Australians have the best ranges of curiosity in cryptocurrency per capita, primarily based on their internet visitors, with most exercise regarding buying and selling and hypothesis, in accordance with new information.

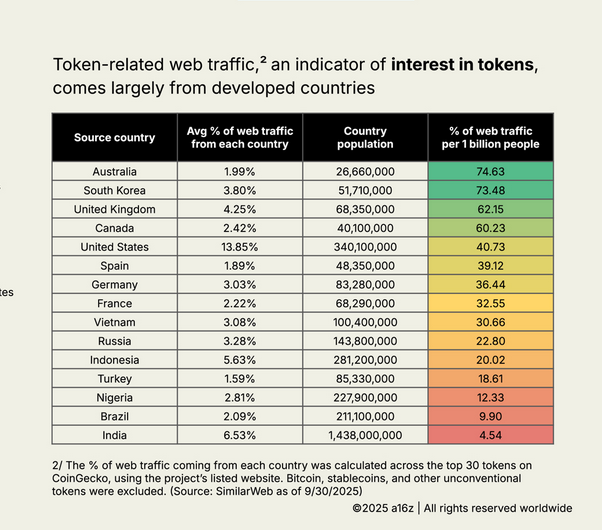

Information compiled by enterprise agency Andreessen Horowitz’s crypto division calculated the share of internet visitors from every nation throughout the highest 30 tokens on CoinGecko, filtering out Bitcoin and stablecoins.

Australians had the best per capita proportion of token-related internet visitors at 74.63% per 1 billion folks, whereas South Koreans had been a detailed second with 73.48% of token-related internet visitors, whereas customers from the UK had been third with 62.15% per 1 billion folks.

Curiously, america lagged as solely 40.73% of internet visitors went to token-related actions per 1 billion folks.

The report additionally discovered that crypto customers from developed nations gravitated towards buying and selling and speculating, whereas customers from growing nations had been extra more likely to take part in on-chain exercise, which was indicated by cellular pockets utilization.

Token-related internet visitors per billion customers of every nation. Supply: Andreessen Horowitz Crypto

Australia’s crypto demand is anticipated to develop in 2026

The general Australian crypto market is anticipated to develop at 19.85% yearly, with whole income reaching 1.2 billion Australian {dollars} ($780 million) by 2026, in accordance with Statista.

Associated: Gemini expands in Australia with wait-and-see method to pending crypto guidelines

In the meantime, the Australian crypto person base is anticipated to achieve 11.16 million by 2026, with almost 41% of Australians collaborating in crypto.

A survey performed by Swyftx signifies that 40% of Gen Z and Millennial Australians remorse not investing in cryptocurrencies a decade in the past.

“Lots of youthful buyers need excessive beta belongings of their portfolios, and the info we have now signifies they often perceive the asset class fairly nicely,” a Swyftx spokesperson advised Cointelegraph.

Journal: Most rich Hong Kong buyers plan to purchase crypto, Japan’s Bitcoin plan: Asia Categorical