethena’s technique work, as a crypto-native undertaking.

Can CME obtain strong crypto earnings?

The carry commerce has been tried and examined within the crypto house, particularly using native markets like HTX, OKX, and Binance. Nonetheless, a regulated product might have to make use of the CME futures market, which doesn’t supply the identical volatility dynamics.

The institutional buying and selling has worn out a number of the inefficiencies that enable crypto natives to faucet the value distinction between spot and futures. Whereas spot merchants on Binance can simply faucet the alternate’s futures contracts, Defiance must obtain the same end result utilizing the extra liquid and environment friendly regulated ETF and futures markets.