The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) has distributed $17.2 million in dividends since launch in March 2024. This marks a major milestone for BlackRock (NYSE: BLK) and Securitize within the tokenization business, paving the way in which ahead.

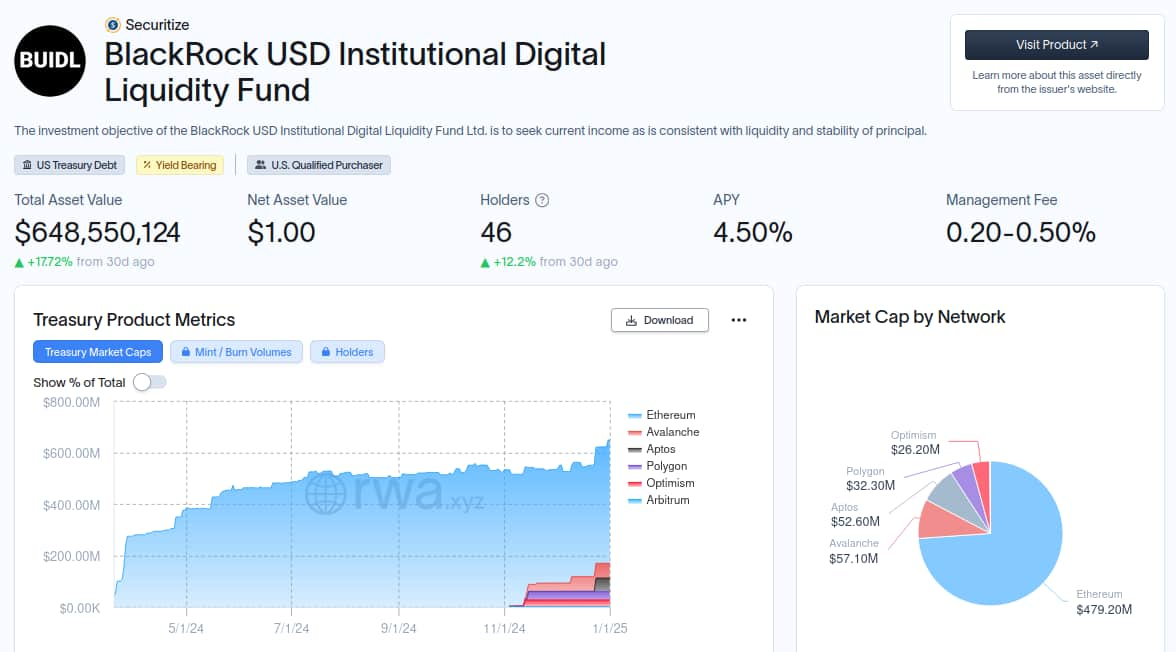

Notably, BUIDL is presently obtainable on six main blockchains and is a tokenized monetary product centered on institutional gamers. Particularly, these high-grade buyers can get publicity to BUIDL on Ethereum (ETH), Aptos (APT), Arbitrum (ARB), Avalanche (AVAX), Optimism (OP), or Polygon (POL).

The fund presently has $648.55 million in Complete Asset Worth, with Ethereum dominating by 74%, with $479.20 million. Avalanche is available in second and Aptos in third, that includes market caps of $57.10 million and $52.60 million, respectively. In closing, Polygon and Optimism have the smallest share with $32.30 million and $26.20 million.

BUIDL’s Web Asset Worth (NAV) is $1 per share, distributed amongst 46 holders, benefiting from a 4.5% APY. Launched by Securitize, the fund is barely accessible to “U.S. Certified Purchasers.”

BlackRock’s BUIDL function within the tokenization finance

Being the most important conventional finance (TradFi) belongings supervisor, with over $10 trillion in belongings beneath administration (AUM), BlackRock performs a key function within the tokenization finance, exposing the decentralized finance (DeFi) to the world.

Every thing began in early 2024, when Larry Fink, CEO at BlackRock Inc., stated he noticed worth in an Ethereum ETF, opening doorways for belongings’ tokenization. Then, the finance large partnered with Securitize in March to launch BUIDL, sending bullish waves to the market.

The fund later expanded to different blockchains than Ethereum, rising its attain and the worth of different cryptocurrencies and ecosystems.

Following BlackRock’s management, different TradiFi gamers and even Bitcoin (BTC) maximalists who had been beforehand proof against Ethereum and different blockchains now acknowledge they had been unsuitable, tokenization with brighter eyes.

Just lately, Michael Saylor talked about that shift in an interview to Altcoins Every day, forecasting a “crypto renaissance,” as Finbold reported. “The massive main change is you may see $500 trillion of standard belongings getting tokenized to change into digital belongings,” stated Saylor.

Now, fans anticipate extra cryptocurrency ETFs to look in 2025 and extra real-world belongings (RWA) tokenized beneath a friendlier regulatory panorama.

Featured picture from Shutterstock